Managing the managers: The rise of the business 'philosopher-kings'

- Published

Are the new ideas and approaches pioneered by management consultants worth their fees?

The place: a textile plant near Mumbai, India. The time: 2008. The scene? Chaos.

Rubbish is piled up outside the building - with almost as much inside. There are piles of flammable junk, and open chemical containers.

The yarn is at least bundled up in white plastic bags, but the inventory is scattered around the plant in unmarked piles.

Such shambolic conditions are typical in the Indian textile industry, and that presents an opportunity.

A team of researchers from Stanford University and the World Bank is conducting a novel experiment. They're going to send in a team of management consultants to tidy up some of these companies - but not others.

Then they'll track what happens to their profits as part of a rigorous, randomised controlled trial, external.

It will tell us conclusively whether the management consultants are worth their fees.

50 Things That Made the Modern Economy highlights the inventions, ideas and innovations which have helped create the economic world in which we live.

It is broadcast on the BBC World Service. You can find more information about the programme's sources and listen online or subscribe to the programme podcast.

That question has often been raised over the years. If managers often have bad reputations, what should we make of the people who tell managers how to manage?

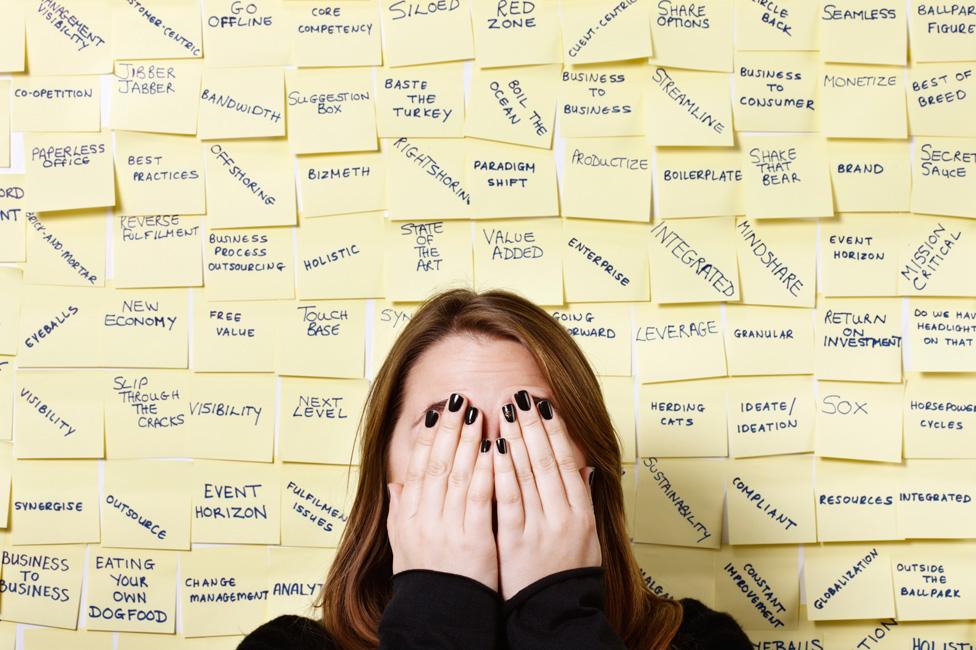

Picture a management consultant. What comes to mind?

A young, sharp-suited graduate, earnestly gesturing to a bulleted PowerPoint presentation that reads something like "holistically envisioneer client-centric deliverables"?

Some management consultants are criticised for their reliance on business jargon

Okay, I got that from an online random buzzword generator. But you get the idea.

The industry battles a stereotype of charging exorbitant fees for advice that, on close inspection, turns out to be either meaningless or common sense.

Managers who bring in consultants are often accused of being blinded by jargon, implicitly admitting their own incompetence, or seeking someone else to blame for unpopular decisions.

Still, it's big business. The year after Stanford and the World Bank started their Indian study, the UK government alone spent well over $2bn (£1.5bn) on management consultants. Globally, consulting firms charge their clients a total of about $125bn (£94bn).

'Noble' origins

Where did this strange industry begin?

There's a noble way to frame its origins: economic change creates a new challenge, and visionary men of business provide a solution.

In the late 19th century the US economy was expanding fast, and thanks to the railway and telegraph it was also becoming more of a national market and less a collection of local ones.

Company owners began to realise that there were huge rewards to be had for companies that could bestride this new national stage. So began an unprecedented wave of mergers and consolidations.

