Teenagers 'ill-prepared' over finances

- Published

- comments

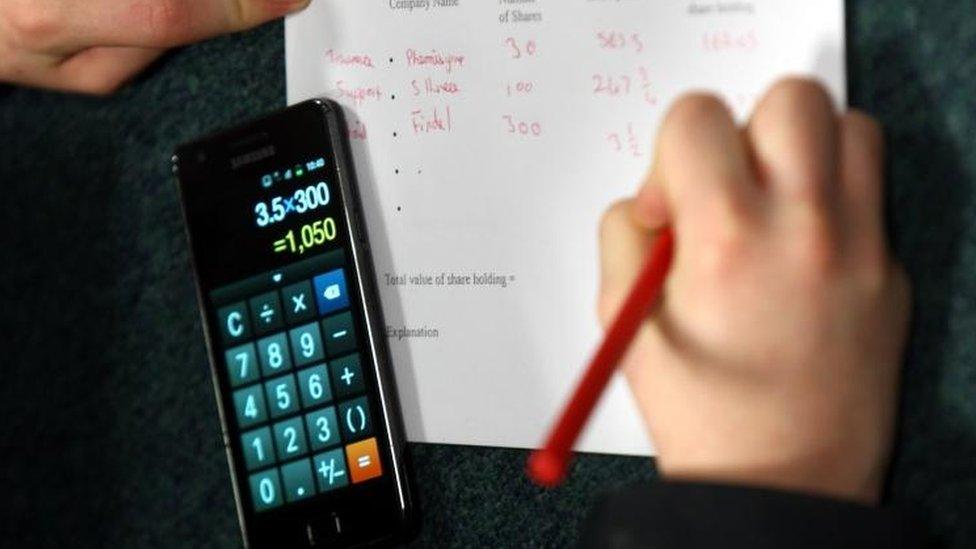

Youngsters aged 16 and 17 need last-minute financial education before adulthood amid fears they are ill-prepared, an advice service has said.

A third of this age group had never put money in a bank account and two-thirds could not read a payslip, research for the Money Advice Service suggested.

Concerns have been raised as these youngsters are just months away from having access to credit.

Financial education is part of the curriculum in schools across the UK.

Setting an example

The Money Advice Service commissioned a survey of nearly 5,000 youngsters aged four to 17, with further questions directed to their parents.

It found that nearly a third of 16 and 17 year-olds were unaware what would happen if council tax was unpaid, while only 7% of seven to 17-year-olds had spoken to their teachers about money.

Three in five parents felt confident talking about money to their children, but their money management "may not set the best example", according to the Money Advice Service which is running a Financial Capability Week. Half of parents asked did not save regularly and 44% said they did not feel confident managing their money.

"In order to find a lasting solution to the problem of the UK's stubbornly low levels of financial capability, we need to help parents be better role models, build their confidence in speaking to their children about these matters and support schools to deliver effective financial education," said David Haigh, director of financial capability at the service.

The service is calling for "just-in-time" financial education, before youngsters become financially independent, alongside more consistent financial education from primary school age, and greater support for parents to talk to their children about money.

What youngsters should know

Understand a payslip and check whether a tax code is correct, rather than an emergency tax code for a first job

Be aware of which bills to pay first, primarily council tax

Know that failing to pay could affect a credit rating for six years, with consequences such as difficulty getting a new mobile phone contract

What parents should do

Help children to be aware of bills that need to be managed, how to pay, and when

Show youngsters your payslip to help understand tax and national insurance, and tax codes

Talk to children about budgeting and savings decisions and how this pays for holidays

Source: Kirsty Bowman-Vaughan, senior children and young people policy manager, Money Advice Service

- Published28 October 2016

- Published29 September 2016