Topshop boss denies report he is selling the business

- Published

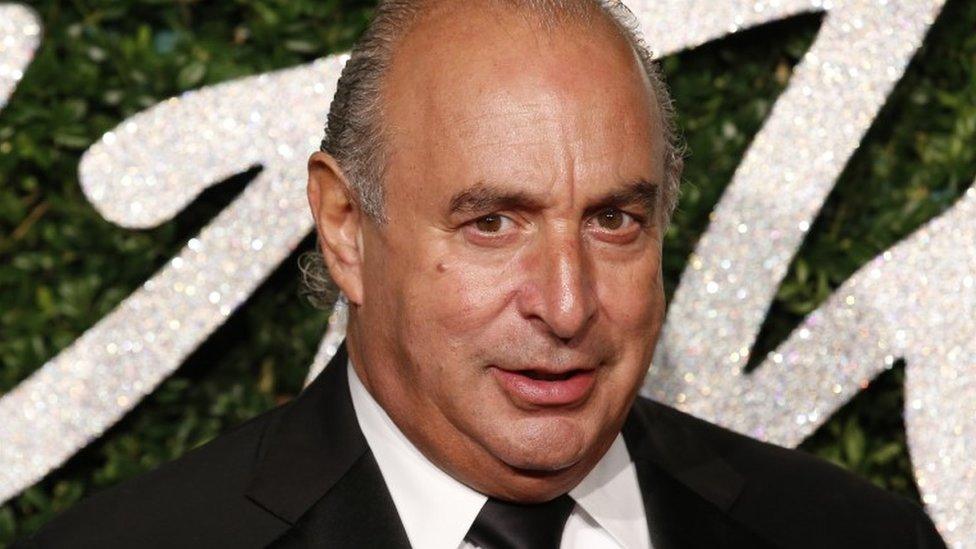

Sir Philip Green has vehemently denied a report that he is planning to sell his Arcadia retail empire.

In a statement, Arcadia said a story in The Sunday Times, external claiming Sir Philip is in talks to offload all or part of the Topshop-owner is "totally false".

The newspaper said Sir Philip is in discussions with China's Shandong Ruyi about a potential deal.

However, Arcadia said neither Sir Philip or its directors "have ever met or had any contact with Shandong Ruyi".

The article also alleges that Sir Philip has been in discussions with bankers from HSBC about separating Topshop from Arcadia.

But Arcadia said the statement regarding discussions with HSBC are "totally untrue", and claimed the report was "further evidence" of a "personal vendetta against Sir Philip and his companies".

It said: "The 22,000 people that work at Arcadia should not be subjected to this type of malicious rumour-mongering."

In response, The Sunday Times said: "This is a public interest story, which The Sunday Times investigated thoroughly before publication, and we stand by our report."

Sir Philip's Arcadia group, whose brands also include Burton, Miss Selfridge, Dorothy Perkins and Wallis, has 2,800 stores across the world.

However, his flagship chain, Topshop, has struggled against competition from the rise of online rivals such as Boohoo and Asos.

Sir Philip Green reached an agreement with the Pensions Regulator in February

According to latest figures, profits at Taveta, Arcadia's holding company, fell 79% in 2016.

Last year, Sir Philip revamped management in a bid to revive the brands.

'Pension payment'

Following The Sunday Times, external story, Frank Field, chairman of the Work and Pensions Committee, said that he had written to Sir Philip Green asking if he will he seek clearance from The Pension Regulator for any deal.

Arcadia, which confirmed receipt of the letter, said that it had promised to pay £50m a year into its pension fund, "the most recent payment being made this month".

It added: "The group remains unborrowed at the operating level and has substantial property assets."

The Work and Pensions Committee last year investigated the sale and subsequent collapse of BHS, which Sir Philip sold to an investment vehicle called Retail Acquisitions Ltd in 2015 before it went bust the following year.

The failed High Street chain was left with a huge pension deficit, although Sir Philip later agreed a £363m cash settlement with the Pensions Regulator to plug the gap.

Mr Field has criticised Sir Philip's actions, and last August the businessman sent a legal warning to the MP.

Shandong Ruyi has been expanding in Europe. It has bought controlling stakes in the Swiss luxury leather goods company Bally and London-listed fashion manufacturer Bagir.

The Chinese company bought Acquascutum last year for £95m.

- Published10 January 2018

- Published31 August 2017

- Published17 August 2017

- Published28 June 2017

- Published8 June 2017