Sir Philip sold BHS to dodge pension cost, says regulator

- Published

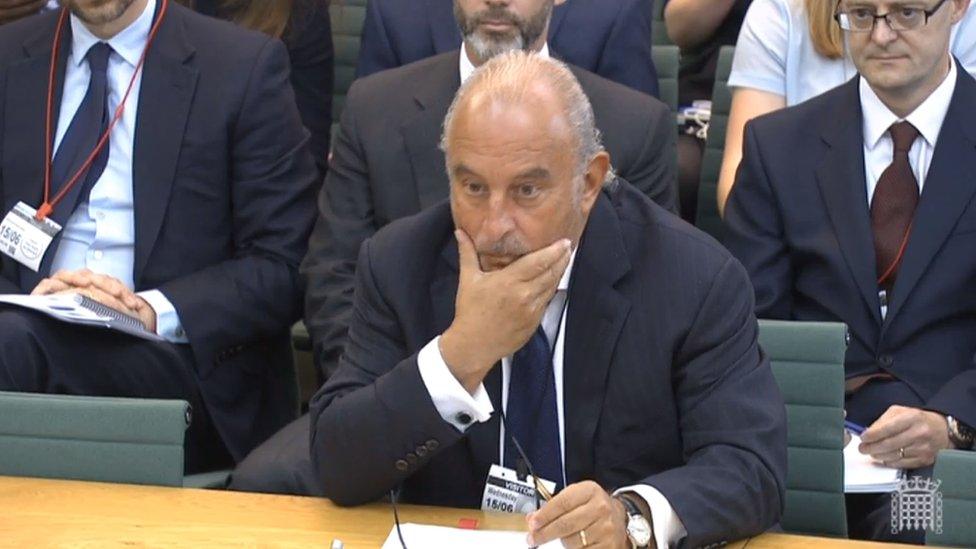

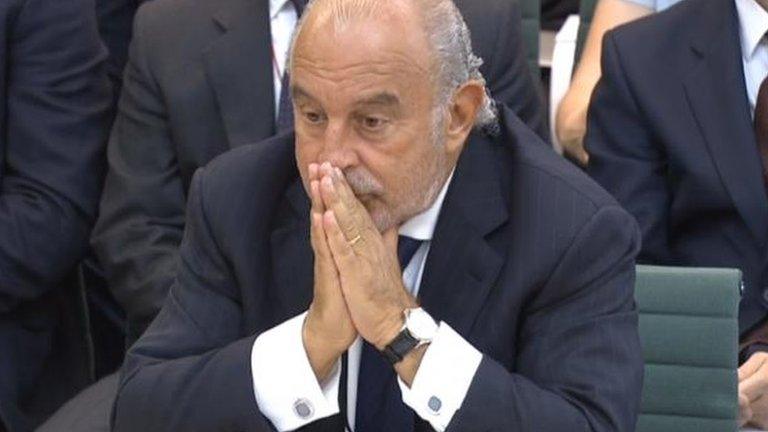

Sir Philip Green gives evidence to the Business, Innovation and Skills Committee and Work and Pensions Committee on the collapse of BHS.

The controversial businessman Sir Philip Green sold the BHS business to dodge responsibility for its insolvent pension schemes if the firm should go bust, says the Pensions Regulator.

The claim is made by the regulator in its report on the sale of BHS in 2015 and its collapse a year later.

In February, Sir Philip finally agreed, after months of pressure, to pay £363m into the BHS pension schemes.

A spokesman for Sir Philip said only "the matter is now closed".

However the report gives, for the first time, external, some details of the warning notice that the regulator gave to Sir Philip in November last year as negotiations over resolving the BHS pension scheme deficits dragged on.

"The main purpose of the sale [of BHS] was to postpone BHS' insolvency to prevent a liability to the schemes falling due while it was part of the Taveta group of companies ultimately owned by the Green family, and/or that the effect of the sale was materially detrimental to the schemes," the regulator says.

Huge scandal

The sale of BHS for £1 in early 2015 to a former bankrupt, Dominic Chappell, and its collapse a year later along with its two pension schemes, led to one of the biggest pension scandals of the past decade.

