RBS to compensate squeezed firms

- Published

Royal Bank of Scotland is to compensate up to 12,000 small business customers that it allegedly mistreated in the wake of the financial crisis.

The bank has announced a fund of £400m for affected firms.

Its Global Restructuring Group (GRG) had been accused of buying assets cheaply from failing firms it claimed to be helping.

However, regulators found RBS did not "artificially engineer" the transfer of customers to GRG.

Last month, RBS said it had let some small business customers down in the past but denied it had deliberately caused them to fail.

'Very sorry'

On Tuesday, RBS chief executive Ross McEwan said: "We have acknowledged for some time that mistakes were made. Some of our customers went through what was a traumatic and painful experience as a result of the crisis.

"I am very sorry that we did not provide the level of service and understanding we should have done."

The bank will automatically refund complex fees paid by about 4,000 small business GRG customers between 2008 and 2013, and will set up a new complaints process.

The process will be overseen by retired High Court judge Sir William Blackburne. Complaints will initially be dealt with by the bank, and any that are not resolved will then be considered by the third party.

Customers who feel they have lost out may have to fight for redress through the courts.

Mr McEwan told the BBC: "It would be fair to say that consequential loss needs to go to the court at the end of the day, because it will be up to a court process in most of these situations for them to determine whether... those businesses were going to be viable, and be a very successful business going forward."

In the case of businesses that have gone bust but are due compensation, it will be up to administrators to decide whether to reconstitute the firm, said RBS regulatory affairs officer, Jon Pain.

It may be the case that only creditors of a dissolved firm will benefit from any compensation, rather than the business owner, he said.

Poor support

In 2014, the FCA commissioned a review of the work of GRG.

On Tuesday, the FCA said, external it found there was no widespread practice of transferring customers to GRG for their value, or requesting cash injections when the bank had no intention of supporting the business.

Small businesses that were transferred to GRG "were exhibiting clear signs of financial difficulty," the FCA said.

However, the bank did fail to support businesses "in a manner consistent with good turnaround practice", including "placing an undue focus on pricing increases and debt reduction without due consideration to the longer term viability of customers".

RBS's announcement coincides with the appearance before the Treasury Select Committee of Andrew Bailey, FCA chief executive.

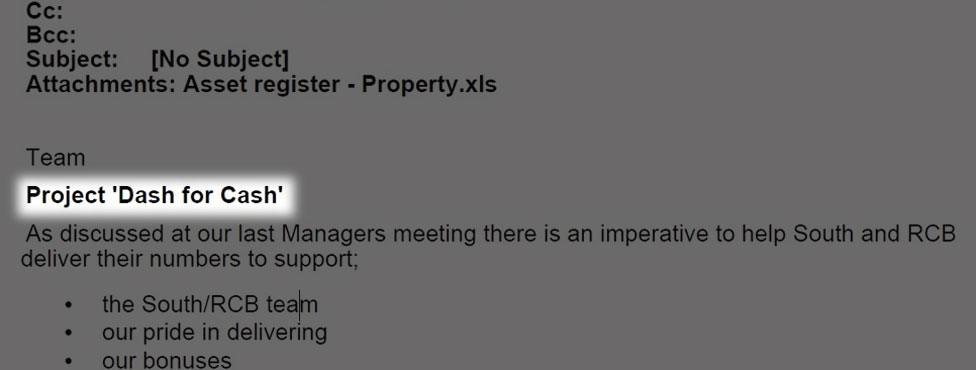

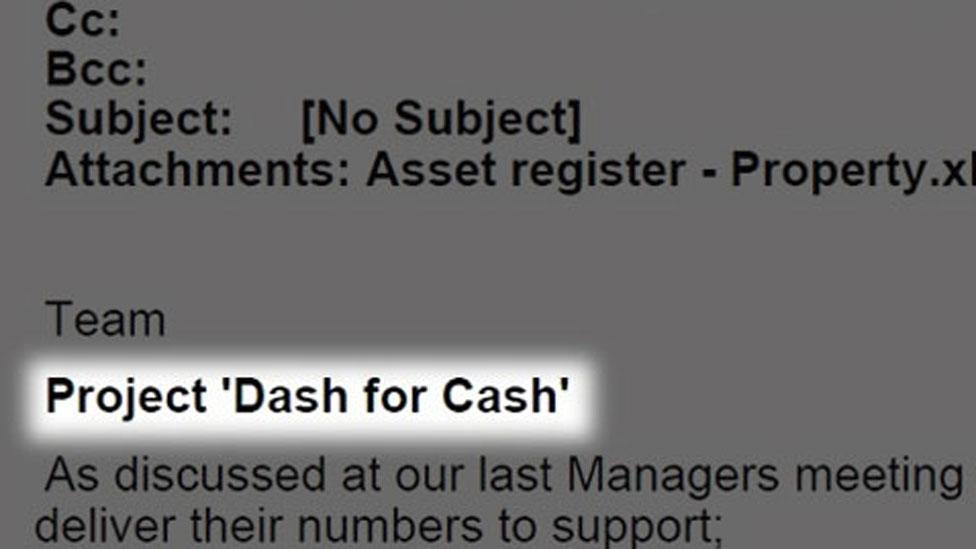

An email from 2008 urged staff to mount a "dash for cash" from the bank's business customers

A report three years ago by the government's then entrepreneur in residence, Lawrence Tomlinson, accused the taxpayer-owned bank of deliberately putting viable businesses on a path to destruction while aiming to pick up their assets on the cheap.

The allegations were supported by a cache of documents, passed by a whistleblower to BuzzFeed News and BBC Newsnight last month.

The documents confirmed that bank staff were rewarded with higher bonuses based on fees collected for "restructuring" business customers' debts - cutting the size of their loans and getting cash or other assets from the customer.

'Customers let down'

In what was described by an RBS executive as "Project Dash for Cash", staff were asked to search for companies that could be restructured, or have their interest rates bumped up.

Last month, the bank told Newsnight: "RBS has been very clear that GRG's role was to protect the bank's position... In the aftermath of the financial crisis we did not always meet our own high standards and we let some of our SME customers down.

"Since that time, RBS has become a different bank and significant structural and cultural changes have been put in place, including how we deal with customers in financial distress."

- Published10 October 2016

- Published12 August 2016