What has happened to energy since privatisation?

- Published

British Gas was privatised in 1986 under Margaret Thatcher's government, while the first parts of the electricity sector were privatised in late 1990, when the 12 regional electricity companies in England and Wales were sold.

Later, the Scottish industry was sold, as were the generating businesses National Power and Powergen and also the National Grid.

The National Grid's main business is moving electricity and gas around the country. This is known as transmission. The very last leg of the journey into people's homes and businesses - known as distribution - is done by a number of different companies.

It has been Labour Party policy since the 2017 election to take the transmission and distribution companies back into public ownership.

The party would then encourage the establishment of locally owned energy supply businesses to compete with the private sector suppliers, including the Big Six suppliers: British Gas, EDF, E.on, npower, Scottish Power and SSE.

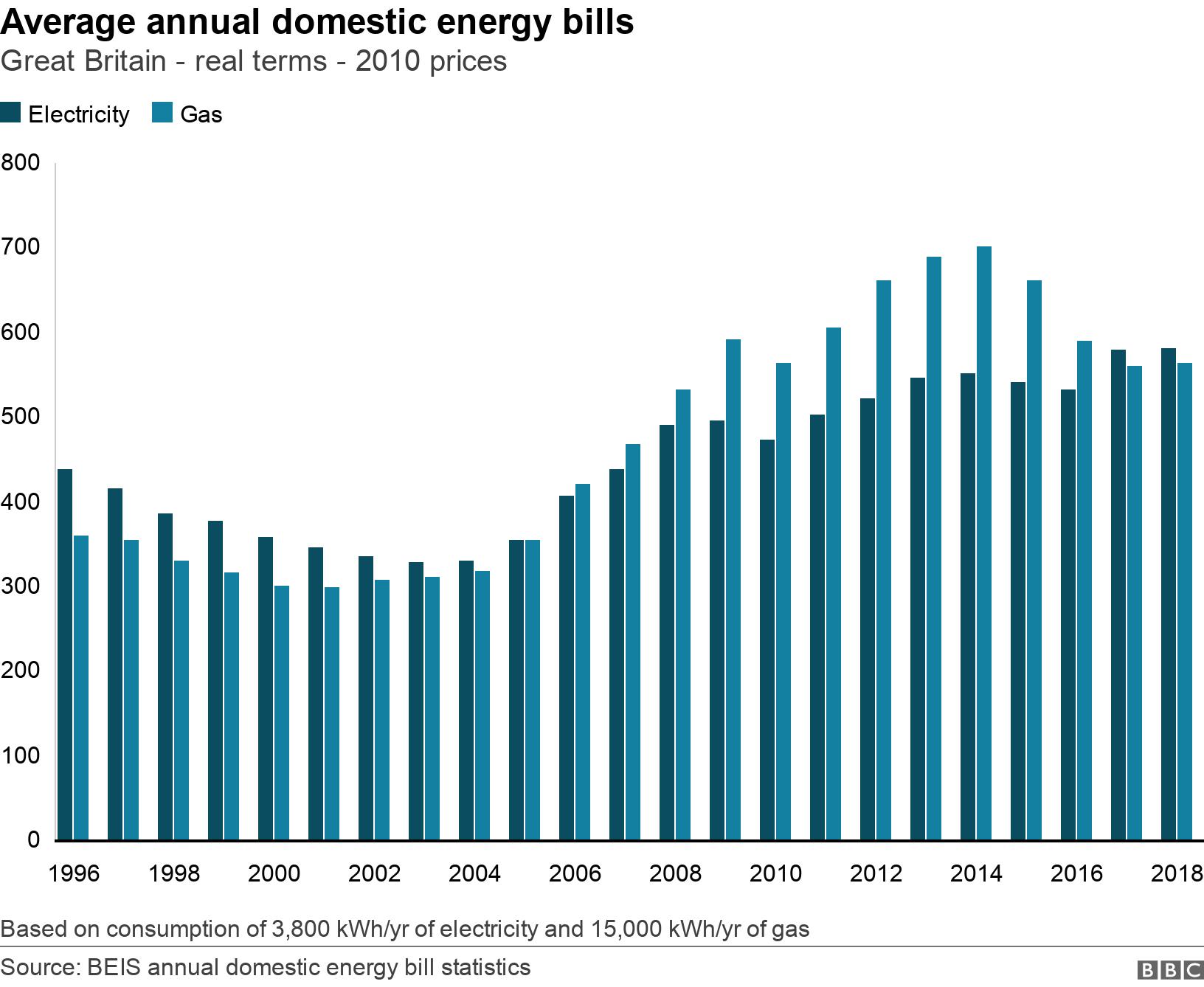

This is what has been happening to energy bills.

