Pension contribution increases a 'harsh jolt' for millions

- Published

- comments

Millions of workers face a "harsh jolt" to their incomes this month, as the amount they have to pay into their pensions triples in value.

From the start of the new tax year on Friday, workers in auto-enrolment pensions will see minimum contributions rise from 1% of their income to 3%.

One accountancy firm is warning that pay packets will suffer as a result.

But other experts say the contributions are easily affordable and will mean higher incomes in retirement.

"The increase in monthly auto-enrolment pension contributions may result in a decrease in take-home pay for some workers," said Rebecca Goldring, a tax manager at accountancy firm Blick Rothenberg.

"For many, this increase will feel like a harsh jolt."

But Nathan Long, senior pension analyst at Hargreaves Lansdown, believes most workers will shrug off the increases relatively easily.

"Workers can now look forward to retirement with more confidence," he said.

"Without this jump in contributions, retirement would be unaffordable for many, and an entire lifetime spent working could become the reality."

Why are contributions going up?

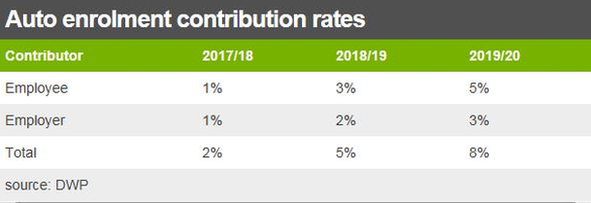

Auto-enrolment pensions began with modest contributions: 1% from the employee - including tax relief - and 1% from the employer.

But to afford a decent retirement, the government has always said that rates need to rise. So from Friday, employees will pay a minimum of 3%, while employers will pay 2%.

From April next year, the rates will rise again: 5% from the employee, and 3% from the employer.

How much more will I have to pay?

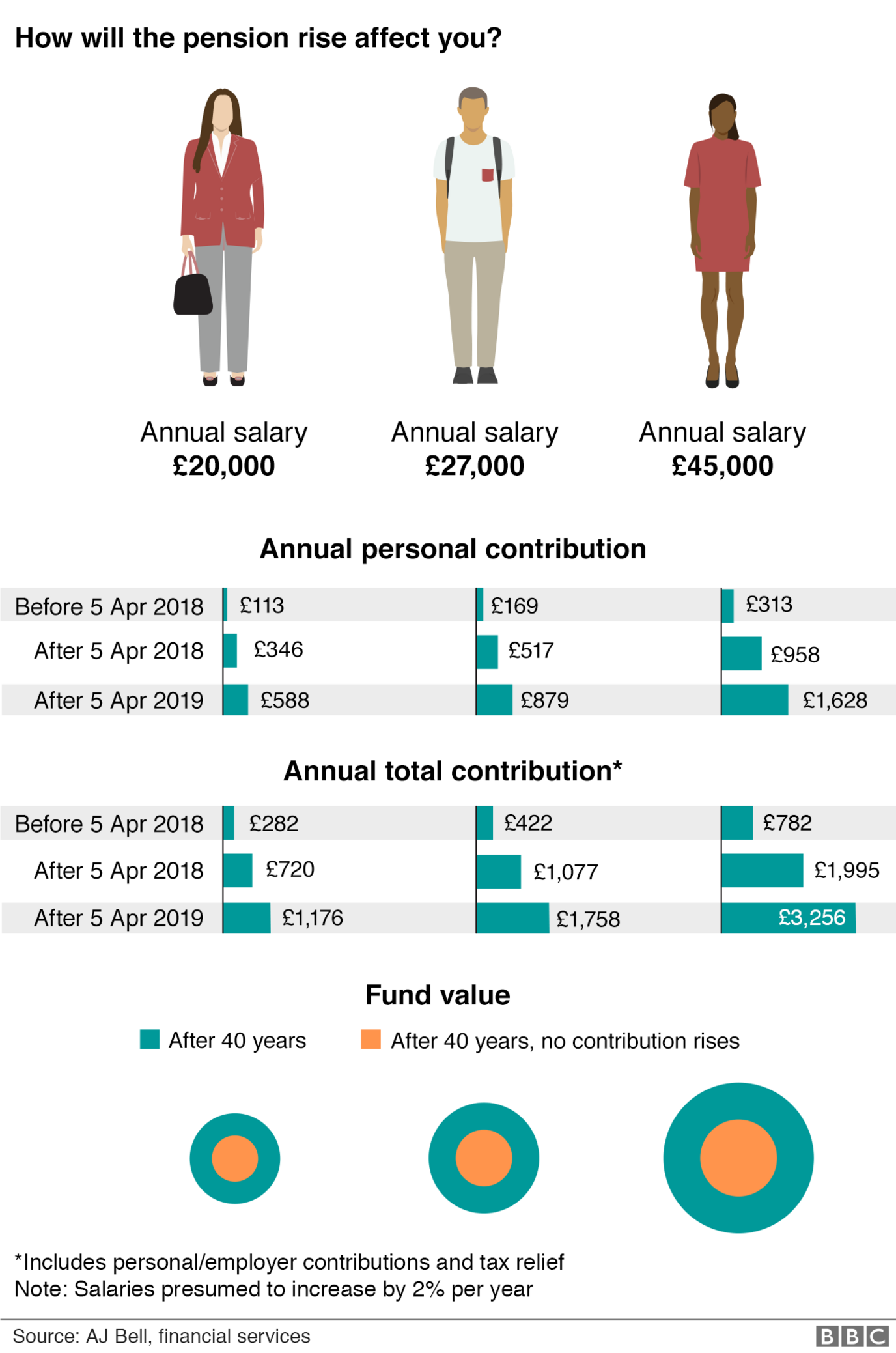

Someone earning an average salary of £27,000 - and currently paying in 1% - will have to pay an extra £350 or so this year. However, after contribution rates rise next April, that will rise to an extra £700 a year.

Someone earning the minimum amount to qualify for an auto-enrolment pension - £10,000 a year - will pay an extra £78, according to the Institute for Fiscal Studies (IFS).

Former pensions minister Steve Webb has argued that millions of people receive an annual pay rise in April, which will help soften the blow. This month, more than two million people on the National Minimum Wage will see their pay rise by up to 5.3%.

What is the benefit to my eventual pension?

Figures produced for the BBC suggest that someone who pays into an auto-enrolment pension from the age of 25 could eventually earn an annual income of up to £18,000 a year, on top of the state pension.

This assumes they use their pension pot to buy an annuity that does not increase with inflation. It also assumes that auto-enrolment pensions will soon be calculated on the whole of a person's salary. At the moment, contributions are only compulsory on earnings above £5,876.

A worker who starts paying contributions at the age of 35 could expect a retirement income of as much as £11,726.

Can I opt out of the increases?

Workers now have three choices:

Continue paying in at the new, higher, rate

Opt out of a pension altogether

Opt to continue paying in at the old rate.

The last option is known as "opting down". As far as the rules are concerned, this means that your employer is no longer obliged to make any contribution at all. However in such circumstances the Treasury would still provide tax relief.

Someone who decides to do this at the age of 25 could receive as little as £2,000 a year in retirement.

The Pensions Advisory Service has more advice here, external.