US attacks UK plan for digital services tax on tech giants

- Published

The US has hit back against a UK plan to impose a new tax on sales by technology giants.

US political leaders and business groups say the proposal would violate tax agreements by targeting US firms.

They warned the tax could spark US retaliation and hurt prospects for a US-UK trade deal.

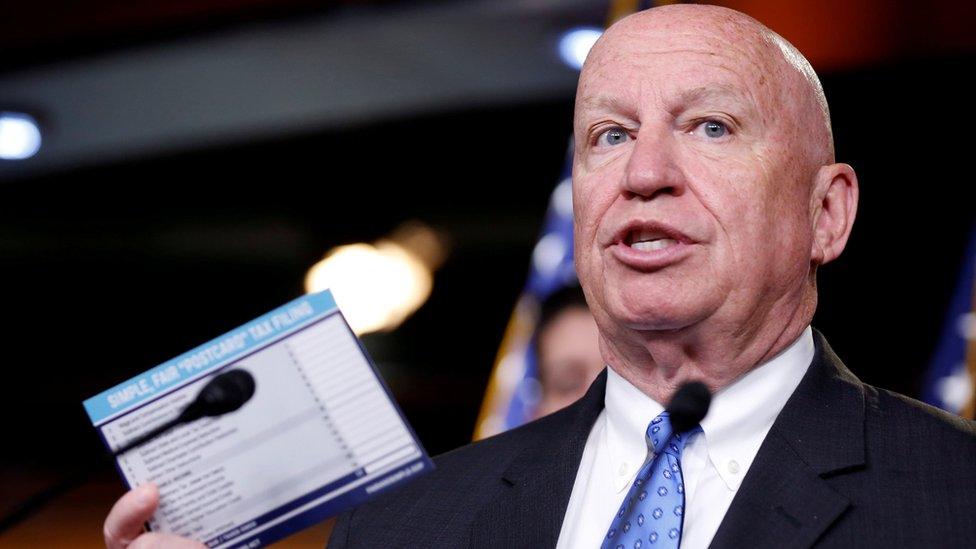

In a statement on Wednesday, Representative Kevin Brady, a Republican from Texas, called the measure "troubling".

"If the United Kingdom or other countries proceed, that will prompt a review of our US tax and regulatory approach to determine what actions are appropriate to ensure a level playing field in global markets," said Mr Brady, who helped shepherd US tax cuts through Congress last year.

His statement echoed comments last week by US Treasury Secretary Steven Mnuchin, external, who voiced "strong concern" about different countries' efforts to develop digital sales tax.

A slew of business groups - including the US Chamber of Commerce and the US Council for International Business - have also come out against the UK plan.

If enacted, the tax measure could "complicate the United Kingdom's push for deeper US-UK trade relations", said Rufus Yerxa, president of the National Foreign Trade Council.

Kevin Brady shepherded the US tax cut through Congress last year

The UK plan, announced as part of the Budget, would place a 2% tax on sales by large social media platforms, internet marketplaces and search engines from April 2020.

In response to Mr Brady's comments, a UK Treasury spokesman said: "As the chancellor said, this tax is a proportionate and targeted interim response that reflects the changing global economy, and how digital businesses derive value from users - it's not targeted at any country and seeks to ensure the tax system is fair."

It comes as wider efforts to capture more tax from multinational tech giants - which are now typically taxed based on their physical presence in a country - gain steam.

The European Commission in March introduced a proposal for a 3% tax on revenues of internet companies with global revenues above €750m (£660m) a year.

While some EU member states are opposed, external, a vote could come before the end of the year. Separately, Spain introduced a digital service measure in its budget that mimics the EU's.

Elsewhere, Colombia, Australia and India are among several countries debating new tax measures that target the digital giants, according to the Internet Association, external, a US trade association with members that include Amazon, Microsoft and Uber.

The 36-member OECD has also been discussing the issue, with a report on reforms due in 2020.

The slew of measures, after years of discussion, explains the alarm in the US, said Lilian Faulhaber, a law professor at Washington's Georgetown University.

"There's a sense in the United States that this digital services tax is becoming more of a real possibility," she said.

'Pure cash grab'

Under President Donald Trump, the US has been supportive of OECD efforts to update the corporate tax system for the global era, said Itai Grinberg, another law professor at Georgetown University.

But many in the US - not just the internet giants - have concerns about proposals, like the UK's, that tax turnover, he added.

"It's a kind of tax that everyone abandoned half a century ago because it's thought of as very economically inefficient and functions basically like a tariff," he said.

He said such taxes do little to make the international tax system more fair: "It's just a pure cash grab".

The UK's chancellor: Searching online for revenues

In announcing the UK tax, UK Chancellor Philip Hammond said progress in global arenas to update tax laws had been "painfully slow".

But the move has irked some in the US.

Josh Kallmer, executive vice president of policy at the Information Technology Industry Council, said the tech industry recognises the need for tax laws to change, but opposes revenue taxes and wants to see the OECD process play out.

"The responses that the UK and EU are poised to take are not helpful," he said. "This is a genuinely global challenge.... Countries have got to coordinate and develop shared principles."

Professor Grinberg said the UK's decision to go it alone gives license to other countries to follow suit, undermining efforts to reach an international solution.

The move is particularly risky for the UK, he added, because the logic for taxing tech firms could be extended other industries important to the UK, especially financial services and pharmaceuticals.

"I think it will go badly for the UK," he said.

The US has a range of options should it want to retaliate, in addition to simply making the issue a focus in US-UK trade talks, he added.

The US could complain to the WTO. Under US law, the president could also act to raise taxes on UK firms as a retaliatory measure.

Professor Faulhaber described the responses being floated as "nuclear options".

"I don't know how likely they are but I do think they're pretty dramatic," she said. "They... suggest that at least some people in the US see these proposals as fairly dramatic."

- Published29 October 2018

- Published10 October 2018