Call for scrutiny of private firms 'to prevent another BHS'

- Published

A committee of MPs is recommending that large private firms should face the same rules on corporate governance as publicly listed companies.

The work and pensions committee says changes could prevent another collapse similar to that of retail chain BHS.

It says private firms with more than 5,000 defined benefit pension scheme members should abide by the Financial Reporting Council's (FRC) code.

BHS's demise in April 2016 affected 11,000 jobs and 22,000 pensions.

Committee chairman Frank Field MP said the collapse of the chain was triggered by "gross failures of corporate governance".

He added: "For a company with a big social and economic footprint like BHS it is simply not enough to be accountable to shareholders - particularly when one shareholder owns most of the stock.

"Would the story have played out the same way if its directors had to be open about the financial decisions they were making for its future?

"The finances and leadership of a company with so many people depending on it should be open to scrutiny."

Large private companies in the UK include John Lewis, Clarks, Matalan, Virgin Atlantic, River Island, Pret a Manger. and the Arcadia Group.

The work and pensions committee - in response to the government's consultation on corporate reform - also called for changes that would make directors at private businesses accountable to pensioners through their scheme's trustees.

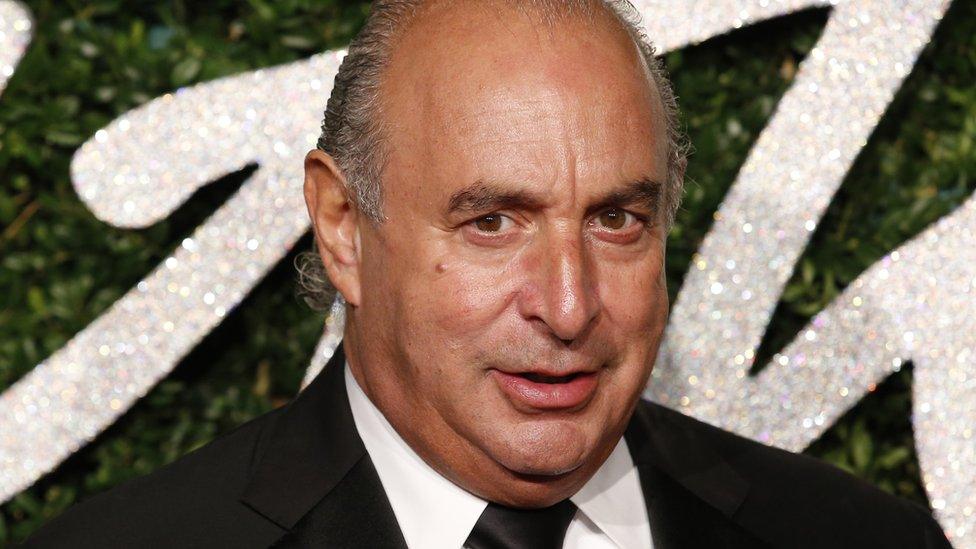

Their recommendations came alongside the release of correspondence between the committee and Sir Philip Green's Arcadia Group on the retail giant's pensions scheme.

Meanwhile, the committee also said that all Insolvency Service reports should be published when judged to be in the public interest.

It comes after the government indicated it would make the report into BHS's demise public.

- Published3 November 2016

- Published3 November 2016

- Published18 October 2016