Name checks to begin on bank payments

- Published

Angelene Bungay lost £13,000 after transferring it to someone she thought was her builder

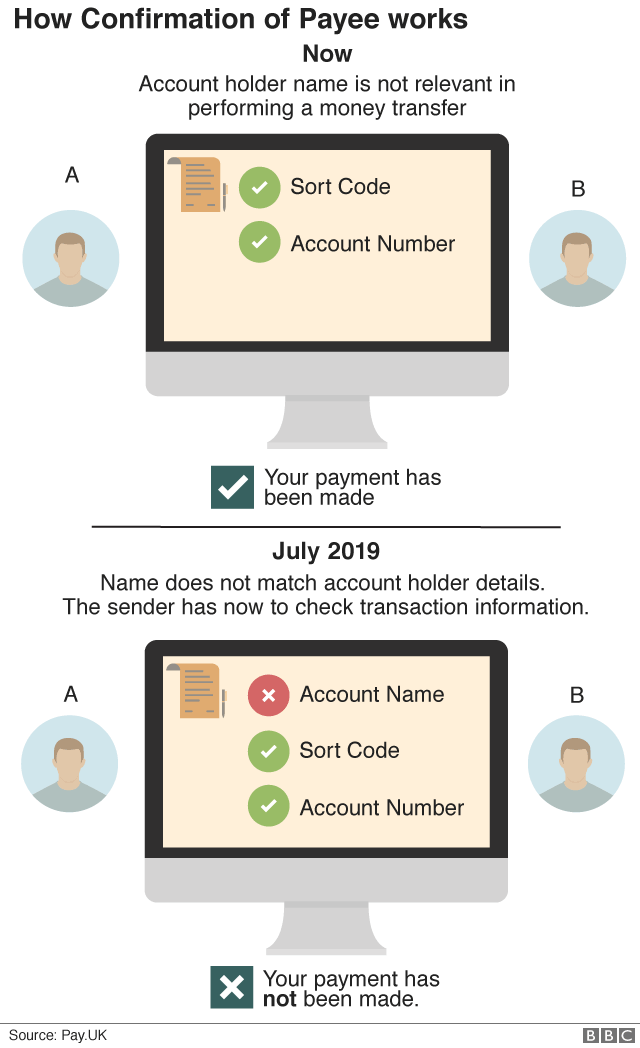

The name of someone receiving a payment will be as important as their banking details for the first time from next summer, in an attempt to combat fraud.

At present, anyone wanting to transfer money enters the intended recipient's name, account number and sort code. However, the name is not checked.

Under plans from the UK's payments operator, the sender will be alerted if the name does not match the account.

Banks have been accused of dragging their heels in introducing the system.

It is designed to combat cases when fraudsters mimic a genuine business and attempt to trick people into sending money to an account controlled by the con-artist.

Details of how the "confirmation of payee" system will work have been revealed by Pay.UK - the operator which oversees the UK's major payments systems.

How Confirmation of Payee will work

When setting up a new payment, or amending an existing one, banks will be able to check the name on the account of the person or organisation you are paying.

If you use the correct account name, you will receive confirmation that the details match, and can proceed with the payment

If you use a similar name to the account holder, you will be provided with the actual name of the account holder to check. You can update the details and try again, or contact the intended recipient to check the details

If you enter the wrong name for the account holder you will be told the details do not match and advised to contact the person or organisation you are trying to pay

Paul Horlock, chief executive of Pay.UK, said: "Sending a payment with an incorrect sort code or account number is like addressing a letter with the wrong post code.

"Even if you have used the correct name it won't reach the intended destination - and fraudsters have become increasingly sophisticated in using this to trick people into sending money to the wrong account.

"Confirmation of Payee will let you check you have the correct name for the person or business you're paying, giving better protection against certain types of fraud, and helping to stop accidental mistakes too."

Tricked out of millions

The aim is to cut down on so-called authorised push payment (APP) scams, in which people are conned into sending money to another account.

A total of £145m was stolen from bank customers in this way in the first half of the year, with many victims unable to get the money back because current legislation means they are liable for any losses incurred if they authorise a payment themselves.

One such victim was Angelene Bungay of Shrewsbury, who was duped into paying £13,000 to someone posing as the builder carrying out her loft conversion.

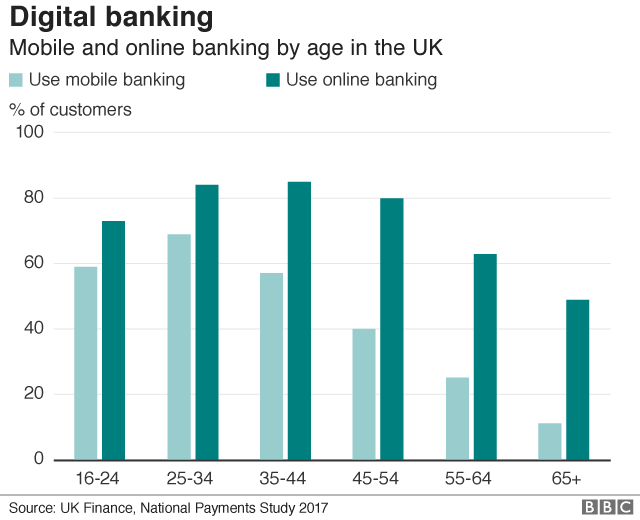

The situation has become more critical owing to the popularity of payments via smartphones and online.

However, regulators and consumer groups have been stressing that banks and building societies should introduce the new system quickly.

Gareth Shaw, from consumer group Which?, said: "Customers will wonder why banks have dragged their heels and not implemented this system years ago, as it could have prevented a significant amount of fraud. With losses to bank transfer fraud increasing drastically it's clear this measure can't come in soon enough."

Under current plans, banks and building societies should have the technology in place by April, with the system up and running by July.

"This is an important step and we would like to see the banks implement this new protection as quickly as possible, giving everyone greater protection against fraud," said a spokeswoman for payments watchdog, the Payment Systems Regulator.

UK Finance, which represents the UK's banks, said the latest plans provided "some useful clarity" and that the industry was fighting fraud on many fronts.

How to protect yourself against fraud

Banking trade body UK Finance offers the following advice:

Never disclose security details, such as your PIN or full banking password

Don't assume an email, text or phone call is authentic

Don't be rushed - a genuine organisation won't mind waiting

Listen to your instincts - you know if something doesn't feel right

Stay in control - don't panic and make a decision you'll regret

- Published28 September 2018

- Published24 September 2018

- Published22 May 2018