How much tax money does the UK government raise and spend?

- Published

Prime Minister Sir Keir Starmer and Chancellor Rachel Reeves have both warned that the October Budget will involve "difficult decisions" on tax, spending and benefits.

However, they are standing by the party's election pledge not to raise the rates of income tax, National Insurance or VAT.

How much money does the government raise?

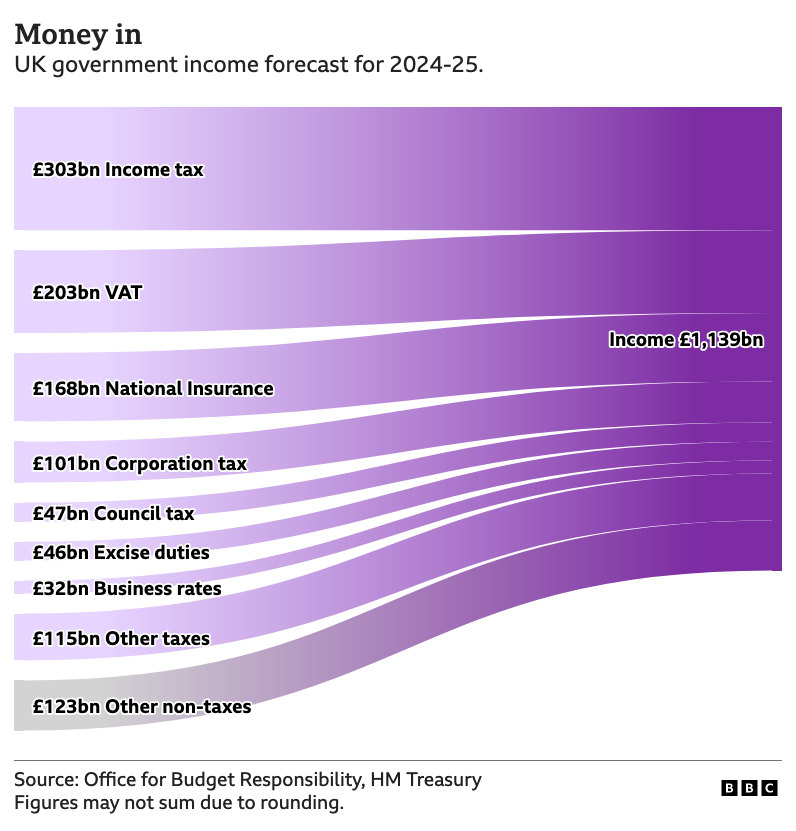

The government raises and spends more than £1 trillion a year, external. A trillion is £1,000bn, or a one with 12 zeroes.

Such a big number is hard to picture, but for that money you could comfortably buy the UK's 10 most valuable companies. It works out at about £15,000 per person in the UK.

Where does the government's money come from?

About a quarter of the money the government expects to raise in the 2024/2025 financial year will come from income tax, which people pay on the money they earn.

It is likely to generate £303bn, according to the independent Office for Budget Responsibility (OBR), external, which assesses the health of the UK economy and publishes financial forecasts.

It is expected to raise even more in the coming years.

This is because the amount you are allowed to earn before you have to pay income tax has been frozen until 2028. The point at which people start paying higher rates of tax has also been fixed.

Freezing the thresholds means that more people start paying tax and NI as their wages increase, and more people pay higher rates.

The next two biggest earners for the government are VAT, which is paid on many purchases, and National Insurance (NI), which is another tax levied on people's earnings.

The OBR forecast that VAT will raise £203bn in 2024/25.

National Insurance is expected to raise £168bn, after two cuts to the starting rate brought it down from 12% to 8%.

The "other" tax category - which includes capital gains tax, stamp duty and vehicle excise duty - is expected to raise £115bn.

The OBR expects the overall level of tax as a proportion of the size of the economy to rise in each of the next five years to a post-war high of 38% of GDP, external, or the total value of the economy.

Some sources of money for the government don't come from taxation, such as student loan repayments, which are included in the "other non-taxes" category.

What does the government spend money on?

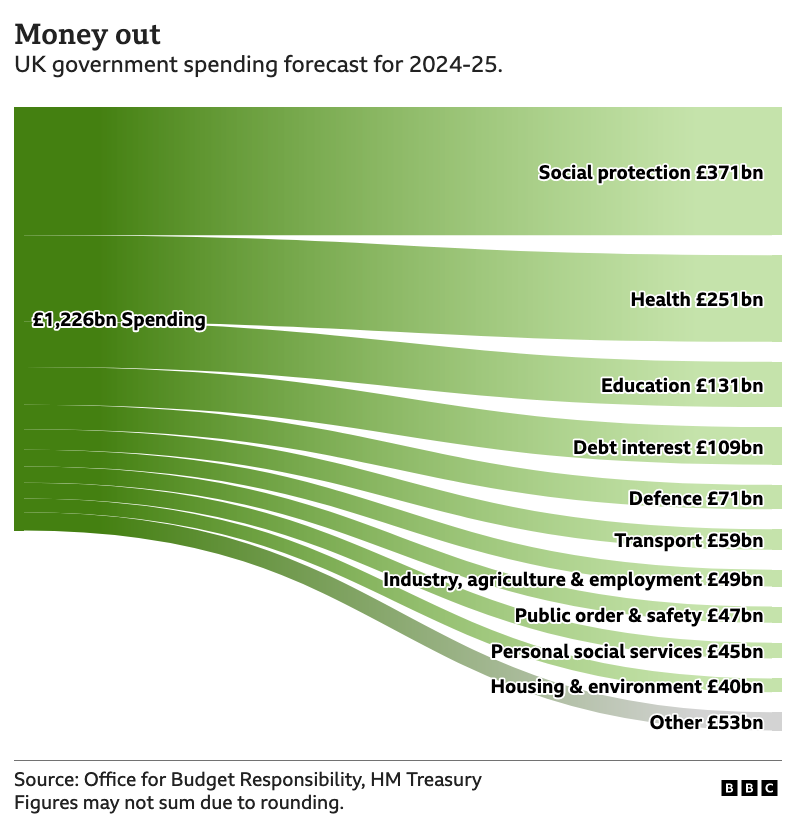

Social protection spending is by far the biggest outgoing for the government, accounting for more than a quarter of all its expenditure.

This includes the cost of benefits paid to pensioners as well those for working-age people.

Before the general election was announced, the OBR predicted spending on social protection would rise to £371bn in 2024-25.

In July, the government said it would restrict the Winter Fuel Payment to pensioners receiving means-tested benefits, which it hopes will save around £1.5bn a year.

At the same time, the new full state pension is set to rise by £460 a year from April 2025, under the "triple lock" arrangement, which guarantees that it keeps pace with earnings and inflation.

About a fifth of government spending goes on health.

Health spending has been rising for decades, because of the growing cost of looking after the UK's ageing population, and increased spending on treatments, external. The OBR forecast the health spending bill would be £251bn in 2024/25.

The next biggest area of spending is education, which was cut in the 2010s and has been recovering since. The OBR expected spending on education to total £131bn in 2024/25.

After this comes the cost of government debt interest - the amount the government has to pay for the money it has borrowed

Spending on debt interest has increased considerably in recent decades The interest is about 50% higher as a proportion of the size of the economy than it was in 2010. The OBR predicted this would reach £109bn in 2024/25.