The figures go back to 1996 only - although the House of Commons Library says, external gas prices fell in the early 1990s, but not in 1995, after VAT was charged on domestic energy bills, while electricity prices changed little.

Since 1996, the electricity bill in this example - provided by the government - has gone up by about one-third in real terms, while the gas bill has gone up by just over a half.

Much of the increase since 1996 seems to have come in the 2000s.

The energy regulator, Ofgem, says, external that retail gas prices have been fairly stable since 2010, after adjusting for inflation, while retail electricity prices steadily increased in real terms between 2010 and 2017.

It also said that there had been a noticeable decline in energy consumption, which would be expected to reduce bills as households use less energy.

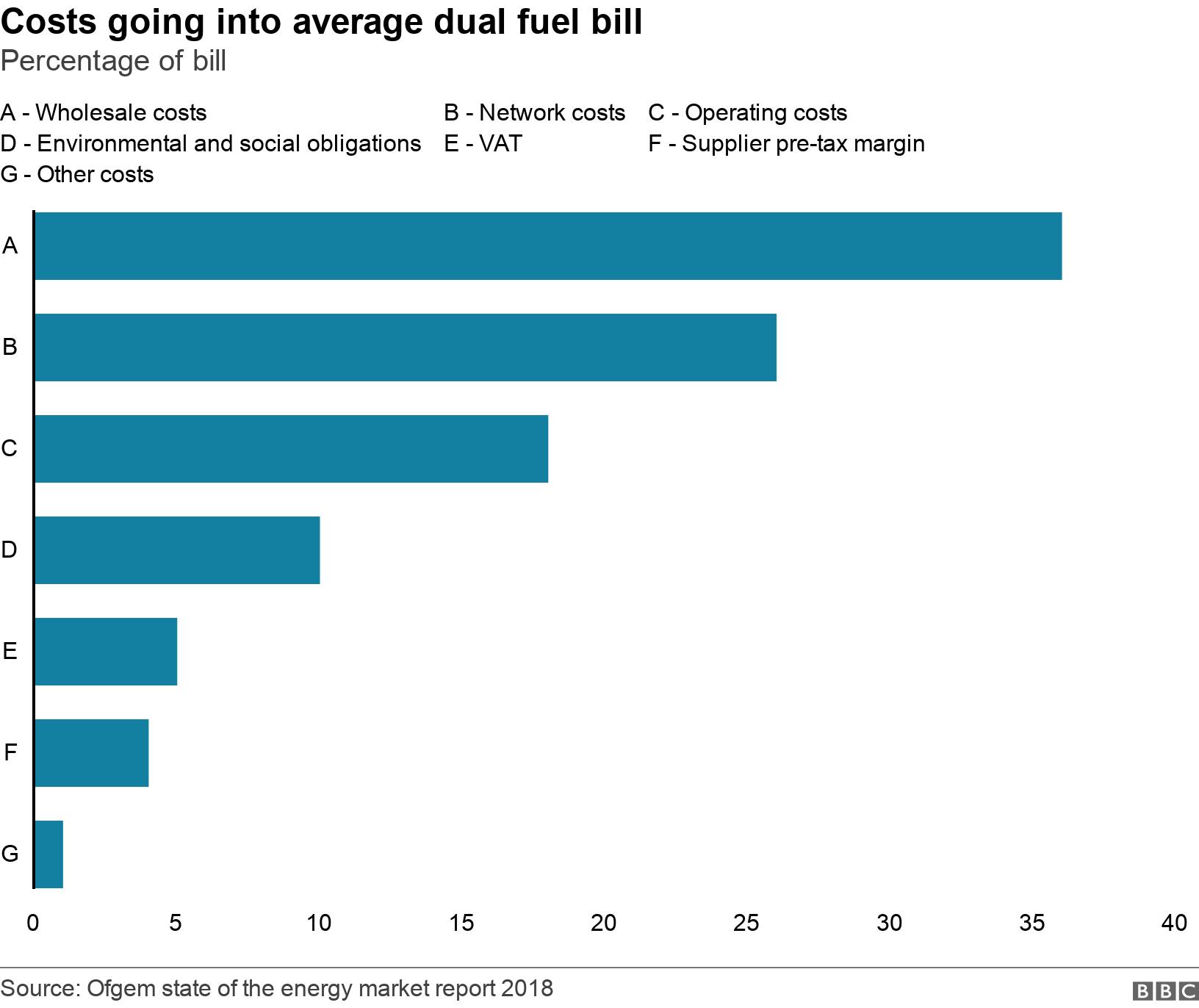

This is the breakdown of where the money in an average dual-fuel bill is going.

The biggest part of the bill - 36% last year - goes on wholesale costs, which is what the energy suppliers are paying for the fuel themselves.

