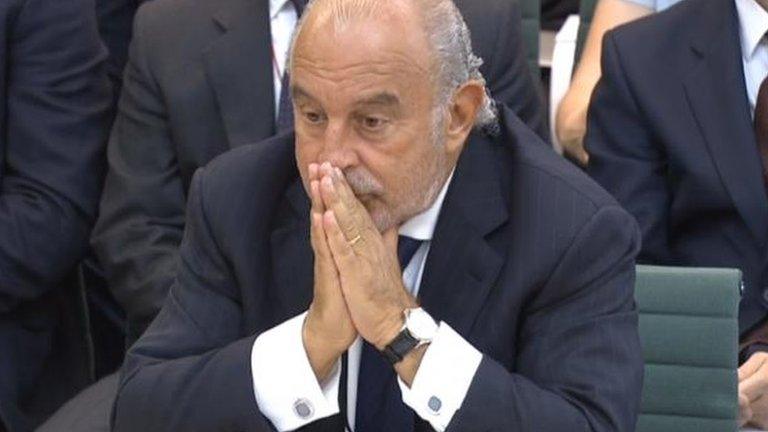

Sir Philip Green's reputation 'still stained' despite BHS pension deal

- Published

Retail tycoon Sir Philip Green's £363m payment to the BHS pension scheme does not wipe away the stains from his reputation, a senior MP has said.

Business committee chairman Iain Wright told the BBC that the payment does not necessarily safeguard his knighthood.

Sir Philip agreed the settlement with the regulator to help fill the failed retailer's pensions black hole.

But fellow Labour MP Frank Field said the BHS saga was far from being fully resolved.

Under the deal with the Pensions Regulator announced on Tuesday, former BHS workers will get the same starting pension that they were originally promised. But the protection against inflation is not as strong.

Green keeps his promise on BHS pensions

Filling the gaps on the High Street

Mr Wright and Work and Pensions Select Committee chairman Frank Field led questioning of Sir Philip over the sale of the chain and its eventual collapse.

'Moral duty'

He owned BHS for 15 years before selling it for £1 to former bankrupt Dominic Chappell.

Mr Wright welcomed the pensions deal but said it "doesn't wipe the stains from his reputation clean" and the "devil is in the detail".

He told BBC Radio 5 live that Sir Philip had a moral duty to right some of the wrongs committed under his watch.

"It sends out a very powerful message. You might try to sell a business. You might try to flog it off on the cheap because you don't want to deal with the pension deficit, but the pension regulator said we'll come after you and we'll make you pay big money in order to safeguard the interests of pensioners and that can only be a good thing," the MP said.

He said Sir Philip's knighthood was a separate issue and nothing had changed in his opinion since the House of Commons unanimously backed a non-binding motion to strip Sir Philip of his title last October.

In a letter to the Times, Mr Field said: "Yesterday's out-of-court settlement will give BHS pensioners a better retirement than had previously looked likely.

"This marks a really important milestone on the road to justice, but we are far from reaching the end of that road."

Key decisions

Mr Field said the government's Insolvency Service was investigating how and why BHS went under, and at "the deals that took place between Sir Philip Green and Dominic Chappell".

At the end of that process, the government had some "key decisions" to make, he added.

Under the deal the Pensions Regulator said the new scheme offered benefits of around 88% of the value of their full BHS scheme.

John Ralfe, the independent pensions expert, said most of the 19,000 pension scheme members will be better off then if they had had to remain with the Pension Protection Fund.

"However, the 9,000 people who could take a cash lump sum would be worse off.

"That's simply because however much the value is of their pension, let's say around £15,000, they will be offered a smaller amount," he said.

"That is a loss to them and a gain not to the pension fund. Although, I'm not entirely clear I believe it will find its way back to Sir Philip as a refund to the £363m." He added.

The Pensions Regulator says anti-avoidance enforcement action against Sir Philip and his companies will cease in light of the settlement, but action continues in respect of Mr Chappell and his firm, Retail Acquisitions.

Former BHS office manager Lin MacMillan who set up a petition urging Sir Philip to "sell the yachts, pay the pensions" welcomed the deal.

"I am glad to see a resolution after months of anxiety and worry for BHS pensioners. I would sum it up as saying it's not as bad as it might have been, but its not as good as it should have been."

'Satisfied'

An online petition calling for Sir Philip to be stripped of his knighthood has attracted nearly 150,000 signatures.

MPs backed the move in a non-binding motion in the Commons last year, but any decision would have to be taken by the Honours Forfeiture Committee.

Sir Philip's contribution is significantly less than the £571m pensions deficit BHS was left with.

But he said it was "significantly better" than schemes entering the Pension Protection Fund (PPF).

"The settlement follows lengthy, complex discussions with the Pensions Regulator and the PPF, both of which are satisfied with the solution that has been offered," he said.

"All relevant notices, including legal matters and claims from the regulator, have been withdrawn, bringing this matter to a conclusion."

- Published1 March 2017

- Published28 February 2017