House price growth at six-year low

- Published

- comments

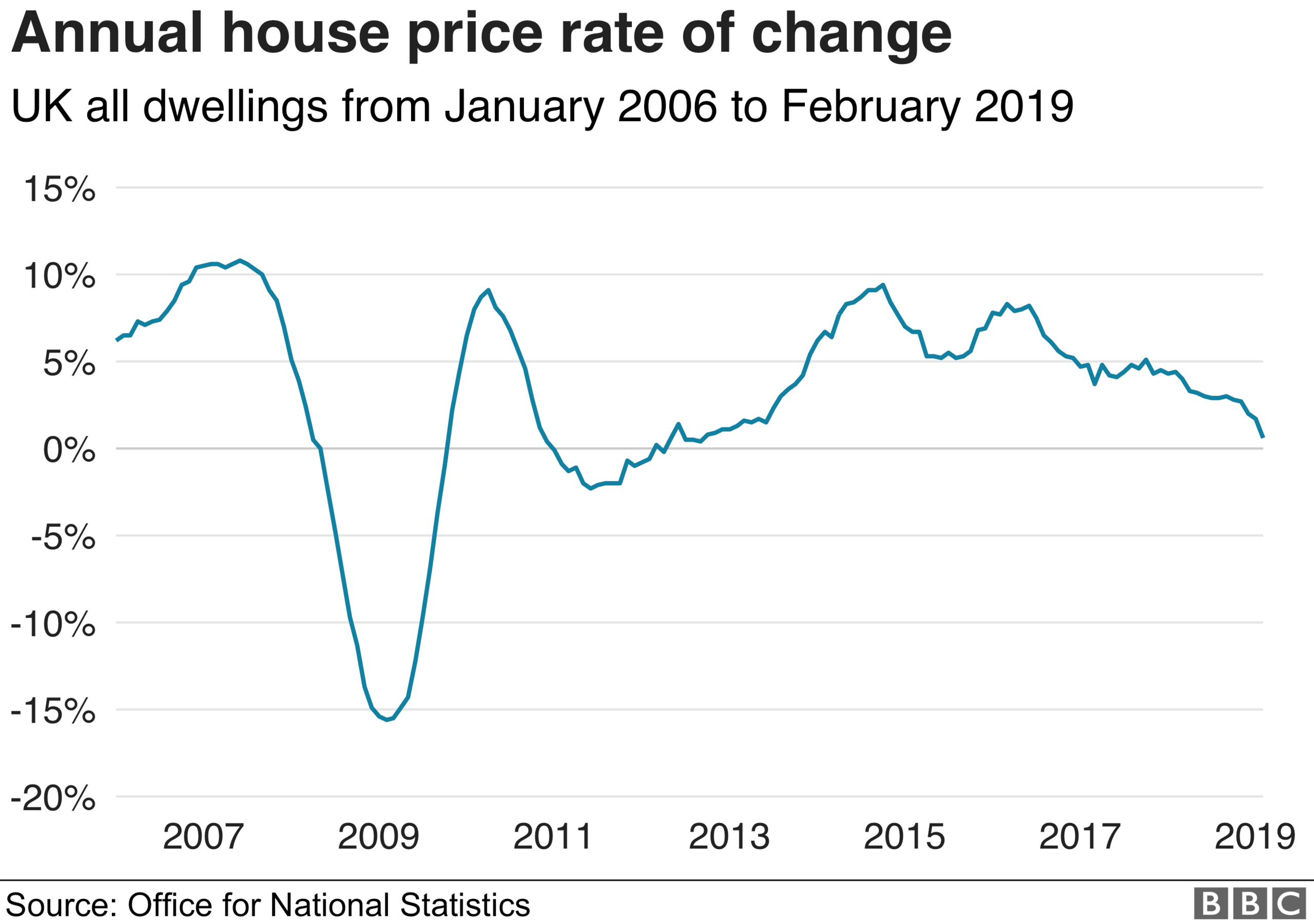

House prices rose in February at the slowest rate since September 2012 while in London house prices fell, the Office for National Statistics said.

Average house prices increased by 0.6% in the year to February 2019 but fell by 3.8% in London.

