Labour conference: John McDonnell unveils shares plan for workers

- Published

- comments

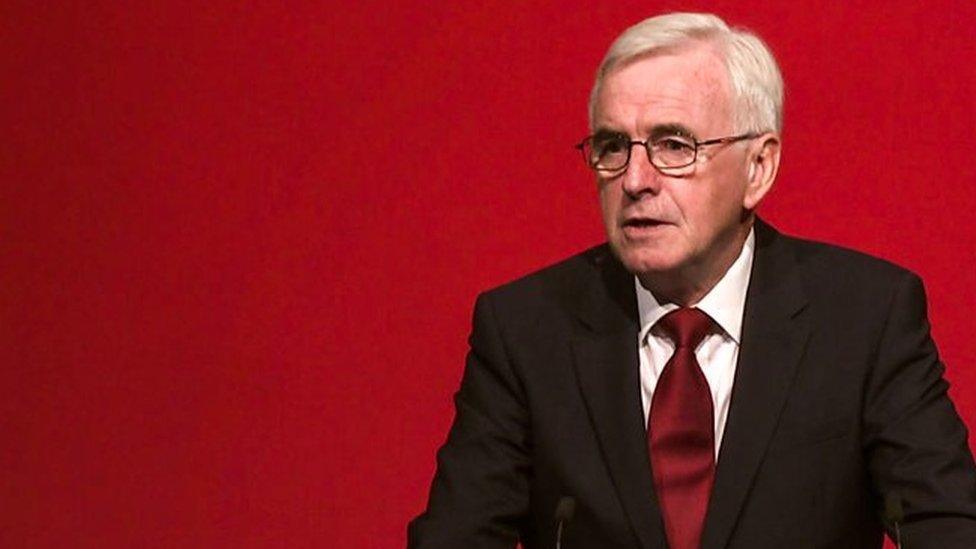

John McDonnell says the new water firms will have "unprecedented levels of openness and transparency".

Labour would force all large firms to give workers shares worth up to £500 a year each, John McDonnell has said.

In his main party conference speech, the shadow chancellor set out plans for "inclusive ownership funds".

He also announced that the water industry in England would be the first to be re-nationalised under Labour.

Existing bosses would be fired and control handed to workers, local councils and customers, with new executives hired on reduced salaries.

He told Labour delegates: "There will be unprecedented openness and transparency in how the industry will be managed.

"We are ending the profiteering in dividends, vast executive salaries, and excessive interest payments.

"Surpluses will be reinvested in water infrastructure and staff, or used to reduce bills. Real investment will allow the highest environmental standards."

Ownership of the existing water and sewerage companies would be transferred to new Regional Water Authorities, with day-to-day operational management in the hands of professional management and the wider workforce.

Existing shareholders would be compensated with bonds and all staff would be transferred to the same jobs, "except for senior executives and directors, whose posts will be re-advertised on dramatically reduced salaries capped by our 20:1 pay ratio policy", Labour sources said.

The new authorities would be self-financing, along similar lines to Transport for London, which manages the London Underground, rail and bus services.

Labour also plans to nationalise the railways, energy and mail industries.

Mr McDonnell also announced:

Plans for a new Public and Community Ownership Unit at the Treasury to bring PFI contracts in-house

Plans to force companies to "sign up to the Fair Tax Mark standards, demonstrating transparently that they pay their fair share of taxes"

A new international forum to deal with future economic crises, headed by Nobel prize-winning economist Joseph Stiglitz

Plans to give workers in private industry more of a say - and a financial stake - in industry are a key plank of Labour's industrial strategy.

Since its conference opened in Liverpool on Sunday, Labour has already announced plans for worker representation on company boards and to make employers provide up to 10 days' paid leave for victims of domestic violence.

Under Labour's "inclusive ownership fund" proposal, Mr McDonnell said workers would be given a financial stake in their employers and more say over how companies are run.

Firms would have to put 1% of their shares into the fund every year up to a maximum of 10%.

The amount of share capital available to workers would be capped at £500, with the rest - estimated at £2.1bn a year by the end of a five-year Parliamentary term - going into a fund to pay for public services and welfare.

'Broadening of ownership'

The scheme would apply to companies with more than 250 workers, although smaller firms could set up inclusive ownership funds if they wanted to.

Labour calculates that 40% of the UK's private sector workforce - some 10.7 million people - would initially be covered by the scheme. Dividend payouts would be made at a flat rate to all employees of the firm.

The funds would be held and managed collectively, with a bar on selling or trading their shareholdings. The system would be similar to that operated by employee-owned retailer John Lewis.

But payments from the fund would be made to individual, eligible employees, Labour sources said.

Labour's plans are based on the John Lewis Partnership

Workers' fund representatives would have voting rights in companies' decision-making processes in the same way as other shareholders.

Labour aides said the creation of the funds would help redress growing inequalities after a decade when average pay has not increased in real terms.

But the dividend payments would not be available to state employees - including workers in industries such as water, which Labour hopes to nationalise.

Labour sources say the £2bn social dividend fund would ensure public sector workers and employees of smaller firms also benefited from what the party calls a "broadening of ownership in our economy".

Analysis: A smash and grab raid?

By BBC business editor Simon Jack

Many companies offer incentives and discounts to employees who wish to build a shareholding over time. That is not the same as taking 10% of the company away from its current owners to stick in a fund for the workers and the government's benefit, which seems to be what the shadow chancellor is proposing.

For a start, the workers will not be able to buy and sell the shares - so they won't really "own" them in a traditional sense. They will be eligible to receive dividends on the shares up to a value of £500 per worker per year. The government gets the rest.

The Labour Party reckons this will raise about £2bn a year. It could end up much more. Let's take just one company - bumper dividend-payer Shell. Ten percent of its £12bn annual dividend comes to £1.2bn.

If each of its 6,500 UK employees got £500 each (totalling £3.25m) that leaves £1.116bn for the government. That's just from one company - every year. Wow.

Read more: Can Labour's shares giveaway work?

Mr McDonnell told Labour delegates: "Workers, who create the wealth of a company, should share in its ownership and, yes, in the returns that it makes.

"We believe it's right that we all share in the benefits that investment produces."

Ahead of the speech, he dismissed claims of an anti-business agenda, telling the BBC that a future Labour government would support the vast majority of "entrepreneurial and ethical" British firms to the hilt.

But he said those which engaged in aggressive tax avoidance and whose "standards did not match up to the rest" could expect a tough response from the government.

Carolyn Fairbairn, director general of the CBI, which represents big business in the UK, said Labour was "wrong to assert that workers will be helped by these proposals in their current form".

She said: "Their diktat on employee share ownership will only encourage investors to pack their bags and will harm those who can least afford it. If investment falls, so does productivity and pay."

The Conservatives said Labour's proposal was "yet another tax rise" that would make it harder for firms to "take on staff and pay them a good wage".

- Published24 September 2018

- Published24 September 2018