Charlotte Hogg resigns as Bank of England deputy governor

- Published

Charlotte Hogg, who was set to become a Bank of England deputy governor, has resigned after failing to disclose her brother worked at Barclays.

Ms Hogg broke the Bank's code of conduct by failing to reveal the potential conflict of interest.

She had been the Bank's chief operating officer since 2013.

But news of her brother's job only emerged earlier this month, when she faced MPs on the Treasury Committee about her promotion to deputy governor.

She would have had responsibility for markets and banking. Her brother Quintin works in the strategy unit of Barclays' investment bank.

A Treasury Committee report released on Tuesday said she "fell short of the very high standards" required and that MPs had "set aside" its approval of her appointment.

Minutes after the committee released its report, the Bank announced Ms Hogg's resignation.

She will not leave immediately and therefore will take part in this week's Monetary Policy Committee meeting.

It will be the first - and last - time Ms Hogg is involved with the MPC, which sets UK interest rates.

Analysis: Kamal Ahmed, economics editor

The Treasury Committee's action against Charlotte Hogg is certainly significant.

And its significance goes well beyond the future of Ms Hogg.

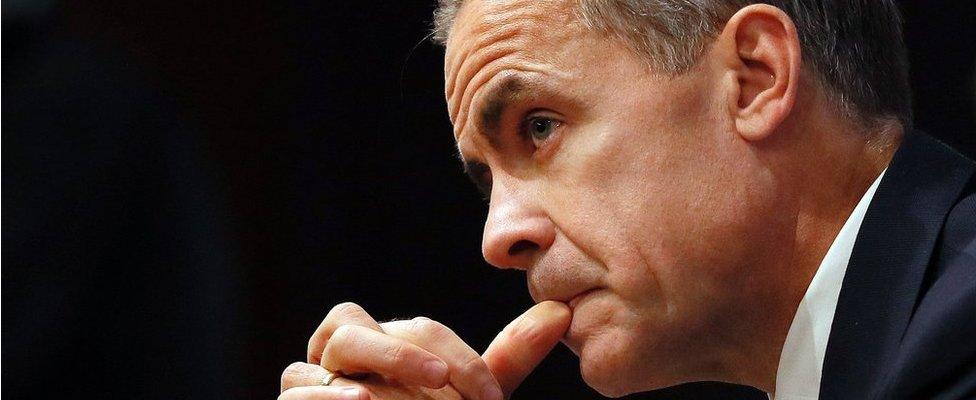

Mark Carney, the Governor of the Bank of England, backed her until one minute to midnight.

Which, after the evidence laid out by the committee today, is likely to be questioned by MPs when Mr Carney next appears before them.

'Honest mistake'

Bank governor Mark Carney said:, external "While I fully respect her decision, taken in accordance with her view of what was the best for this institution, I deeply regret that Charlotte Hogg has chosen to resign from the Bank of England.

"We will do everything we can to honour her work for the people of the United Kingdom by building on her contributions."

In her resignation letter,, external Ms Hogg said she was very sorry for failing to disclose her brother's role.

She also said she had offered to resign last week.

"It was an honest mistake: I have made no secret of my brother's job - indeed it was I who informed the Treasury Select Committee of it, before my hearing.

"But I fully accept it was a mistake, made worse by the fact that my involvement in drafting the policy made it incumbent on me to get all my own declarations absolutely right," Ms Hogg said.

"I also, in the course of a long hearing, unintentionally misled the committee as to whether I had filed my brother's job on the correct forms at the Bank.

"I would like to repeat my apologies for that, and to make clear that the responsibility for all those errors is mine alone."

The Bank is planning to tighten up its governance of the code of conduct.

"Ms Hogg has acted in the best interests of the Bank of England" chair of Treasury Committee tells BBC Radio 4's World at One

Andrew Tyrie, chairman of the Treasury Committee, said: "This is a regrettable business with no winners. Ms Hogg has acted in the best interest of the institution for which she has been working. This is welcome.

"It is also welcome that the Bank has responded immediately by announcing an internal review.

"The Bank's governance is already in much better shape than it was a few years ago. It is something to which the Governor and Court has been committed for some time. But there is clearly more to do."

John Mann, an MP on the Treasury Committee, told BBC Radio 5 live it was "appropriate" she had resigned.

"She wrote the code of conduct for the Bank of England which says: 'Do you have a family member working in the banking industry, ie a brother or sister?'

"It's an explicit set of standards that she wrote and didn't comply with and that made her position totally untenable.

"The question for Mark Carney is why the set of standards wasn't being adhered to. He needs to be very clear now on what the Bank's going to do to address this. It's clearly a systemic issue in the Bank."

- Published14 March 2017

- Published14 March 2017

- Published14 March 2017

- Published2 March 2017