Mnuchin defends record during treasury secretary hearing

- Published

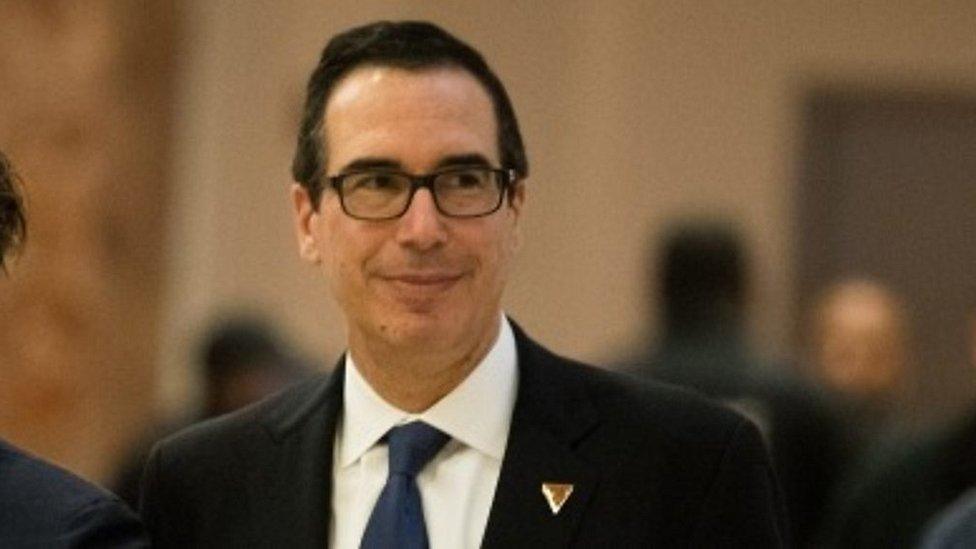

President-elect Donald Trump's choice for treasury secretary, Steven Mnuchin, has faced strong criticism during a Senate confirmation hearing.

Mr Mnuchin was outlining his experience and qualifications to hold one of the most important jobs in finance.

But it was overshadowed by claims that his former bank, OneWest, ruined lives during the US property crash by foreclosing on 36,000 loans.

"I have been maligned", the ex-hedge fund boss told the Finance Committee.

Mr Mnuchin spent 17 years at Goldman Sachs before leaving in 2002 to set up an investment group and fund Hollywood movies.

'Foreclosure machine'

He led a buyout of IndyMac, whose collapse in 2008 was the second biggest bank failure of the financial crisis.

It was renamed OneWest, turned around, and then sold in 2014 for a big profit.

But Mr Mnuchin was accused of turning the California bank into a "foreclosure machine" in order to boost profits.

Ahead of the hearing, Elizabeth Warren, an anti-Wall Street Democratic senator, set up a forum where former OneWest foreclosure victims could air their complaints.

Mr Mnuchin, whose fiancée and children sat behind him, told the committee: "Since I was first nominated to serve as treasury secretary, I have been maligned as taking advantage of others' hardships in order to earn a buck. Nothing could be further from the truth."

He said he felt "enormous sympathy" for people who lost their homes "because the system failed them".

However, Senator Ron Wyden, the Finance Committee's top Democrat, criticised OneWest for its automated "robo-signing" of foreclosure documents.

'Offshore web'

He also attacked Mr Mnuchin's use of tax havens such as Anguilla and the Cayman Islands to shelter hedge fund profits, questioning his qualifications to oversee a major revamp of tax laws to make them fairer to working Americans.

Protesters outside the Steven Mnuchin hearing in Washington

"In Mr Mnuchin's case, millions of dollars in profits from Hollywood exports like the movie 'Avatar' were funnelled to an offshore web of entities and investors," Mr Wyden said.

The US treasury secretary is the leading government voice on domestic and international economic policy and one of the key figures shaping US financial strategy.

Despite the hearing being dominated by OneWest and Mr Mnuchin's track record, he faced questions on the strength of the US economy and how he would manage Mr Trump's tax and spending plans.

In one exchange, Mr Mnuchin said that the Trump administration would follow trade policies to ensure a strong US dollar.

"I will enforce trade policies that keep our currency strong on the global exchanges and create and protect American jobs," he said.

During questioning Mr Mnuchin said:

He is "100% committed" to enforcing sanctions on Russia

Reforming the tax system was important for US economic growth

The US should be able to achieve 3% to 4% annual growth, which is "absolutely important"

Regulation is "killing small banks" and "we don't want to end up in a world where we have four big banks in this country"

The US tax department is understaffed and lacks the technology to do a proper job

Analysis: John Mervin, BBC News, New York:

Anyone hoping to pick up more detail about the Trump administration's economic plans from Mr Mnuchin's hearing may be disappointed. Although matters of policy have been discussed, they were overshadowed by the attempts of Democrats on the committee to shape Mr Mnuchin's image in the public eye.

Many of their questions focussed on the ways in Mr Mnuchin benefited from America's housing market collapse which cost so many families their homes, and from the tax loopholes which allow wealthy investors to avoid US tax. That Mr Mnuchin took over a failed bank and also ran a hedge fund is hardly news.

But Democratic senators seem determined to make sure that anyone following his confirmation understands that far from being part of a populist movement, to reform and remake US economy, Mr Mnuchin has so far been at the heart of financial system, which enriches the elite and hurts the common people.

- Published13 January 2017

- Published12 January 2017

- Published30 November 2016

- Published30 November 2016

- Published30 November 2016