Next up, at 26%, is the amount they spend on getting the energy around the country to people's homes - and it's that part that Labour wants to nationalise.

The National Grid says that only about three percentage points of that is down to its transmission costs, with the rest going to the companies that distribute the energy.

Towards the bottom of the ledger is the average amount that goes towards the supplier's profits, which is 4% of the average bill.

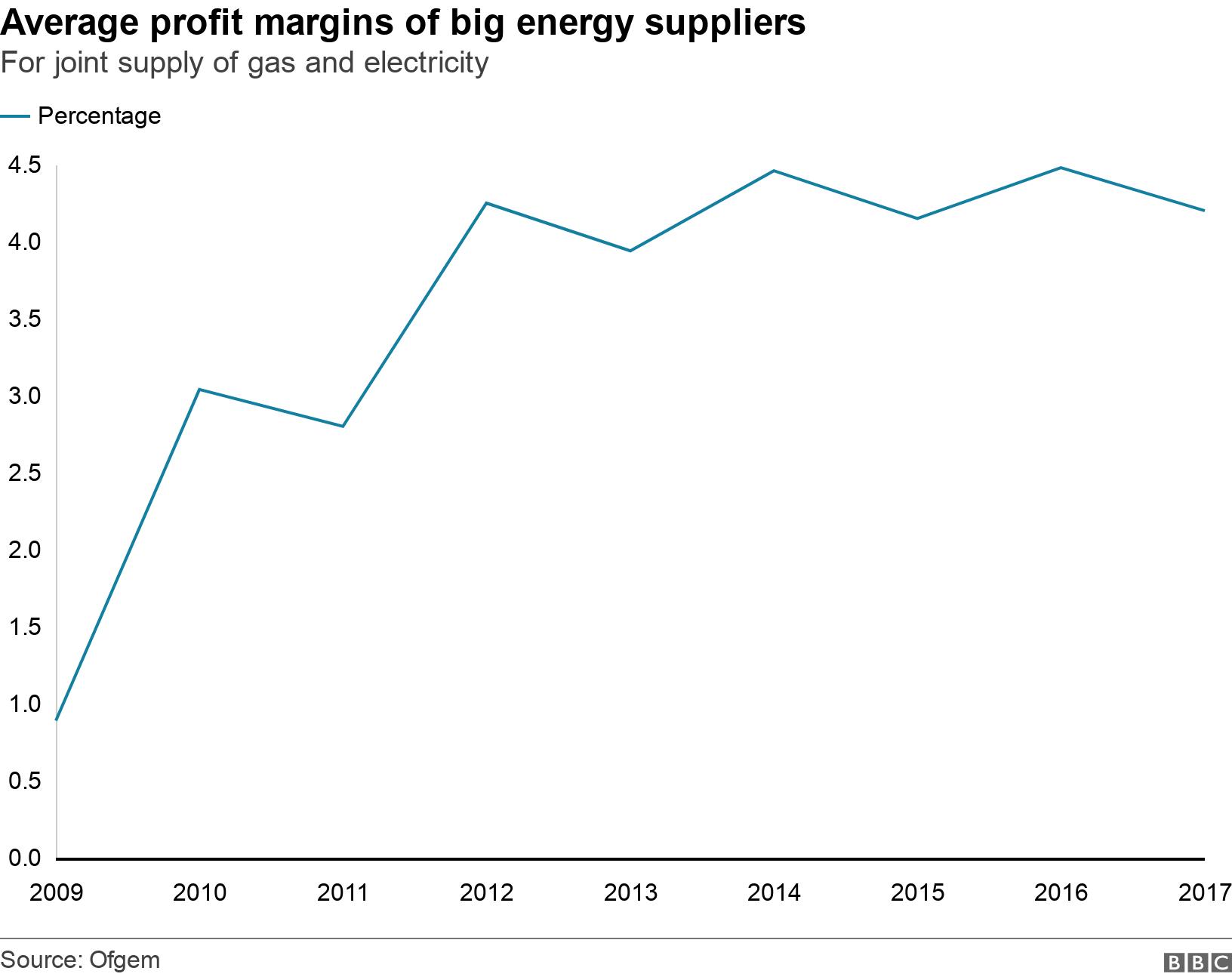

Shadow energy secretary Rebecca Long-Bailey says: "Companies have been able to post huge profit margins."

Ofgem says that the current rate of 4% for suppliers has grown from about 1% in 2009 - but there is considerable variation between suppliers.

For example, in 2017 npower reported making a loss of almost 5% on dual-fuel supply, while British Gas made an 8% profit.

The Competition and Markets Authority's 2016 report, external on the sector suggested that a 1.25% margin would provide a "normal" level of profits.

