India rupee ban: Snapdeal to deliver cash

- Published

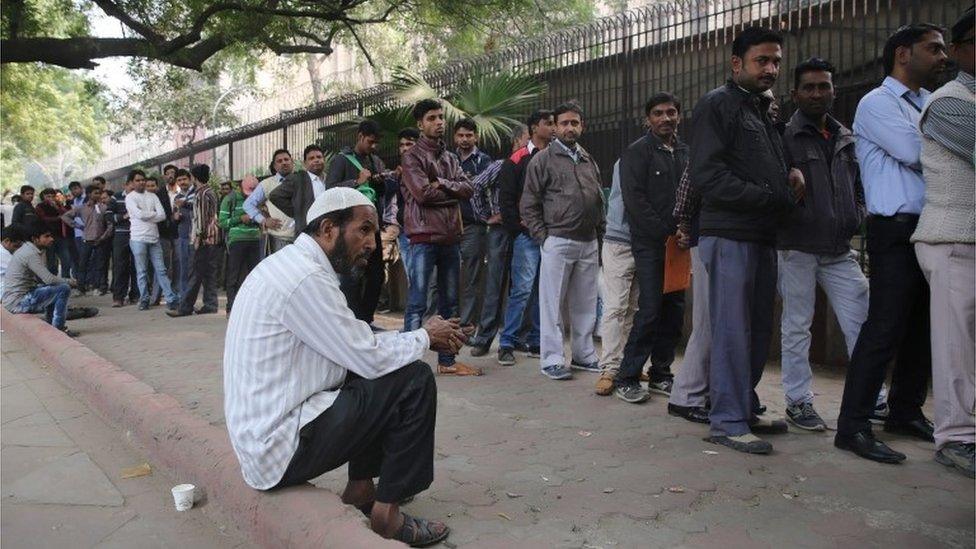

Indian tech firms have been taking advantage of a cash-crunch that has led to queues at banks and ATMs

One of India's biggest online retailers has started offering the country's most sought-after item...cash.

Snapdeal is letting people in two cities order rupees online, and pay with their bank card when the money is brought to their door.

It is the latest firm to try and take advantage of a country-wide cash-crunch, after last month's government ban on 500 and 1000 rupee notes.

ATM queues and cash withdrawal limits mean getting currency is tricky.

Analysts said that it could be a shrewd way to encourage new users to download the retailer's app, and tempt existing shoppers to make other purchases at the same time.

The rupees that Snapdeal delivers will primarily be money received from their customers who make cash-on-delivery purchases - a very popular service for e-commerce users in India.

But with fewer people likely to be paying for items in cash due to the lack of money in circulation, some suggest the scheme could be difficult to sustain.

India announced that 500 and 1,000 rupee notes were no longer legal tender as part of a crackdown on corruption

'Tide over'

While only available for now in Gurgaon and Bangalore, there are plans to roll out the service more widely.

"The launch of the cash on demand service is intended to further help our consumers tide over any cash crunch that they might face in addressing their daily needs," Snapdeal co-founder Rohit Bansal said.

Snapdeal is charging one rupee fee for the service which is paid at the time of the booking. Customers can get up to 2,000 rupees per transaction after swiping their card through a point of sale machine carried by courier.

Earlier this month, online grocery service Grofers started a similar service letting its customers get cash back when they had shopping delivered to their homes.

That system is run in partnership with Yes Bank, which has also teamed up with taxi firm Ola to provide mobile ATMs.

More small retailers, that were previously cash-only, have been forced to start taking new forms of payment

India's Prime Minister Narendra Modi announced that 500 and 1,000 rupee notes were no longer legal tender as part of a crackdown on corruption on 8 November.

Together the two notes represented 86% of the currency in circulation and there have been chaotic scenes in India ever since, with people have spending hours queuing outside banks and cash machines which often run out of money.

In some instances the police have had to be called in to manage queues of anxious customers trying to access legal tender.

The government hopes the measures will encourage more people to have bank accounts and move towards a society less reliant on cash. People have been given until the end of the year to put the old notes into their bank account.

Local firms which allow people to make digital payments both online and in shops have reported a surge in transactions as people look for cashless alternatives.

- Published8 December 2016

- Published22 December 2016