Debenhams: Three things that went wrong

- Published

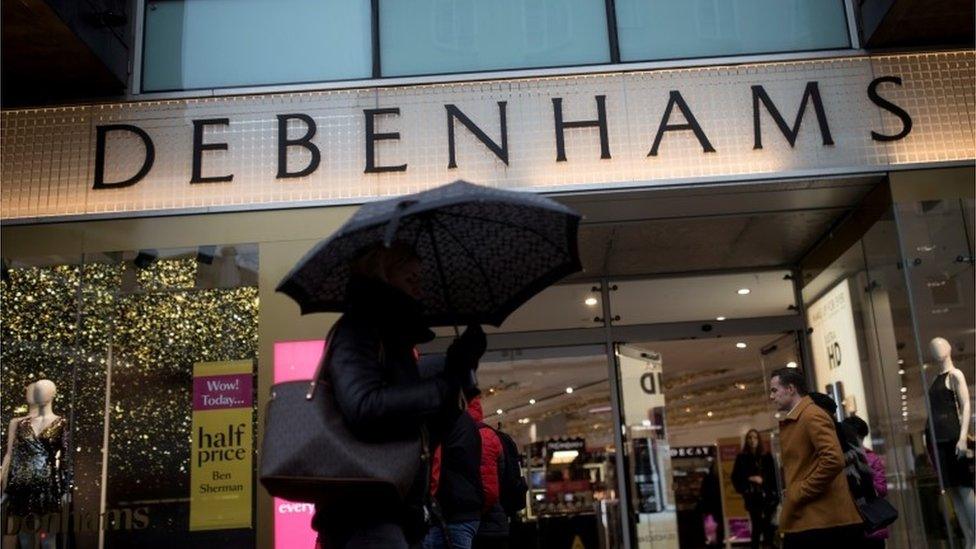

Ailing department store chain Debenhams has been rescued by its lenders after falling into administration.

Three years ago, the 166-strong chain was worth £900m, compared with £20m as of this week.

It's been one of the main draws of High Streets - and later, shopping centres - for years, and it has a venerable history.

Its origins go back to 1778, when King George III was on the throne, when it opened as a drapers' store in central London.

It expanded over the years and became a global business, with offices in South Africa, Australia, Canada and China. At one point, it owned upmarket department store Harvey Nichols.

By 1950, Debenhams was the largest department store group in the UK, with 110 stores.Debenhams: Three things that went wrong

Debenhams joined the stock market, for the third time, in 2006, with a worth of £1.7bn. Its share price hit 207p one day later - a level that it has never bettered since.

1. Lagging fashion trends

With hindsight, Debenhams' timing could hardly have been worse. Fashion is cyclical, but a new trend was beginning that turned out to be a game-changer.

Laith Kalif at stockbrokers Hargreaves Lansdown (HL) points out that a year after Debenhams floated in 2006, the iPhone was launched.

That was a key element in the transformation of the way we shop for goods, helping the rush to online shopping with the extra ease and functionality of the app.

Debenhams, of course, isn't alone in failing to see the future.

Robert Hayton, from property adviser Altus Group, says that since 2010, almost a third of department stores in England and Wales have disappeared.

They have ended up being converted for other types of use, split into smaller units or even demolished as the sector adapts to this fundamental structural change.

As the shift to online grew and became entrenched, Debenhams remained a laggard compared with others, notably arch-rival John Lewis.

Although not the only retail chain to fail to predict the future, the consistent lack of response to the unfolding trends eventually did for Debenhams, says Richard Lim from analysts Retail Economics.

He says: "Put simply, the business has been outmanoeuvred by more nimble competitors, failed to embrace change and was left with a tiring proposition. The industry is evolving fast and it paid the ultimate price."

On top of that, management failed to maintain the historic brand itself, says Simon Reynolds from branding consultancy Landor: "It's a case of 'another one bites the dust' as the 240-year-old business falls into the hands of its lenders.

"Ultimately, Debenhams failed to establish a clear brand proposition for its customers. It couldn't demonstrate what made it different to its competitors and it lacked relevance to younger customers."

2. Too many stores, too many sales

In 2006, Debenhams stuck fast to its expansion plans, seemingly unaware of changing trends.

At that time, it had 120 stores and planned to double the number, piling on the costs as it became increasingly out of step with shoppers' buying habits.

Hargreaves Lansdown says it managed to keep shoppers interested by eye-catching promotions, including its Blue Cross days, which featured generous discounting.

Richard Hyman: "The fundamental fact is its lack of relevance."

But the stockbroker says that came at the expense of profits: "The problem with regular discounting is it becomes a self-propagating strategy.

"If customers are used to getting goods at a knock-down price, they hold off buying until there's a sale on."

Veteran independent retail consultant Richard Hyman says the heart of the matter is lack of relevance: "It simply doesn't sell enough product. It's not sufficiently relevant. It isn't clear who it is targeting. That is the key issue - its relevance as a business.

"If you solved the immediate property problems, you'd still be left with the fundamental fact: it doesn't have enough sales. Its sales are static."

The weakening pound in the wake of the EU referendum also didn't help matters, increasing the cost of stocking the shelves with overseas goods.

3. Debt and costs

This physical expansion brought with it the soaring costs that have unhorsed so many other bricks-and-mortar retailers.

Altus says these prime-sited large properties came with big rents, high rates and onerous lease liabilities, as well as large staffing needs and leases that were difficult to give up,

All that "conspired to create a beast that was unable to adapt in a fast-changing retail environment".

Altus says the revaluation of business rates in 2017 has seen the average rates bill for a large department store rise to £642,852 this year.

That's up 26.9%, or £132,378, compared with the year before the revaluation came into effect.

Hargreaves Lansdown says Debenhams stores have an average lease term of 18 years, while the department store currently has £4.3bn of minimum lease payments over the next 20-plus years under current arrangements.

All these costs were rising while footfall through the shops and profit margins were falling, almost halving from 19% in 2006 to 10% today, according to Hargreaves Lansdown.

Although revenues were higher than in 2011, when profit before tax peaked at £160.3m, last year Debenhams posted a pre-tax loss of £491.5m.

HL's Laith Khalaf says: "Debenhams is a tale of woe from start to finish."

- Published9 April 2019