How has the economy fared since the Brexit vote?

- Published

With Theresa May about to trigger Article 50 and the UK set to start two years of Brexit negotiations with the rest of the EU, how is the country's economy doing?

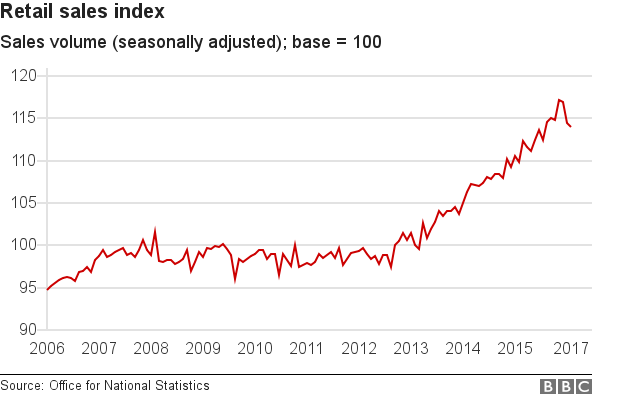

Before the referendum last June, many economists produced gloomy forecasts which have since been proved wrong. Consumers' confidence has not suffered, and by and large, things have gone on as before.

However, the UK has not actually left the EU yet - the real change may only happen once it does.

The current uncertainty, ahead of talks between the UK and the rest of the EU, over what form Brexit will take is an issue for many firms when it comes to investment planning.

Economy

The UK economy grew by more than previously reported in the final three months of 2016, according to the latest official estimate.

Gross domestic product (GDP) increased by 0.7%, up from 0.6%, according to the Office for National Statistics (ONS).

The upward revision is mainly due to the manufacturing industry having done better than thought.

The ONS cut its estimate for growth in 2016 as a whole to 1.8%, down from the 2% it forecast last month.

There are hints that Brexit uncertainty is hitting business confidence. The ONS also said there had been a slowdown in business investment, which fell by 1% compared with the three months to the end of September.

Growth in the UK's service sector eased to a five-month low in February, according to a closely watched survey.

The Markit/CIPS purchasing managers' index (PMI) for services fell to 53.3, down from 54.5 in January. However, it remains above the 50 threshold that separates growth from contraction.

Meanwhile, the UK's independent budget watchdog, the Office for Budget Responsibility (OBR) recently revised up its growth forecast for this year from 1.4% to 2%.

However, it expects growth to then slow to 1.6% next year.

The pound and share prices

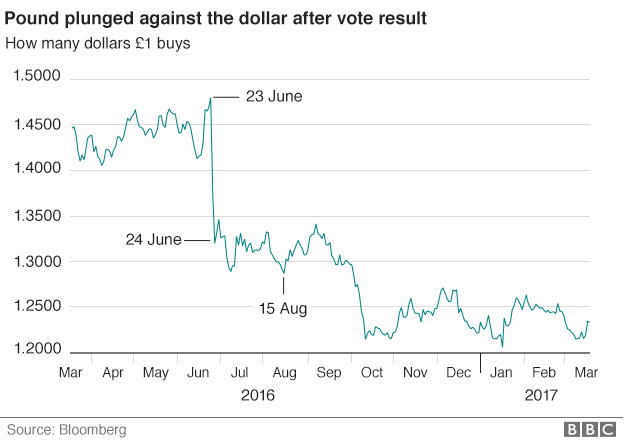

The pound fell dramatically after the Brexit vote last year, and since then has been trading around 15% lower compared to the dollar and 12% lower compared to the euro than it was before the referendum.

The fall in the pound has helped exporters but it has made foreign holidays more expensive for British tourists.

It has also increased import costs for manufacturers (see Trade below) which is a key factor for sectors such as the car industry, where vehicles which may be completed in the UK often have imported component parts.

Record low UK interest rates have also contributed to a weaker pound.

When Parliament passed the Brexit bill allowing the prime minister to trigger Article 50 and start the Brexit negotiations, the pound hit an eight-week low against the dollar.

Currency strategists say that sterling is likely to remain volatile in the coming months until there is greater clarity about the UK's Brexit deal.

