Nationwide delays Open Banking launch

- Published

The Nationwide building society was given a last-minute extension to prepare for an overhaul in banking competition.

Open Banking, a system allowing customers to securely use their payment history to get better deals, started on 13 January.

The UK's nine biggest current account providers were told by the Competition and Markets Authority to be ready.

Five had already been given extra time. Nationwide also missed the deadline.

"Nationwide has completed most of the work necessary and is continuing to robustly test the process, to ensure customers are given the best possible experience," a spokeswoman for the UK's largest building society said.

"We have therefore agreed a new timeline with the CMA for implementation of our Open Banking capability."

It will start the system in March.

A maximum of six extra weeks preparation time had already been given to Barclays, Bank of Ireland, RBS and HSBC by the UK's competition authority.

Santander-owned Cater Allen, a private bank that has 40,000 active business current accounts, will miss the deadline by a year, as it needs to rebuild its IT system.

That left just Allied Irish Bank, Danske and Lloyds Banking Group fully ready to start on time.

What is Open Banking?

Traditionally, banks have held all our information about our past transactions and spending habits.

A change in UK law now means that banks and building societies must allow regulated businesses access to a customer's financial data, but only if the customer has given their permission.

The bank can only block access if it suspects fraud or unauthorised access.

The UK's Open Banking system should ensure that such access is given by the UK's nine biggest current account providers in a secure way, and without the need for customers to reveal their online banking login details or passwords.

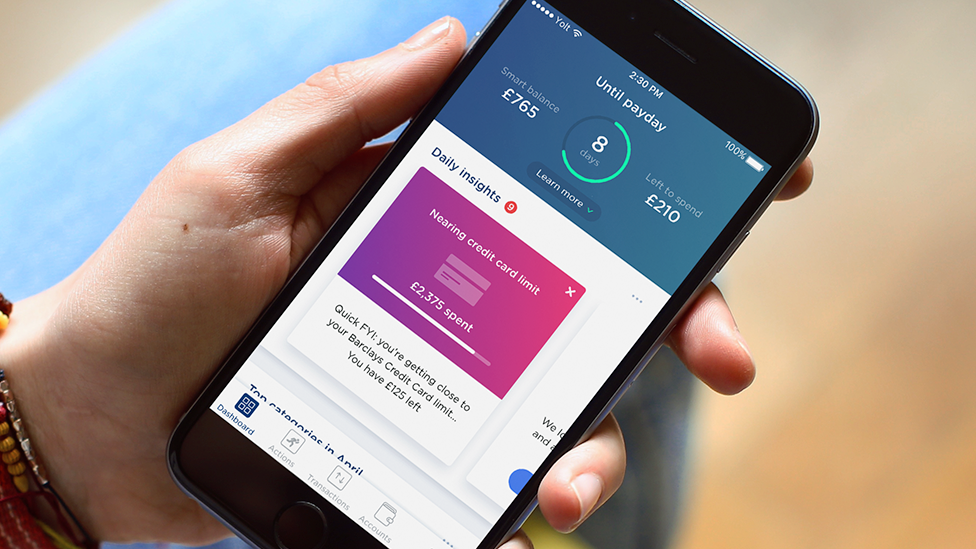

The main idea is that individuals can allow apps and online services to analyse their spending and find better deals on everything from loans and mortgages to shopping and broadband. Customers can give, and withdraw, permission at any time.

- Published12 January 2018

- Published11 January 2018