Four reasons John Lewis is under pressure

- Published

The John Lewis Partnership has announced a 45% drop in annual profit for 2018 and said its workers, who also own the firm, will only get a 3% bonus, down from 5% a year earlier.

Its poor results come at a time of hardship for High Street stores in general and department stores in particular.

While other chains come under real pressure - reporting losses large enough to imperil their ability to pay rent - or indeed face collapse, John Lewis's struggles must be seen in context, say retail experts.

The company has some inbuilt advantages, they say.

Employees - or partners as they are known at the company - will be hoping these can be used to turn around the firm's fortunes.

In 2008, staff were awarded bonuses equivalent to 20%, external of their pay, sharing a £181.1m fund. Since then, the trend has been slowly downhill, and the 3% bonus is the lowest since 1954.

1. Never knowingly undersold

Under John Lewis's "never knowingly undersold" guarantee, the chain promises to match the price of a product with any of its High Street competitors.

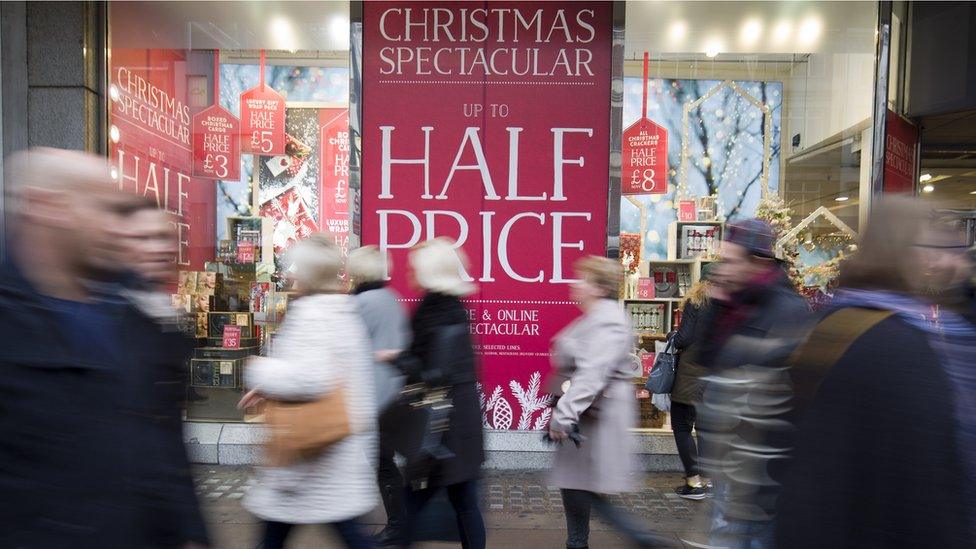

This means that they have been hit with "an unprecedented level of discounting in order to match rivals' prices which inevitably undermines profits," said Diane Wehrle of market research firm Springboard.

This has been compounded by its competitors driving their own prices down as they try to tempt customers.

John Lewis cut prices for Black Friday in common with many of its rivals

"Why is this the most price-promotional period?", asks retail consultant Richard Hyman.

"It's retailers on the back foot, who don't really know what else to do, following the price down," he adds. "They feel they don't have any other lever to pull."

2. The decline of the department store

Department stores have a "relevance problem", says Natalie Berg, retail analyst and founder of NBK Retail. "This idea of under-one-roof shopping doesn't really exist any more," especially with the rise of online shopping.

Last year, House of Fraser fell into administration before being bought by Mike Ashley, the billionaire Sports Direct founder, and earlier this week Debenhams issued another profit warning as its sales continued to fall.

However, Ms Berg says John Lewis "has been more agile to adapt to these changes" because of its ownership structure.

Employees own the company and so they are trusted to take on more consultative roles with shoppers, she says, offering the kind of service an online shop cannot.

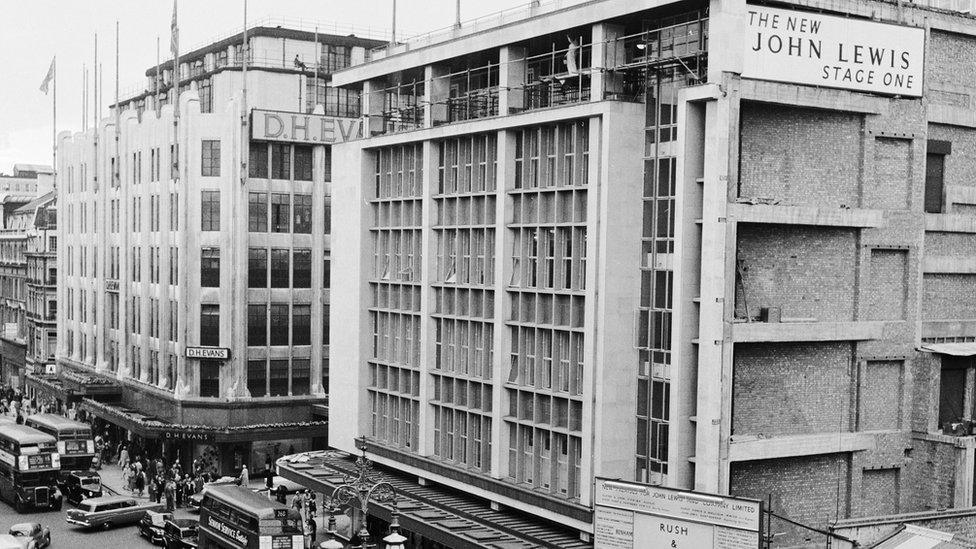

The 1950s were the last time staff received such low bonuses

And Richard Hyman does not think that it's a hard and fast rule that the department store must die. "Irrelevant, poor department stores are dead, but look at Selfridges," he says.

Selfridges reported sales up 8% in the first 24 days of December. The department store said it helped draw customers through various entertainments including a Christmas cabaret, confetti cannons, visits from Father Christmas and choirs.

3. Retail malaise

"Clearly John Lewis is not immune to the trading challenges currently faced by retailers, which is a general reining-in of consumer spending," says Springboard's Diane Wehrle.

For Mr Hyman, too much shopping space, too many stores and too many websites chasing demand is cutting profits on the High Street. While costs for businesses rise ever upward, demand does not. And the outlook isn't good.

"For the last five or six years, the retail market has become progressively more difficult," he says. "Next year will be tougher still."

But for John Lewis this isn't the existential threat it has proved for retailers as diverse as LK Bennett, Hardy Amies, Patisserie Valerie, Maplin or Toys 'R' Us.

"You have to judge these companies against their peers," he says. "Customer service, provenance, value and trust" are what may improve its fortunes.

4. Staying on top

At the same time, John Lewis has had to invest in IT, as many other retailers have, to meet customer demand, says Ms Wehrle. This helped January sales rise 1%, "but the capital investment it requires means that profit has taken a significant hit".

"This is a market like no other we have seen," says Mr Hyman, and despite the company's strengths, it does face challenges.

But, he says "we won't see an end to department stores".

"It will be less what you do and more how you do it."

- Published5 March 2019

- Published11 January 2019

- Published7 June 2018