Wonga payday firm stops offering new loans

- Published

Wonga's adverts featuring puppets were controversial and eventually cut

Payday lender Wonga has said it is no longer accepting new loan applications as it teeters on the brink of collapse.

The company said in a statement on its website, external that it was continuing to "assess its options" and existing customers could still use their services to manage their loans.

It follows a surge in compensation claims against the firm amid a government clampdown on payday lenders.

Reports say the firm has lined up Grant Thornton to act as administrators.

Wonga, the UK's biggest payday lender, has faced criticism for its high-cost, short-term loans, seen as targeting the vulnerable.

The company's statement said: 'While it continues to assess its options, Wonga has decided to stop taking loan applications. If you are an existing customer, you can continue to use our services to manage your loan.'

Wonga has previously said it will make a decision about its future within weeks.

The payday lender has added a Q&A section, external to its website with advice for existing customers. This includes advice that customers must still repay existing loans "in line with your repayment agreement".

Analysis: Simon Jack, BBC Business Editor

The average payday loan is £250. The interest Wonga receives on that is an average of £150.

But the lender is facing a wave of compensation claims and the cost of processing each of them - whether the borrower's claim is up held or not - is £550.

A year ago, 90% of all claims were "organic". That means the borrower initiated the claim him or herself.

Only 10% came through claims management companies (CMCs). Those percentages have reversed with 90% now coming through CMCs leading to a big rise in absolute claim numbers.

CMCs have taken to "weaponising volume" - as one industry insider told me: "The lenders have to respond to each claim within 8 weeks. The CMCs know this and so wait till they have accumulated hundreds or even thousands of claims and drop them on the lender in one go and start the clock.

"Up against this pressure, the lenders are more likely to pay out as they don't have the time to sift through the merits of each case."

In 2014, the Financial Conduct Authority found that Wonga's debt collection practices were unfair and ordered it to pay £2.6m to compensate 45,000 customers.

Since then, payday loan companies have faced tougher rules and have had their charges capped.

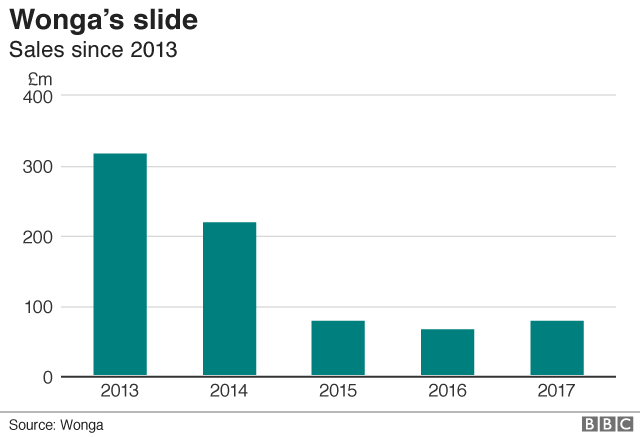

This has hit Wonga's profits hard and in 2016 it posted pre-tax losses of nearly £65m, despite claiming its business had been "transformed".

It has continued to face legacy complaints and was forced to seek a bailout from its backers this month amid a surge in claims.

It marks a huge fall from grace for Wonga, which in 2012 was touted to be exploring a US stock market flotation that would have valued it at more than $1bn (£770m).

Analysis: Kevin Peachey, personal finance reporter

Wonga never considered itself to be a payday lender, preferring instead to describe itself as a maverick technology company that happened to sell loans.

Its technology was groundbreaking, allowing the smartphone generation to choose how much they wanted to borrow with the slide of a thumb.

That convenience, matched with a huge advertising campaign featuring amusing puppets and upbeat voiceovers, proved a hit. At the height of its success in 2013, Wonga had a million customers.

But Mick McAteer, founder of the not-for-profit Financial Inclusion Centre, said this demand was a bubble: "They were flogging [credit] and they created demand for it."

In other words, some borrowers simply did not need to borrow from a payday lender, but were attracted towards these high-cost, short-term loans anyway.

- Published30 August 2018

- Published26 August 2018

- Published28 September 2017

- Published2 October 2014