Why UK exporters are set for a sugar rush

- Published

- comments

Sugar gets sweeter for UK farmers

The UK's sugar beet industry is looking to ramp up production, as European Union quotas come to an end this week after nearly 50 years.

For the first time since 1968 the UK can produce and sell as much sugar around the world as it would like.

The end of the quota also means that French, German and other EU producers can sell more sugar into the UK.

Experts predict that could result in lower prices - but the British industry is confident it can compete.

What will the sugar changes mean?

Two years ago Paul Kenward, the boss of British Sugar, had a problem.

Under the EU's quota he was only allowed to sell 1.056 million tonnes of sugar beet, but it had been a particularly bumper harvest and he'd produced more than 1.4 million tonnes.

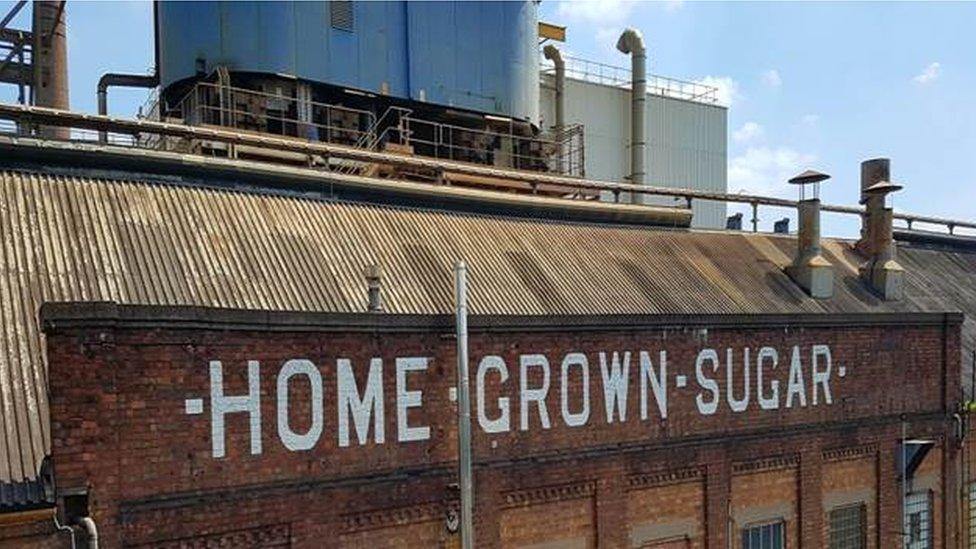

British Sugar has four factories in the UK, including this one at Newark, Nottinghamshire

"Customers wanted to buy from me, but I wasn't allowed by European Union rules to sell it," Mr Kenward tells the BBC. "We had to store it for two years - that was very expensive."

From this weekend, those limits will come to an end after years of lobbying by the UK government.

The 3,500 British farmers that grow beet - which looks like a big turnip - and British Sugar, which is the main processor of British-grown beet, see the change as a huge opportunity.

UK beets account for approximately 60% of British sugar consumption

British Sugar - which also makes Silver Spoon sugar - plans to step up production immediately and is looking to sell 1.4 million tonnes next year, up from 900,000 this year.

It's also planning to export sugar to the world market for the first time in at least a decade.

"The UK is one of the most efficient producers worldwide," says Jane Clark, who farms sugar beet in Lincolnshire. "It should put us in a good place to be competitive."

The changes are not linked to Brexit - and the industry is hopeful it will still be able to compete after the UK leaves the EU.

Britain's other big sugar producer, Tate & Lyle Sugars, processes sugar cane, and so is not directly affected by the changes.

How big is the UK sugar beet industry?

There are nearly 10,000 workers in the industry's UK supply chain

The UK consumes 2 million tonnes of sugar a year

60% of that comes from UK beets

Another 15% comes from EU beets and 25% from imported sugar cane

Source: British Sugar

How will it affect sugar prices?

Analysts say the increased supply of sugar - not just from the UK, but from other major EU producers - should ultimately lead to lower prices.

At the moment, white sugar sells for about 500 euros (£440) a tonne in the EU, compared with just over 300 euros a tonne on the international market, according to EU figures, external.

Analysts say the price of sugar could fall - but it'll have little impact on sponge cakes

Prices will become more volatile after the end of the quota, says Carlos Mera, a sugar analyst at Rabobank. "Whether consumers benefit or not, I think they probably will."

However, the effect on sugary products, like cola and sponge cake, will be more muted, because the cost of sugar only makes up a small part of the overall price of those goods.

For example, if the cost of sugar fell by 40%, that might lead to a saving of less than 1% on the price of a Victoria sponge cake.

So far, though, sugar supply contracts in the EU are still much higher than international prices, says Callum Macpherson, head of commodities at financial services firm Investec. There is also the effect of the sugar tax on soft drinks to take into account.

The Food and Drink Federation says it is difficult to predict how prices will be affected.

A wide range of factors, including world market prices, beet sugar exports, cane sugar imports, the price of other ingredients and raw materials, influence the price of sugary goods, it says.

Will the industry be able to cope?

Although the end of the quota enables UK firms to sell more sugar abroad, it will also allow EU producers to sell more in the UK.

French beet producers will also be able to produce more and could target the UK

When EU milk quotas were scrapped in 2015, it flooded the market with oversupply and put some dairy farmers out of business.

So will beet farmers suffer a similar fate?

"I don't think there are any sugar beet producers in the country that just grow sugar beet," says Jane Clark. "We all grow a range of crops, whether it be wheat, barley, or oats."

Mr Kenward says the industry learnt a lot from what happened with milk. "We prepared for this for the last few decades, and can change production more easily than dairy farmers," he says.

There's also the uncertainty around what trade terms will be in place after Brexit.

British Sugar says that if the EU starts charging tariffs on its sugar beet after Brexit, the firm would ask the UK government to charge the same tariff on EU beet.

As for trade with the rest of the world, British Sugar accepts that dropping sugar tariffs might be part of the deals struck with other countries.

But it's still confident it can compete, as the UK is "the most cost-efficient producer in the world", Mr Kenward says.

Is there a difference between sugar beet and sugar cane?

Brazil, Thailand and India are the world's biggest sugar cane producers

When it comes to flavour, beet farmer Jane Clark says there is no difference between sugar from beets or cane.

The climate and soil conditions in the UK, France, Germany, and the Netherlands suit sugar beet. Its production took off after an English blockade during the Napoleonic wars hit French cane-sugar imports.

In comparison, sugar cane tends to grow in the tropics, with Brazil, Thailand and India the main producers.

"You can refine sugar down to various levels," Jane says. "White sugar is the most refined, your brown sugar is less refined."

Ultimately, it's all the same chemical formulation: "Sugar is sugar"

- Published26 September 2017

- Published30 March 2017

- Published29 March 2017