Heinz, which dates back to 1869, grew substantially at the beginning of the 20th century

Companies swallowed each other up, creating giant household names: US Steel, General Electric, Heinz, AT&T.

Some employed more than 100,000 people. And that was the challenge: nobody had ever tried to manage such vast organisations before.

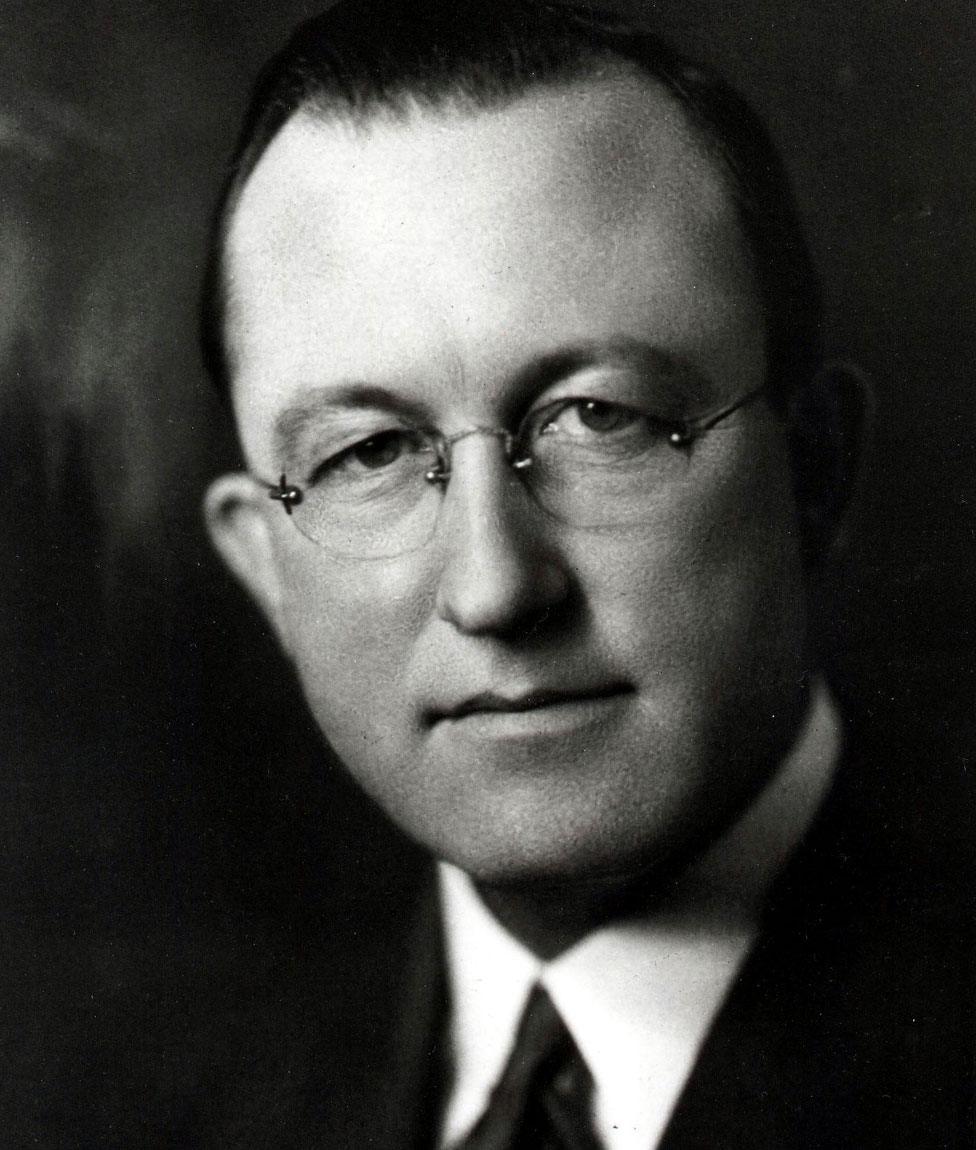

Enter a young professor of accountancy by the name of James McKinsey. His breakthrough was a book published in 1922, with the not-entirely-thrilling title Budgetary Control.

Accounting for the future

But for corporate America, Budgetary Control was revolutionary. Rather than using traditional historical accounts to provide a picture of how a business had been doing over the past year, McKinsey proposed drawing up accounts for an imaginary corporate future.

