UK interest rates cut to 0.25%

- Published

Governor Mark Carney: "The economy is in a period of uncertainty and about to go through a period of adjustment"

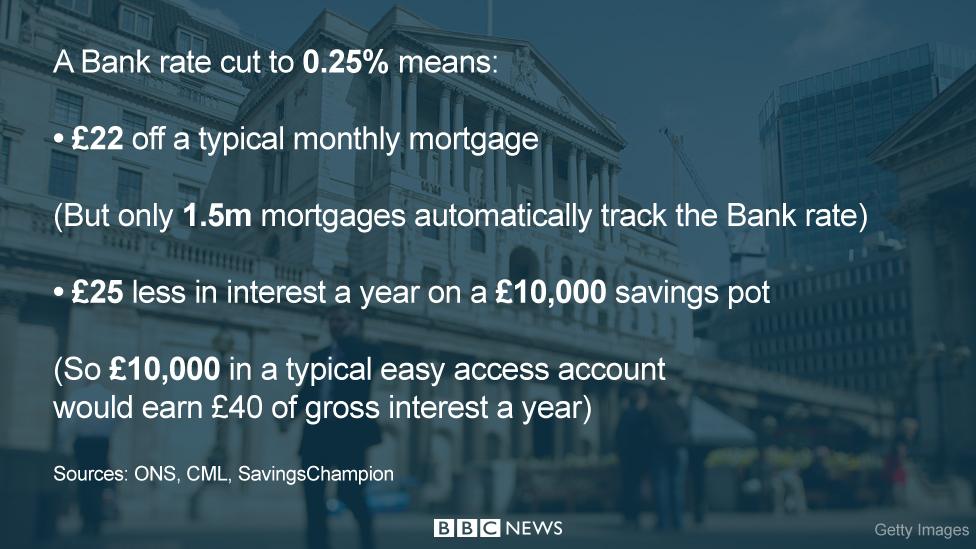

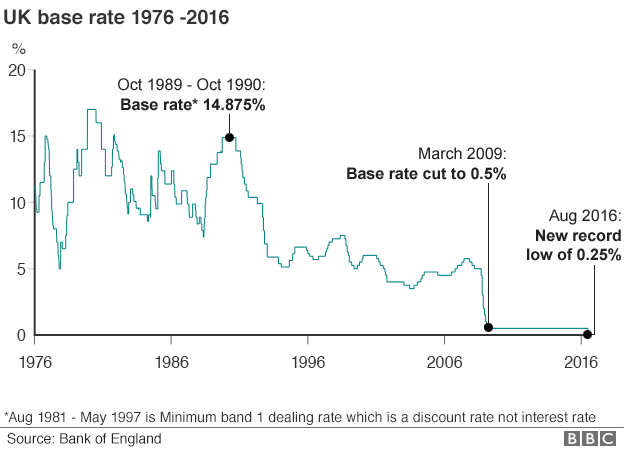

UK interest rates have been cut from 0.5% to 0.25% - a record low and the first cut since 2009.

The Bank of England has also signalled that rates could go lower if the economy worsens.

The Bank announced additional measures to stimulate the UK economy, including a £100bn scheme to force banks to pass on the low interest rate to households and businesses.

It will also buy £60bn of UK government bonds and £10bn of corporate bonds.

Governor Mark Carney said there was scope to cut the interest rate further.

He said that a majority of the nine-member Monetary Policy Committee (MPC) backed another cut if subsequent data showed the economy was deteriorating.

Mr Carney also took a tough stance on banks and the introduction of its Term Funding Scheme. This will lend directly to banks at rates close to the new 0.25% base rate to encourage them to pass on the lower interest rates to businesses and households.

The governor said that banks have "no excuse" not to pass on the lower borrowing costs to customers and will be charged a penalty if they fail to do so.

He said: "The MPC is determined that the stimulus the economy needs does not get diluted as it passes through the financial system."

The Bank also announced the biggest cut to its growth forecasts since it started making them in 1993.

It has reduced its growth prediction for 2017 from the 2.3% it was expecting in May to 0.8%.

Mr Carney that the decision to leave the EU marked a "regime change" in which the UK would "redefine its openness to the movements of goods, services, people and capital".

