Carillion: 'Matter of days' to stop collapse

- Published

The future of troubled engineering company Carillion is being discussed at high-level government meetings this weekend, the BBC understands.

The firm is a key government contractor for projects including the HS2 high-speed rail scheme, schools and prisons.

Sources say the firm has a "matter of days" as it teeters on the edge of collapse, with £1.5bn of debt including a pension shortfall of £587m.

Carillion is trying to reach an agreement with creditors.

Liberal Democrat leader Sir Vince Cable said the government must not bail out the struggling construction company, the second largest in the UK.

Sir Vince, a former business secretary, told BBC Breakfast: "They've got to force the shareholders and indeed the creditors, the big banks, to take losses, and then the government can take responsibility for taking the contracts forward and making sure they are delivered."

Jon Trickett, shadow minister for the Cabinet Office, called on the government to take contracts back into public control, describing its relationship with the Carillion as a "failing ideological project".

"It has been clear for months that Carillion has been in difficulty but the government has continued to hand over contracts to the company," he said.

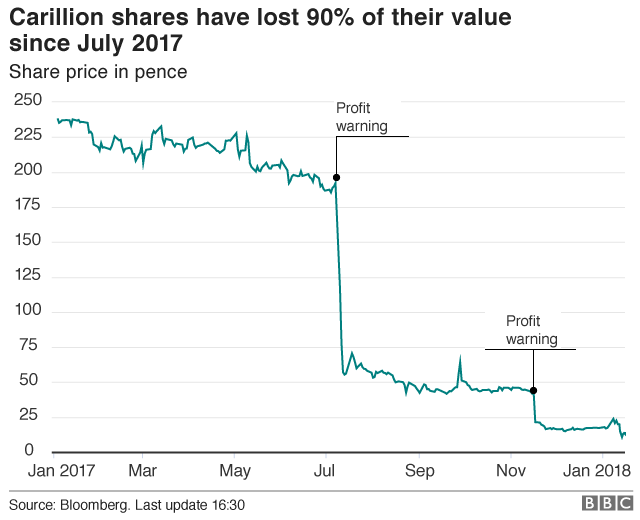

In 2016 the Wolverhampton-based company, which employs 43,000 people globally, had sales of £5.2bn and until July boasted a market capitalisation of almost £1bn.

But since then its share price has plummeted and it is now valued at about £61m.

Officials from the justice, transport and business departments will gather this weekend for a meeting chaired by the Cabinet Office.

The consultancy EY has been put on notice in case the company falls into administration.

On Friday, reports that creditors had rejected a potential rescue plan sent Carillion's shares down by more than 28%.

Analysis: A moral hazard

By BBC business correspondent Joe Lynam

A decade ago the government bailed out the banks because - being central to the workings of the entire economy - they were "too big to fail".

Now the same issue of moral hazard arises for the engineering giant Carillion.

If it collapses, what happens to politically sensitive work that it does, such as building hospitals and running schools, jails or Ministry of Defence facilities?

Pausing that work until new contracts are tendered, bid for and awarded would take years.

But bailing out a private company like Carillion, which paid out dividends to its shareholders last year, won't play well with taxpayers.

So Carillion will either have to restructure its debts within days with its now impatient banks or file for administration and hope that EY can find a solution which is quick, clever and doesn't cost jobs.

Bailing out Carillion 'would send the wrong message', Vince Cable says.

But in Friday's statement, Carillion said: "Suggestions that Carillion's business plan has been rejected by stakeholders are incorrect."

It said the firm remained in constructive dialogue about short-term financing while "longer term discussions are continuing".

The government has said it is "monitoring the situation closely".

A government spokeswoman said: "Carillion is a major supplier to the government with a number of long-term contracts. We are committed to maintaining a healthy supplier market and work closely with our key suppliers."

The BBC understands that the Ministry of Justice has drawn up plans to bring £200m of prison contracts run by Carillion back into public control.

Carillion, which was founded in the late 1990s as a spin-off from building giant Tarmac, also operates in Canada, the Middle East and the Caribbean.

It has worked on key projects overseas including the Suez Canal road tunnel and Toronto's Union Station.

It is also the second largest supplier of maintenance services to Network Rail.

The general secretary of the RMT rail union, Mick Cash, said the government should give Carillion's workers "clear-cut assurances", as thousands of jobs were "hanging by a thread".

It also wants an assurance that operations would be directly transferred over to Network Rail if Carillion goes bust.

- Published15 January 2018

- Published12 January 2018

- Published7 January 2018

- Published3 January 2018