The pound may have weakened but investor confidence as measured by UK share prices is holding up well - UK stockmarkets have risen since last summer.

The FTSE 100 has risen 16% since the eve of the referendum.

Much of this could be linked to the pound's decline. As big companies' profits are often international and calculated in dollars, they would automatically rise when converted back into the weaker pound.

Yet there is a similar picture when looking at the mid-range FTSE 250, which includes many firms focused on the domestic market. This index is now about 11% higher than it was on 23 June 2016.

Interest rates

Importantly, many forecasts of immediate economic gloom if the UK voted to leave the EU were proved wrong. They did not take into account possible compensatory action by the Bank of England in the wake of a Brexit vote.

After the referendum the Bank of England took steps to boost the economy. In particular it cut interest rates from 0.5% to 0.25% in August - the first reduction in the cost of borrowing since 2009 - taking UK rates to a new record low.

Rates are unlikely to go up any time soon. This month's Budget provided little stimulus for the economy via tax breaks or spending announcements, so the Bank is more likely to keep rates on hold, because raising them could affect growth.

However, at the most recent meeting of the Bank's interest rate-setting committee, one member of the Monetary Policy Committee did vote for a rate rise.

House prices

UK house prices accelerated in February rising by 4.5% in a year, according to the Nationwide, and by 5.1%, according to the Halifax., external

"Housing demand is being supported by an economy that continues to perform well with employment still expanding," said Martin Ellis, Halifax housing economist.

But the rate at which house prices are rising has slowed significantly, nearly halving since spring 2016. The outlook for the market is uncertain, with the Nationwide predicting a 2% rise in UK house prices over the course of 2017.

Migration

Net migration to the UK dropped to 273,000 in the year to September 2016, down 49,000 from the previous year.

The Office for National Statistics said it was the first time in two years the balance of people arriving and leaving the UK had dipped below 300,000.

Published in February, this is the first data to include migration estimates following the EU referendum.

Immigration was estimated to be 596,000; of these 268,000 were EU citizens, 257,000 non-EU citizens and 71,000 were British citizens.

Some 323,000 people are thought to have left the UK in the same period, up by 26,000 on the previous year.

Of these, 103,000 were EU citizens, 93,000 non-EU citizens and 128,000 British citizens.

Trade

The UK has long been running a trade deficit, meaning that overall it imports more than it exports, and both imports and exports have been boosted by the weaker pound.

UK exports and imports both rose in January - by £400m and £300m respectively - leaving the trade deficit in goods and services steady and unchanged from December 2016 at £2.0bn, external, the ONS said.

However, the ONS also said that in 2016, excluding oil and other erratic commodities (such as ships, aircraft, precious stones, silver and non-monetary gold) the underlying trend in trade in goods was a widening of the deficit.

The chart below shows that the UK does sell more services abroad than are imported - but this is not enough to counter the bigger deficit in the value of the goods sold abroad, compared with the value of the goods imported.

Construction

House building has slowed to a six-month low as costs have soared, due largely to a weaker pound.

However, output in the construction industry overall has risen for the sixth consecutive month in February, led by civil engineering.

Some firms say that rising input costs have had an effect on decision making and have led to delays in contracts being completed.

Jobs and wages

The unemployment rate has been falling steadily over the last five years, as the UK recovered from the global financial crisis, which saw up to two million jobs lost, according to one report, external.

Wages have been growing faster than inflation in recent months, though the gap is narrowing, leading to warnings of squeezed incomes.

In the three months to January, regular pay increased by 2.3%, compared with the same period a year earlier. That was sharply lower than the 2.6% seen in the three months to December.

Meanwhile, inflation currently stands at 1.8%, up from 1.6% a month ago.

Real income growth is now running at 0.6%.

"If the incomes squeeze translates into falling consumer confidence, then the main driver of the better-than-expected economic news since the referendum could turn more negative," says the BBC's economics editor Kamal Ahmed.

Follow Tim Bowler on Twitter @timbowlerbbc, external

- Published30 December 2020

- Published24 June 2016

- Published27 July 2016