These future accounts would set out a business's plans and goals, broken down department by department.

And later, when the actual accounts were drawn up they could be compared to the plan, which could then be revised.

McKinsey's method helped managers take control, setting out a vision for the future rather than simply reviewing the past.

James McKinsey saw the potential of setting out a corporate vision of the future

McKinsey was a big character - tall, and fond of chomping cigars, ignoring his doctor's advice. His ideas caught on with remarkable speed: by the mid-1930s he was hiring himself out at $500 (£380) a day - about $25,000 (£19,000) in today's money.

And as his own time was limited, he took on employees. If he didn't like a report they wrote, he'd hurl it in the bin. "I have to be diplomatic with our clients," he told them. "But I don't have to be diplomatic with you bastards!"

Aged just 48, James McKinsey died of pneumonia. But under his lieutenant, Marvin Bower, McKinsey & Company thrived.

Bower was a particular man. He insisted that employees wore a dark suit, a starched white shirt, and, until the 1960s, a hat.

McKinsey & Co, he said, was not a business but a "practice". It didn't take on jobs, but "engagements". It was not a company, but a "firm". Eventually it simply became known as "The Firm".

'Business philosopher-kings'

Duff McDonald wrote a history of The Firm, arguing that its advocacy of scientific approaches to management transformed the business world.

It acquired a reputation as perhaps the world's most elite employer. The New Yorker once described McKinsey's young Ivy League hires parachuting into companies around the world as a "Swat team of business philosopher-kings".

But hold on. Why don't company owners simply employ managers who've studied those scientific approaches themselves? There aren't many situations where you'd hire someone to do a job, and also hire expensive consultants to advise them how to do it.

What accounts for why companies like McKinsey gained such a foothold in the economy?

Part of the explanation is surprising: government regulation. The Glass-Steagall act of 1933 was a far-reaching piece of American financial legislation.

The Glass-Steagall act - signed by Franklin Roosevelt in June 1933 - was meant to limit conflicts of interest

Among many provisions, Glass-Steagall made it compulsory for investment banks to commission independent financial research into the deals they were brokering.

Fearing conflicts of interest, Glass-Steagall forbade law firms, accountancy businesses and the banks themselves from conducting this work. Effectively, the act made it a legal requirement for banks to hire management consultants.

In 1956 the Justice Department banned the emerging computer giant IBM from providing advice about how to install or use computers. Another business opportunity for the management consultants.

More from Tim Harford:

Minimising conflicts of interest was a noble aim, but it hasn't always worked out well.

Some time after McKinsey's long-serving boss, Rajat Gupta, left the firm, he managed to get himself convicted and imprisoned for insider trading.

McKinsey also employed Enron's Jeff Skilling, external, and then was paid for advising him, before quietly fading into the background while Enron collapsed and Skilling went to jail.

Here's another argument for employing management consultants: ideas on management evolve all the time, so maybe it's worth getting outsiders in periodically for a burst of fresh thinking.

'Land and expand'

But often it doesn't work like that: the consultants continually find new problems to justify their continued employment. Some use the analogy of leeches, attaching themselves and never letting go.

It's a strategy known as "land and expand". One UK government ministry recently admitted that 80% of its supposedly temporary consultants had been working there for more than a year - some for up to nine years.

Needless to say, it would have been much cheaper to employ them as civil servants.

No doubt the consultancy firms will claim that their expertise is giving the taxpayer value for money.

Which brings us back to India, and that randomised controlled trial.

Management consultants saw an opportunity in the often shambolic Indian textile industry

The World Bank hired a global consulting firm to put some structure into these jumbled Mumbai textile factories, instituting preventive maintenance, proper records, systematic storing of spares and inventory, and the recording of quality defects.

It worked. Productivity jumped by 17% - easily enough to pay the consulting fees.

We shouldn't conclude from this study that cynicism about management consulting is always misplaced.

These factories were, after all, what a jargon-filled PowerPoint presentation might call "low-hanging fruit".

But it's scientific proof of one thing, at least. As so often in life, when an idea is used simply, and humbly, it can pay dividends.

Tim Harford writes the Financial Times's Undercover Economist column. 50 Things That Made the Modern Economy is broadcast on the BBC World Service. You can find more information about the programme's sources and listen online or subscribe to the programme podcast.

- Published2 October 2017

- Published5 April 2017

- Published5 January 2016

- Published5 January 2016

- Published29 July 2013