And it estimated that customers had been paying £1.4bn a year more than they would in a fully competitive market, saying that was because people who did not switch tariffs were losing out.

Ofgem says that 61% of customers have switched supplier only once or never, while 19% of consumers had switched supplier between July 2017 and June 2018.

The government criticised Labour's plans for leaving politicians in charge of keeping the lights on, and added: "Through measures like our energy price cap, the Conservative government will continue to protect people from unfair bill rises, while increasing renewable electricity to a record high."

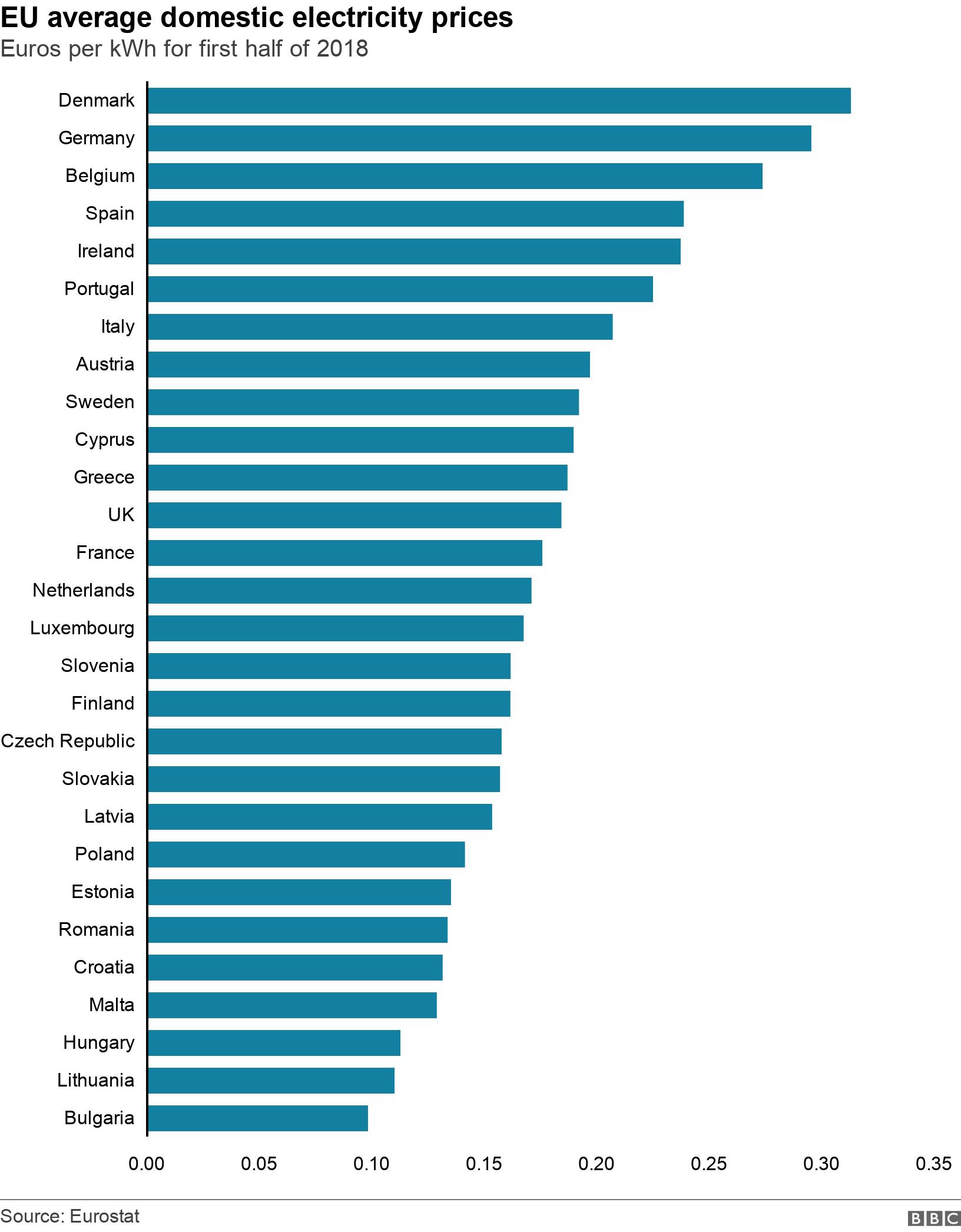

Despite the lack of switching and the weakness of the pound, the UK's electricity prices are below the average level across the EU, as this chart from Eurostat shows.

The UK is half way down the list for domestic gas prices, external, paying 0.05 euros (4.4p) per kWh, compared with an EU average of 0.06 euros.

- Published11 May 2017