UK house prices pick up says Nationwide, but outlook clouded

- Published

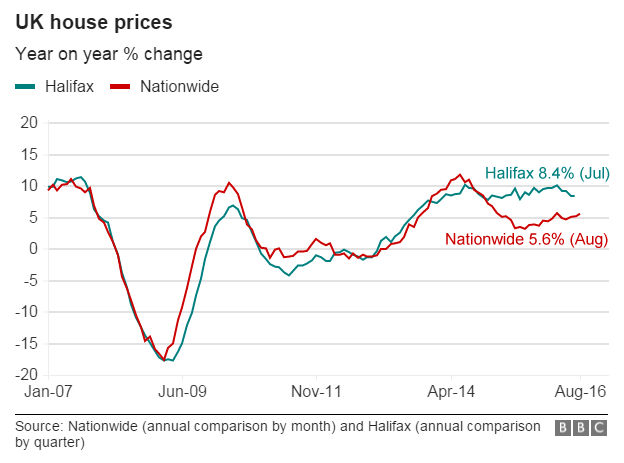

August saw a "slight pick-up" in house price growth, says the Nationwide, but the outlook is still "clouded".

The building society said prices rose by 0.6% compared with July, making the average cost of a home £206,145.

Prices in August were 5.6% higher than a year earlier, compared with 5.2% in July.

"The pick up in price growth is somewhat at odds with signs that housing market activity has slowed in recent months," Nationwide said, external.

On Tuesday, Bank of England figures indicated the number of mortgages approved by banks and building societies in July was at its lowest for a year and a half.

But Nationwide added that while buyer demand had softened, the number of new homes coming to market had also been low. That has kept the balance of demand and supply in check, which in turn has kept prices higher.

Rate cut

The future for property prices would be determined by the labour market and confidence amongst buyers, said Nationwide chief economist Robert Gardner.

He said High Street sales had held up well so far, but noted that most forecasters expected the economy to show "little growth" over the rest of the year.

However, the Bank of England's decision to cut its benchmark interest rate to 0.25% earlier this month would provide an immediate boost to many mortgage borrowers, he added.

The typical saving for a borrower on a variable rate is around £15 a month.

Some other economists said they expected house price growth to be weaker in the months ahead.

"We believe housing market activity is likely to be limited over the coming months, and prices will weaken as prolonged uncertainty following the UK's vote to leave the EU constrains consumer confidence and willingness to engage in major transactions," said Howard Archer, chief UK economist at IHS Global Insight.

He predicted that house price growth will ease further towards the end of 2016, with a 5% fall in prices next year.

"While data from Nationwide point to resilient house price growth in August, leading indicators suggest that this won't last," said Hansen Lu, property economist with Capital Economics.