The star fund managers who have doubled savers’ money

- Published

If you had put £10,000 into a good savings account 10 years ago, you would now have £11,361.

After inflation, that means a loss in real terms. Frankly, you would have got better value by blowing it on a holiday.

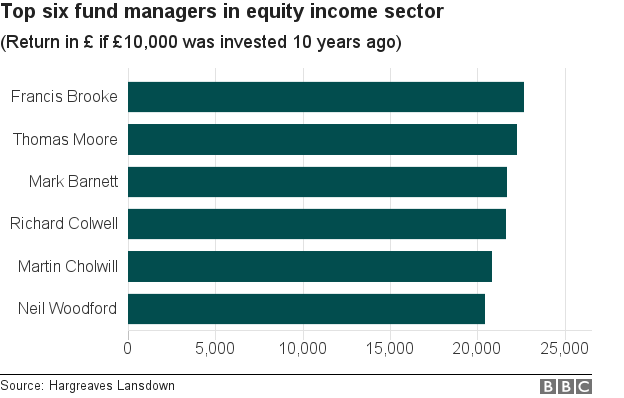

But had you invested that cash in any one of half a dozen different equity income funds, you could have doubled your money.

In fact, if you had chosen well you could now have over £22,000.

The figures come from a study by Hargreaves Lansdown, which tracked the performance of 30 equity income fund managers over the 10-year period from December 2006 to December 2016.

Given that the period included the financial crisis, when stock markets crashed, it is quite an achievement.

But Britain's best-known fund manager - to those familiar with the industry - is not top of the table. Neil Woodford, who is getting ready to launch his newest fund, comes in at number six.

What is an equity income fund?

Equity income funds invest in shares, with the idea of producing an annual income for the investor, paid out of the underlying dividends

Funds typically require a minimum investment of £100

They are distinct from funds that purely aim to increase the capital value of the investment, known as growth funds

However, some of the most successful equity income funds have succeeded in increasing the capital, as well as producing an income or yield

Top performers

To make it into the study, managers had to have been in the business for at least 10 years.

Top performer was Francis Brooke, pictured above, who runs the Trojan Income Fund. Investing with him would have turned £10,000 into £22,697 over the 10 years. That sum includes £8,000 in capital gains, and £4,000 in income.

The figures include charges.

His fund is one of the least volatile, and is the only one in the sector not to have cut its dividend in the last decade.

He puts his success down to a rigorous focus on quality, ignoring "market noise" and not chasing returns.

"Our aim is to protect investors' capital, and to increase its value year-on-year. Our approach is conservative, with attention always paid to the downside risk of any investment," he told the BBC.

The funds:

Francis Brooke: Trojan Income

Thomas Moore: SLI UK Equity Income Unconstrained

Mark Barnett: Invesco Perpetual High Income

Richard Colwell: Threadneedle UK Equity Alpha Income

Martin Cholwill: Royal London UK Equity Income

Neil Woodford: CF Woodford Equity Income

'Good custodians'

The study also shows that the country's best-known fund manager, Neil Woodford, has not performed quite as well over the last 10 years as his former colleague Mark Barnett.

The two men previously worked together at Invesco Perpetual in Henley-on-Thames, and ever since their relative performances have been closely scrutinised.

But while there may be some quiet satisfaction this weekend in the Barnett camp, some experts still favour Woodford.

"Both have been successful. One has simply been successful over a longer time period," says Laith Khalaf, senior analyst at Hargreaves Lansdown.

"For us that probably means that Woodford edges it over Barnett, but actually they're both very good managers. They're both very good custodians of your money."

In just over two weeks' time, Woodford, pictured above, will launch his newest fund, the Income Focus Fund.

But unlike his existing Equity Income Fund, which pays investors around 3.6%, this one will aim to pay 5p in the pound during the 2018 calendar year.

However, he points out that the combined returns from the Equity Income Fund - taking both capital gain and income into account - are likely to be bigger than from the Income Focus Fund.

Last week he told journalists that 2016 had been a poor year for him, but he was optimistic about the prospects for the new fund.

"My view is there's more opportunity in the market than I've seen for a long time, and I see a lot of undervalued stocks."

As one who has pro-Brexit instincts, he also believes that the current economic forecasts are too pessimistic.

"I think the economy will continue to perform better than people think."

Relative returns

If you do want to invest in an equity income fund, the Hargreaves Lansdown research shows you have to choose carefully.

As the chart above indicates, good and even average managers have outperformed the wider market.

The average manager has turned £10,000 into £17,796.

However, a poorly performing equity income fund would have returned you only £11,849, scarcely better than putting your cash in the bank. A high interest savings account would have given you just £11,361.

In both cases you would have been much better off buying a simple tracker fund.

A FTSE All-Share tracker would have grown your money to £16,367.

"You don't want to be invested in an average fund; you want to be invested in a good fund," says Laith Khalaf.

Rather than take the risk of putting your money with a poor fund manager, he says, a FTSE All-Share tracker could provide better value.

"If you don't want to go down that road, a tracker fund is for you."

The effect of inflation means that any figure below £12,538 indicates your investment has lost value in real terms.

Should I buy an equity income fund?

Assessing the relative performance of equity income funds depends on the timescale you take.

Over the last decade, returns on the stock market as a whole have been slightly better than returns from equity income funds.

Over the last 20 years though, the reverse is true.

Either way, Hargreaves Lansdown advises investors to have at least some of their portfolios in equity income, even though they may not need a regular flow of cash.

Francis Brooke agrees: "We regard equity income investing as a good choice for retail investors - whether or not they need to spend their income."

As ever, past performance is no guide to the future.

Nevertheless the analysis of 10-year track records is amongst the best intelligence you're likely to get.

- Published19 June 2015