Can Labour's shares giveaway work?

- Published

- comments

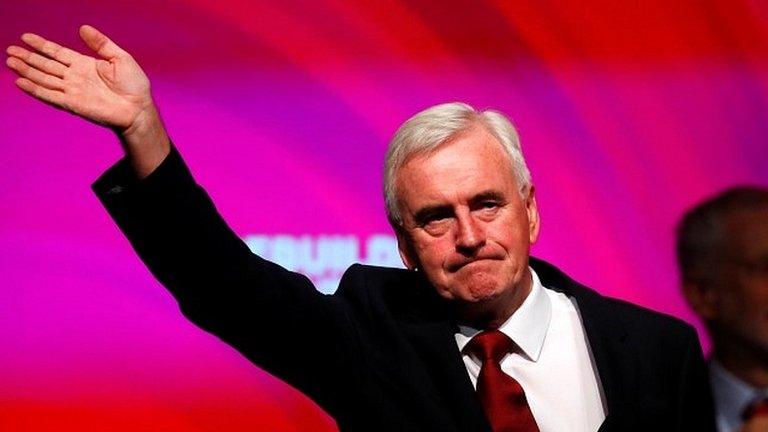

Does John McDonnell want to harness business for the good of society rather than its self-serving chiefs?

Or, does he want to launch a smash-and-grab raid on private property to pay for an enlarged and aggressively interventionist state?

Which is it?

Employee share ownership has support from across the political spectrum and indeed from many businesses which recognise that employees that have a stake in the company for which they work will be more engaged in securing its financial success.

Many companies offer incentives and discounts to employees who wish to build a shareholding over time.

That is not the same as taking 10% of the company away from its current owners to stick in a fund for the workers and the government's benefit, which seems to be what the shadow chancellor is proposing.

For a start, the workers will not be able to buy and sell the shares - so they won't really "own" them in a traditional sense. They will be eligible to receive dividends on the shares up to a value of £500 per worker per year. The government gets the rest.

Whopping tax?

The Labour Party reckons this will raise about £2bn a year. It could end up much more.

Let's take just one company - bumper dividend-payer Shell. Ten percent of its £12bn annual dividend comes to £1.2bn.

If each of its 6,500 UK employees got £500 each (totalling £3.25m) that leaves £1.116bn for the government. That's just from one company - every year. Wow.

That single example is why business thinks this is a whopping tax in a not-very-good disguise.

The changes to company behaviour would be hard to predict. But in the case of Shell, it could follow Unilever by scrapping its dual Anglo-Dutch structure and moving to a single HQ and listing in Holland.

Labour: We'll make firms give staff shares

Labour keeps option of fresh Brexit vote

Big listed companies forced to pay 10% of their dividends to the government might choose to de-list to avoid the charge and the UK would become less attractive as a place for new businesses to list their shares.

How much less attractive is hard to say, but 10% of the company - albeit given over ten years - is a mighty big slice to give away.

Business groups such as the CBI are, perhaps predictably, warning that investors will pack their bags. But Mr McDonnell insists these changes are gradual and that previous attempts to promote the interests of workers or make multinationals pay more tax have failed.

Bolder action

He's got a point. He's not the only one to realise that a pop at big business is a vote winner.

Theresa May promised a crackdown on pay, workers on boards and increased supervision of private companies when she became leader of the party in 2016.

Three years later almost all have been abandoned or watered down - with the publication (not cap, mind) of the ratio between highest and lowest paid the most tangible achievement.

The Tories claim to be the party of the worker is seen to have been diluted along with their attempts at reform.

Much bolder action is needed according to McDonnell.

Effectively making the government a 10% shareholder of every UK listed business is certainly that.

- Published24 September 2018

- Published24 September 2018