HSBC to pay $101.5m to settle currency rigging probe

- Published

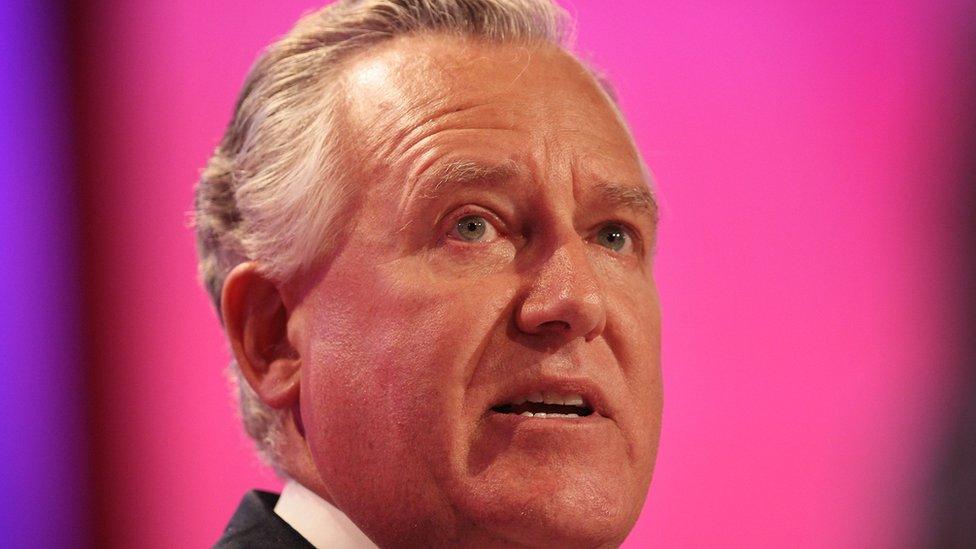

HSBC Holdings has its roots in Hong Kong and is Europe's biggest bank

HSBC has agreed to pay $101.1m (£72.7m) to settle a US criminal investigation into rigged currency transactions.

The bank has admitted its traders twice misused confidential information provided to them by clients for its own profit.

HSBC, which is Europe's biggest bank, saw one of its former bankers convicted last year in connection with the probe.

A US jury found Mark Johnson guilty of defrauding client Cairn Energy in a 2011 currency trade.

Compliance promise

The HSBC settlement is made up of a $63.1m criminal penalty and $38.4m in restitution to an unnamed corporate client.

Separately it had already settled with Cairn Energy for approximately $8m.

The DPA, which would allow HSBC to avoid criminal charges, is pending a review by a US court.

The bank said it had agreed to boost its compliance programme and internal controls, as well as to cooperate fully with regulatory and law enforcement authorities, external.

Ex-HSBC banker found guilty of fraud

HSBC to pay €300m to settle tax probe

HSBC 'ignored money laundering warning'

HSBC 'helped clients dodge tax'

It is not the first time HSBC has been in trouble with US authorities.

In September, the US Federal Reserve fined HSBC $175m over "unsound" practices, external in its foreign exchange business.

And in November, the banking giant agreed to pay €300m ($353m; £266m) to French authorities to settle a long-running investigation into tax evasion by French clients.

The French financial prosecutor's office claimed HSBC's Swiss private banking unit helped clients evade tax.

- Published15 November 2017

- Published23 October 2017

- Published17 July 2017

- Published2 November 2017

- Published30 October 2017