Mortgage approvals at the lowest for five years

- Published

- comments

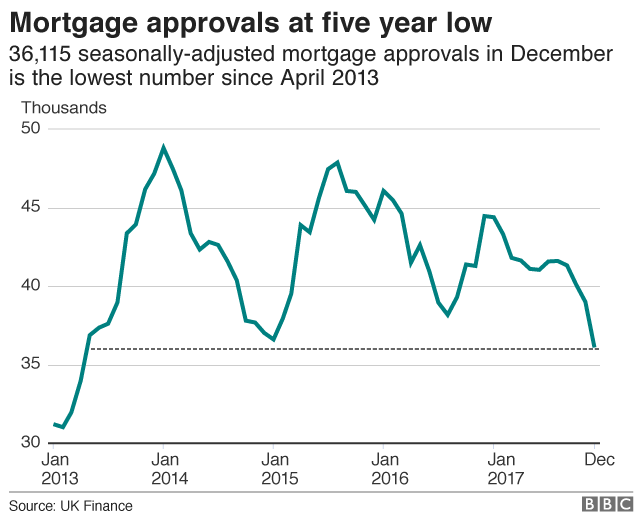

The number of mortgages given out by UK banks has dropped to its lowest level for nearly five years, according to industry figures.

UK finance said, external there were 36,115 seasonally-adjusted mortgage approvals in December, the lowest number since April 2013.

The drop occurred despite a reduction in stamp duty for first-time buyers, which took effect in November.

However experts said it was too soon for that to have made a difference.

Nevertheless, some borrowers may have been put off by the increase in standard variable rate mortgages in December, following the Bank of England's decision to raise base rates to 0.5% in November.

"December's marked drop in mortgage approvals suggests that already pressurised housing market activity took a further hit from the Bank of England raising interest rates in early November," said Dr Howard Archer, chief economic adviser to the EY Item Club.

"Housing market activity has been under pressure from squeezed consumer finances and fragile confidence."

During December, UK banks approved £7.02bn in mortgage lending - the lowest amount since September 2016.