He said: "We took these steps because the economic outlook has changed markedly, with the largest revision to our GDP forecast since the MPC was formed almost two decades ago."

Mr Carney added: "By acting early and comprehensively, the MPC can reduce uncertainty, bolster confidence, blunt the slowdown, and support the necessary adjustments in the UK economy."

The decision to cut interest rates to 0.25% was approved unanimously by all nine members of the MPC and is the first change in interest rates since March 2009.

The £60bn bond-buying programme, which increases quantitative easing to £435bn, was approved by a vote of 6-3, with Kristin Forbes, Ian McCafferty and Martin Weale preferring to wait until more concrete data is available rather than relying on surveys.

The corporate bond-buying scheme was opposed by one member: Kristin Forbes.

Pound falls

The corporate bond-buying scheme will purchase up to £10bn of bonds issued by companies outside the financial sector. Only companies considered to be contributing to the UK economy will be eligible. More details of the scheme will be released in September.

The extensive series of measures was revealed with the central bank predicting that inflation would rise above its 2% target as a result of the falling value of the pound.

Analysis: Kamal Ahmed, economics editor

The Bank of England is not very confident about the future of the economy.

It says growth will fall dramatically, announcing the biggest downgrade to its growth forecast since it started inflation reports in 1993.

The economy, it says, will be 2.5% smaller in three years' time than it believed it would be when the Bank last opined on these matters in May.

Unemployment will rise (although only marginally), inflation will rise, real income growth will slow and house prices will decline.

Growth, the Bank believes, will fall perilously close to zero over the final six months of this year.

It predicts that the amount of money lent through the scheme could reach about £100bn.

A weaker pound makes imported goods more expensive, which boosts inflation. The pound fell by 1% against the dollar following the Bank's announcement.

Daniel Mahoney, head of economic research at Centre for Policy Studies, said: "The Bank's further loosening of monetary policy could prove problematic for the UK economy. The falling pound means that inflationary pressures are already building up, and today's decision will exacerbate them."

A weaker outlook

The Bank has warned that there will be "little growth in GDP in the second half of the year", although the forecast for 2016 growth has been left unchanged at 2% as a result of stronger-than-expected growth in the first half.

The BBC's Kamal Ahmed explains why the Bank of England is cutting interest rates

The forecast for 2018 has been cut from 2.3% to 1.8%.

It also expects the unemployment rate to rise to 5.4% next year and 5.6% in 2018.

The MPC meeting was the last one before it moves to only meeting eight times a year, meaning that it is not scheduled to meet again until 3 November, although it can call an extra meeting before then if it wants to.

A majority of MPC members said that if the economy performed as they expected in the coming months, they would support cutting interest rates again before the end of the year to their lowest possible level of "close to, but a little above, zero".

Fighting off recession

Before the referendum, there were warnings of a recession if there was a vote to leave the EU.

The Bank of England's quarterly inflation report does not foresee a recession, although all of its forecasts take into account the stimulus measures.

Even with those measures, the Bank still predicts little growth in the second half of the year, suggesting there could have been a recession if the Bank had not acted.

However, Scott Corfe, director of the Centre for Economics and Business Research, said: "Even with this stimulus, CEBR expects economic growth to slow from about 1.5% this year to less than 0.5% in 2017.

"A recession - at least a couple of quarters of negative growth - will be difficult to avoid and unemployment is likely to rise from current levels."

Business organisations the CBI and the British Chambers of Commerce both called on the government to do its bit to help.

Mr Carney has written to Chancellor Philip Hammond to outline the measures taken by the MPC as well as explaining why inflation remains, for now, significantly below its target rate.

In response, Mr Hammond wrote: "Alongside the actions that the Bank is taking, I am prepared to take any necessary steps to support the economy and promote confidence."

He said that those plans would be set out in the Autumn Statement.

Lucy O'Carroll, chief economist at Aberdeen Asset Management, said: "The Bank really needed to announce this kind of combination of measures. What will really count is whether the chancellor provides a fiscal boost in the autumn. Monetary policy can't do much more on its own."

- Published1 November 2022

- Published4 August 2016

- Published4 August 2016

- Published4 August 2016