Is the Bank of Japan running out of options?

- Published

Japan has been trying to spur growth for years

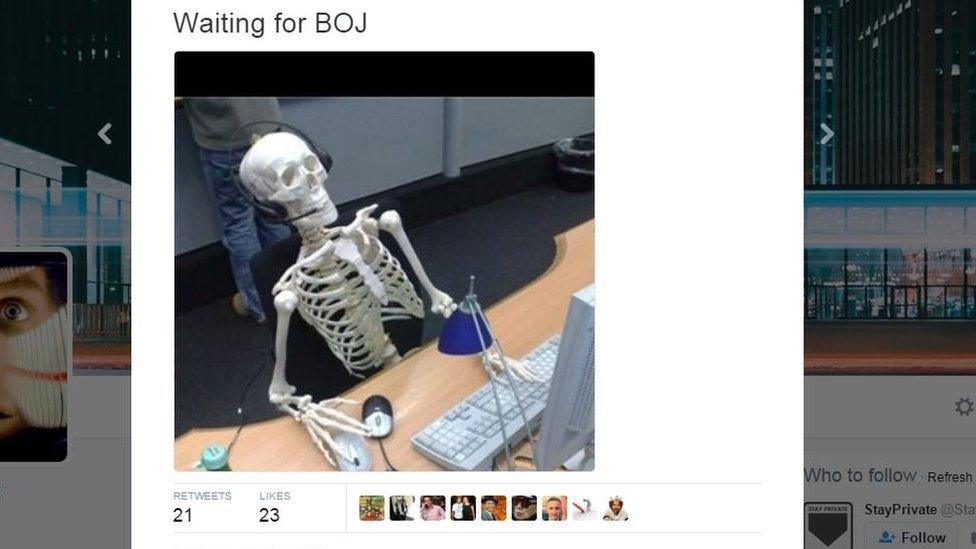

So I just spent my whole morning waiting for the Bank of Japan to make its mind up about what it should do to jump-start Japan's economy.

Looks like I wasn't the only one, as many traders took to Twitter to vent their frustration at the delay.

But after all the faffing and fussing, did this highly anticipated decision from one of the world's most powerful central bank governors deliver the much-needed boost to Japan's flagging economy?

Probably not.

But here's why you should care about the change in the policy measures.

Now for the details:

The Bank of Japan kept interest rates at -0.1%

It abandoned the monetary base - which means it can pump as much money as it likes into the economy.

It said it will allow inflation to overshoot its previous 2% target

It said it will aim to keep its 10-year bond yield at zero.

Have I lost you yet?

In a nutshell, the fact that interest rates haven't been cut further below zero has caused investors to jump for joy. It's provided a short-term boost to markets and the Japanese yen is weakening against the US dollar - which is good for exporters.

So, for now at least, the market is applauding Governor Kuroda's main move. But what about some of the other measures?

Why does it matter?

Here's why what the BoJ did is important - not just for Japan, but for other developed economies.

It set a target of zero for the 10-year bond yield. Basically this means it wants to protect the long-term interest rate from creeping below zero even if short-term interest rates do go negative.

As Greg McKenna, chief market strategist with FX, told me "by bringing back the gap between short and longer term rates the BoJ helps banks and investors earn a better return in their business and investment".

This is where I want inflation, at 2%, Mr Abe says

The BoJ also abandoned the monetary base - allowing it to pump as much money as it wants into the economy.

"It is a departure from conventional central bank thinking," Mr McKenna added.

"The Bank of Japan has abandoned the monetary base, and is committed to continue to expand that monetary base until the rate of inflation hits and holds at 2%.

"I get a sense this may be the only way left for the Bank of Japan to get inflation going again - but of course, it remains to be seen whether these measures will actually be effective. "

Departing from conventional central bank thinking appears to be the name of the game. Ever since the financial crisis hit in 2008, central banks in the developed world have had to find new and unorthodox ways to boost growth.

But remember, central bank policies aren't supposed to operate in isolation. In Japan at least, they were part of a three-pronged approach to fix the Japanese economy - the Abenomics programme, which, as I've written about before, has yet to show that it's working.

The focus shifts yet again to Japan's government and Prime Minister Shinzo Abe's plan to boost the economy. Japan's government must do more to deliver the goods on structural reforms as part of its Abenomics policy to boost growth, rather than continue to rely on the central bank.

- Published21 September 2016

- Published21 September 2016

- Published13 September 2016