Credit card use squeezed over Christmas

- Published

Squeezed shoppers played safe with their credit cards at Christmas rather than spending big on the High Street, Bank of England figures show.

Consumers paid back nearly as much as they borrowed on credit cards in December - the key month for Christmas trading.

Some £92m more was borrowed than repaid, the lowest level of any month since September 2014, the data shows.

Concerns still remain that some people are being stretched beyond their means.

Separate figures published on Tuesday show that personal insolvencies owing to unmanageable debt hit a seven-year high in 2018.

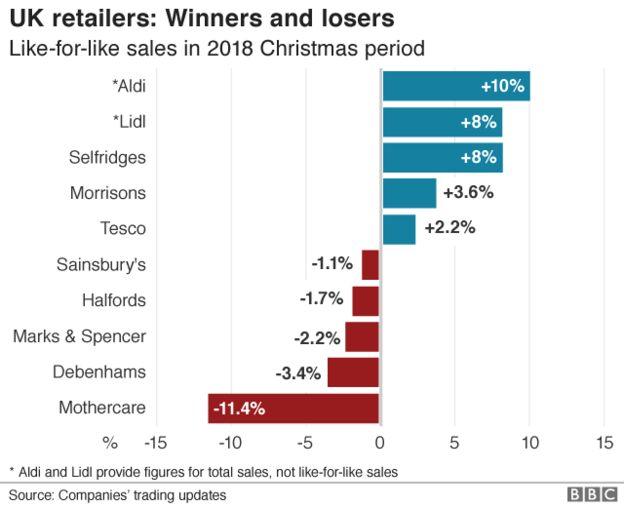

Christmas was tough for some retailers. The British Retail Consortium said it had been the worst Christmas for retailers in 10 years.

The Bank of England's seasonally adjusted figures, external show that £72bn remains outstanding on the UK's credit cards, but that balance only rose slightly in December.

The Bank described credit card borrowing as "particularly weak" during the month.

There was no evidence that consumers had thrown their credit cards around in November, during discounting events such as Black Friday. That month £348m more was borrowed than repaid, but that was no more than the average for the final six months of the year.

All this suggests they did not spend a lot on cards at Christmas, with the intention of paying back over the course of 2019.

General consumer borrowing, which includes loans, overdrafts and credit cards continued to grow but the rate of increase has slowed.

The annual growth rate stood at 6.6% in December, much lower than the double-digit growth seen in the second half of 2016 and first half of 2017.

Back then, there was pressure on the Bank to act, and lenders have become more stringent on how they lend money to individuals.

- Published29 January 2019

- Published11 January 2019