When the retail chain went bust, with the eventual loss of 11,000 jobs, the pensions of some 19,000 current and past employees of BHS came under severe threat.

The affair also prompted MPs to vote for the cancellation of Sir Philip's knighthood, with a joint report of two parliamentary committees, external describing him publicly as the unacceptable face of capitalism because of the way, under his ownership, he extracted several hundred million pounds from BHS via dividend payments while running down the business.

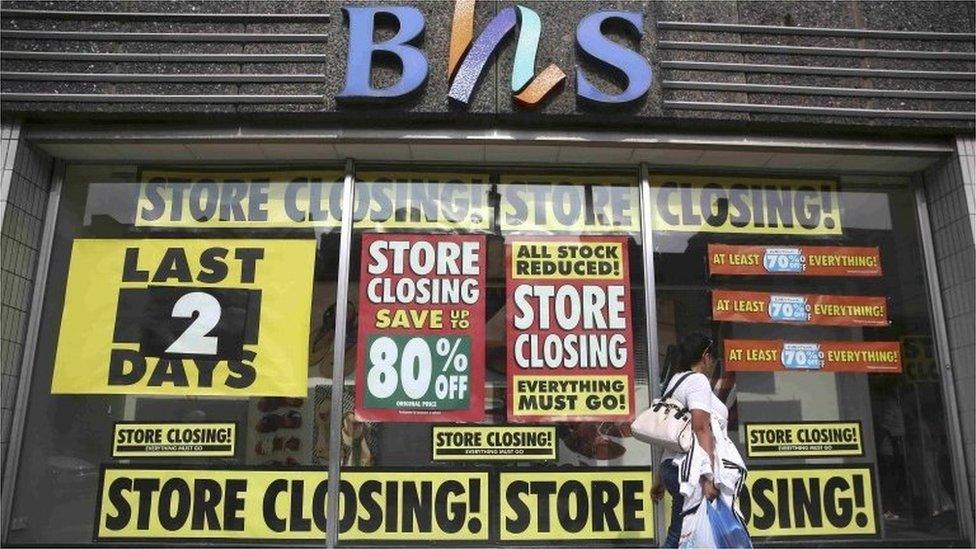

The BHS stores closed down in August 2016

The saga also led to some fierce criticism of the Pensions Regulator itself, which was accused by some MPs of being asleep on the job and not acting quickly enough to protect the interests of the BHS scheme members, despite knowing the schemes were in a parlous position.

Now, the regulator admits it should indeed have acted much more quickly and says that it will be more pro-active in the future, especially where it appears that an employer is trying to avoid its responsibility to fully fund a pension scheme

"We are committed to using our statutory powers more often where we believe there is avoidance activity," the report says.

"Key areas where we recognise that we could have performed better are the timeliness of our engagement and the clarity of our communications.

"In particular, we recognise the importance of setting out clearly and robustly our expectations to pension trustees and sponsoring employers in cases where the affordability of deficit repair contributions is an issue for the employer," the regulator added.

To do this, the regulator will ask the government for extra funding and will beef up its staffing.

John Ralfe, a pensions expert who advised the two parliamentary committees, said: "The report demonstrates that the regulator is prepared to behave in a more activist fashion."

Settlement

The regulator's report confirms that £343m has been put by Sir Philip into an escrow account to fund a new pension scheme for BHS scheme members.

A further £20m has been put aside by him to cover various administrative expenses of the rescue deal.

Existing members of the BHS schemes have three options:

to transfer to the proposed new pension scheme

to opt for a lump sum payment if eligible

to remain in their current scheme, which will probably be transferred to the Pension Protection Fund.

Overall, members of the new scheme will receive pension benefits worth only 88% of those promised by their old BHS scheme, as the new arrangement will offer reduced levels of inflation protection.

The regulator's report said that since agreeing the funding arrangement with Sir Philip the scheme now had a £100m surplus.

- Published2 April 2017

- Published1 March 2017

- Published28 February 2017

- Published27 November 2020