Toshiba: Why troubled Japanese firms survive

- Published

- comments

"What else are you hiding?" screamed journalists at Toshiba executives, according to this reporter's tweet from Tokyo., external

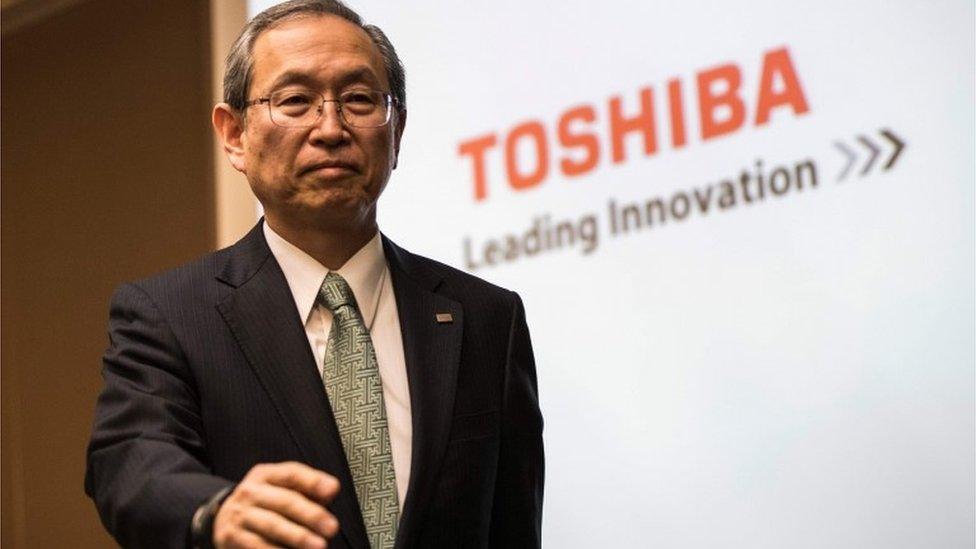

From a cancelled earnings announcement, to a chairman resigning, to a shambolic shouting match between executives and reporters at a hastily organised press conference - it would be fair to say that Toshiba is facing a sorry state of affairs.

Toshiba has now confirmed that it will ask for another month before it releases its earnings - but it has issued a preliminary report warning of losses worth some US$3.4bn.

Many analysts are concerned that this is a sign of far worse things to come.

"It's really unheard of in Japan to miss your planned earnings announcement," Marc Einstein with Frost and Sullivan told me.

"Timing and being on time is sacred in Japanese business culture - so things must be considerably worse than anticipated."

So what's gone wrong at Toshiba - once a poster child for post-war industrial Japan, now a company that hasn't made a profit since 2013?

Tosh in trouble

Behind the well publicised problems at the firm is a "disastrous" management, says Amir Anvarzadeh of BGC Partners in Singapore.

Part of the problem is also the fact that these massive Japanese companies know they can rely on the government to bail them out.

"The government will almost certainly intervene to rescue the firm," adds Mr Anvarzadeh. "They allowed TEPCO to survive, so they're going to allow this to survive. What they should do is let it die."

That's a scenario though that's probably hard for Japan's policy makers to stomach - especially given the number of people Toshiba employs - more than 180,000 people around the world.

Zombie firms

It's not just Toshiba that's in this mess, as I've written about before, Sharp, Takata and Mitsubishi are just a few recent examples of shambolic goings ons at Japan Inc, and are all massive employers too.

But Toshiba is as good an example as any of what's wrong.

It's not making money and lied about that. It's made bad investments, and it's lied about how well those investments are doing.

It's consistently failed to provide solutions for what is in effect a failing business.

And yet it - and others like it - survive, partly because of government support and a reluctance to let big firms fail, and partly because of the fiscal environment in Japan.

"Debt in Japan is almost free," says Mr Einstein, "So it's not been difficult for Toshiba or for any company in Japan to keep the lights on. There are questions about whether that should change - but because it hasn't there's no incentive for Japanese companies to change their behaviour."

Killing me softly

Like most things in Japan then, it links back to the government and the three arrows of Abenomics - the third arrow being structural reforms of Japan INC.

Prime Minister Shinzo Abe has been criticised for not pushing Corporate Japan to change more - fearful of upsetting the tight nexus between politics and business that exists.

But there's a bigger problem: what Zombie companies do to the Japanese economy.

Imagine for a moment that you're a nimble young entrepreneur in Tokyo, hoping to strike it big. But what would be the point if everything you've been taught about business - making products that people buy, turning a profit, keeping your books in order - are completely ignored by the government and big industrial giants?

You're playing by the rules, but the big boys aren't - which means there's no level playing field for smaller players.

Consistently providing Japan's failing firms with avenues to capital and bailing them out won't achieve the stated goals of Mr Abe's new vision for an entrepreneurial, innovative Japan.

It will only end up ensuring that the rot within Japan Inc remains entrenched in the country's business culture.