Debenhams creditors back turnaround plan

- Published

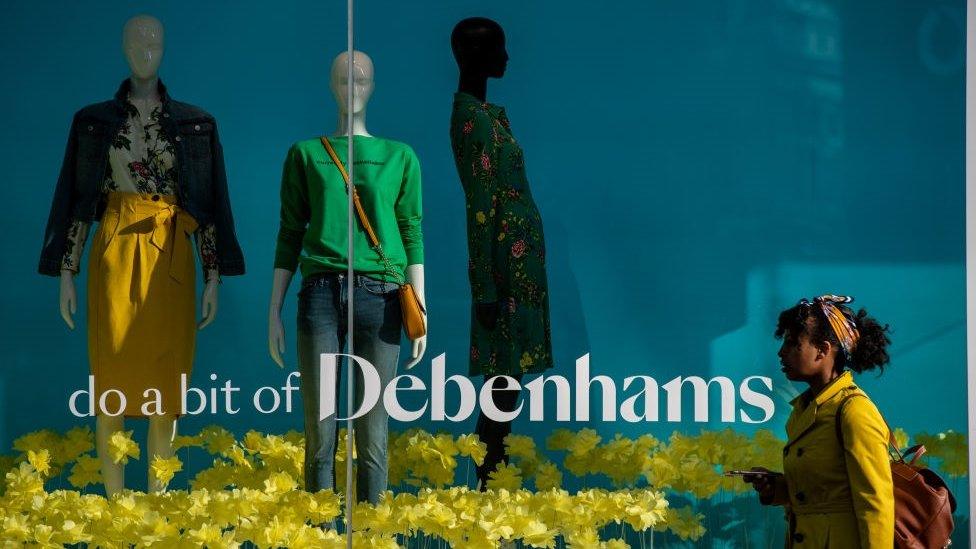

Debenhams' creditors have backed a turnaround plan that will see the closure of 50 stores and rent reductions for others.

Landlords and others voted with a majority "significantly above" the required threshold of 75% on each of the board's proposals.

The announcement came hours after it emerged administrators had rejected all takeover bids for the struggling firm.

That means it is still owned by Celine, a consortium of the retailer's lenders.

Debenhams is the biggest department store chain in the UK with 166 stores. It employs about 25,000 people.

Debenhams' executive chairman Terry Duddy said: "I am grateful to our suppliers, our pension stakeholders and our landlords who have overwhelmingly backed our store restructuring plans.

"We will continue to work to preserve as many stores and jobs as possible through this process. This is a further important step to give us the platform to deliver a turnaround."

Celine bought the business out of administration in April after key Debenhams shareholder Sports Direct had made several unsuccessful approaches.

Administrators subsequently invited bids for the business, but none of them matched Celine's and so they were not "at the level required to be taken forward".

Celine's Stefaan Vansteenkiste said the investor consortium was a "committed long-term owner" which had pumped £200m in fresh funding into Debenhams "for the financial restructuring process and to fund the company's operating turnaround".

What is the plan?

The turnaround plan involves a store closure programme under a process known as a Company Voluntary Arrangement (CVA), which also allows for rents to be renegotiated at stores that remain open.

The chain has already named 22 stores which will start closing next year, including those in Canterbury, Wolverhampton and Kirkcaldy.

Of the stores which stay open, 39 will stick to their current rental rates for the duration of their leases.

For the other stores, the company is aiming to secure rental reductions of between 25% and 50%.

'National scandal'

Debenhams' fortunes have been on a downward spiral for several years.

Like many other retailers, it has suffered in the face of increased online sales. In addition, it has too many stores, many of them too small, so it is shouldering substantial costs.

Last year, it reported a record annual loss of £491.5m.

Before Debenhams' lenders took control of the firm, Mike Ashley's Sports Direct had been a major shareholder in the retailer, owning about 30% of the shares.

The high-profile billionaire made several takeover approaches for the chain, but all were rejected. Mr Ashley subsequently described the Debenhams takeover by its lenders as a "national scandal".

The investors involved in Celine are Barclays and Bank of Ireland, as well as Silver Point Capital and GoldenTree Asset Management, which specialises in high-risk, high-reward investments.

- Published26 April 2019

- Published18 April 2019

- Published10 April 2019

- Published9 April 2019

- Published9 April 2019

- Published8 April 2019