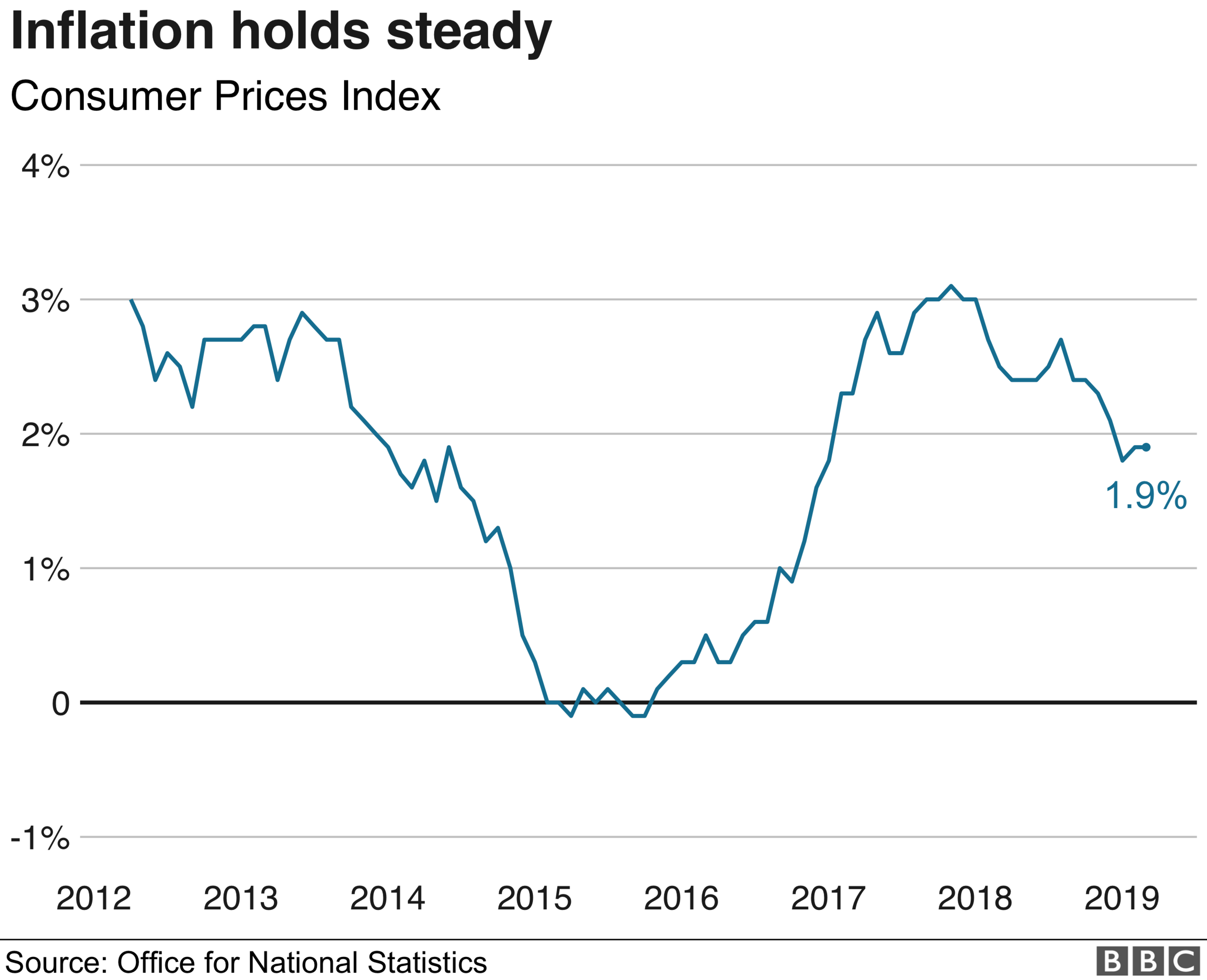

The ONS said inflation was stable at 1.9% in March as a rise in fuel prices from February was offset by falls in food prices.

The figures ease pressure on the Bank of England to raise interest rates.

The Bank of England targets inflation - the rate of price increases - at 2% and last month kept rates unchanged at 0.75%, where they have been since August last year.

What is happening to house prices?

The ONS said there had been a slowdown in house price growth over the past two years.

The average UK house price was £226,000 in February, £1,000 higher than a year ago.

The fall in London house prices was the largest fall since mid-2009, but the city remains the most expensive place to buy property with an average price of £460,000.

Ben Brettell, senior economist at Hargreaves Lansdown, said the fall in London house prices was the largest since the immediate aftermath of the financial crisis.

"This follows efforts by policymakers to cut down on riskier mortgage lending, though clearly uncertainty over Brexit will have played a large part in the capital's faltering housing market," he said.

Other indicators have pointed to a subdued housing market. Halifax, the UK's biggest lender, said earlier this month that property prices had fallen by 1.6% in March compared with February.

What is driving inflation?

At 1.9%, the latest inflation rate, measured by the Consumer Prices Index, was a little lower than the 2% that had been forecast by economists.

Mike Hardie, head of inflation at the ONS, said: "Inflation is stable, with motor fuel prices rising between February and March this year, offset by falls in food prices as well as the cost of computer games growing more slowly than it did at this time last year."

Inflation in the games, toys and hobby sector fell to 1.1% in March from 3.1% in February helping to keep a lid on the overall basket of prices.

Average petrol prices were 1.2p per litre higher at 120.3p.

What does it mean for interest rates?

Mr Brettell said the inflation number made the Bank of England's job easier "as there's no pressure to raise rates as it grapples with continued uncertainty over Brexit".

Howard Archer, economic adviser to the EY Item Club of forecasts said it was "decent news for both consumers and the Bank of England".

It comes after data on Tuesday had shown that average weekly earnings, excluding bonuses, rose 3.4% in the three months to February and the unemployment rate lower than at any time since the end of 1975.

The Bank of England's Monetary Policy Committee will meet next month to discuss rates.

Mr Archer said: "Despite a tight labour market, it is difficult to see the Bank of England raising interest rates at their May meeting or any time soon, amid likely MPC concern that prolonged Brexit uncertainties will likely to weigh down on the economy".

However, Samuel Tombs, chief UK economist at Pantheon Macroeconomics, said that the inflation data would not give the MPC "breathing space" to keep rates on hold because "the labour market is still tightening and the economy is coping with Brexit uncertainty".

What is the economic outlook?

The Bank of England has said that economic outlook would continue to depend "significantly on the nature and timing of EU withdrawal".

In the short-term economists say pressure on inflation could come from household energy prices in April when energy regulator Ofgem increases its price cap by 10%.

Mr Archer said it was "questionable" whether earnings growth can continue as the growth in wages dipped to a five-month low of 3.2% in the month of February.

- Published16 April 2019

- Published5 April 2019