What went wrong for Woodford and why it matters

- Published

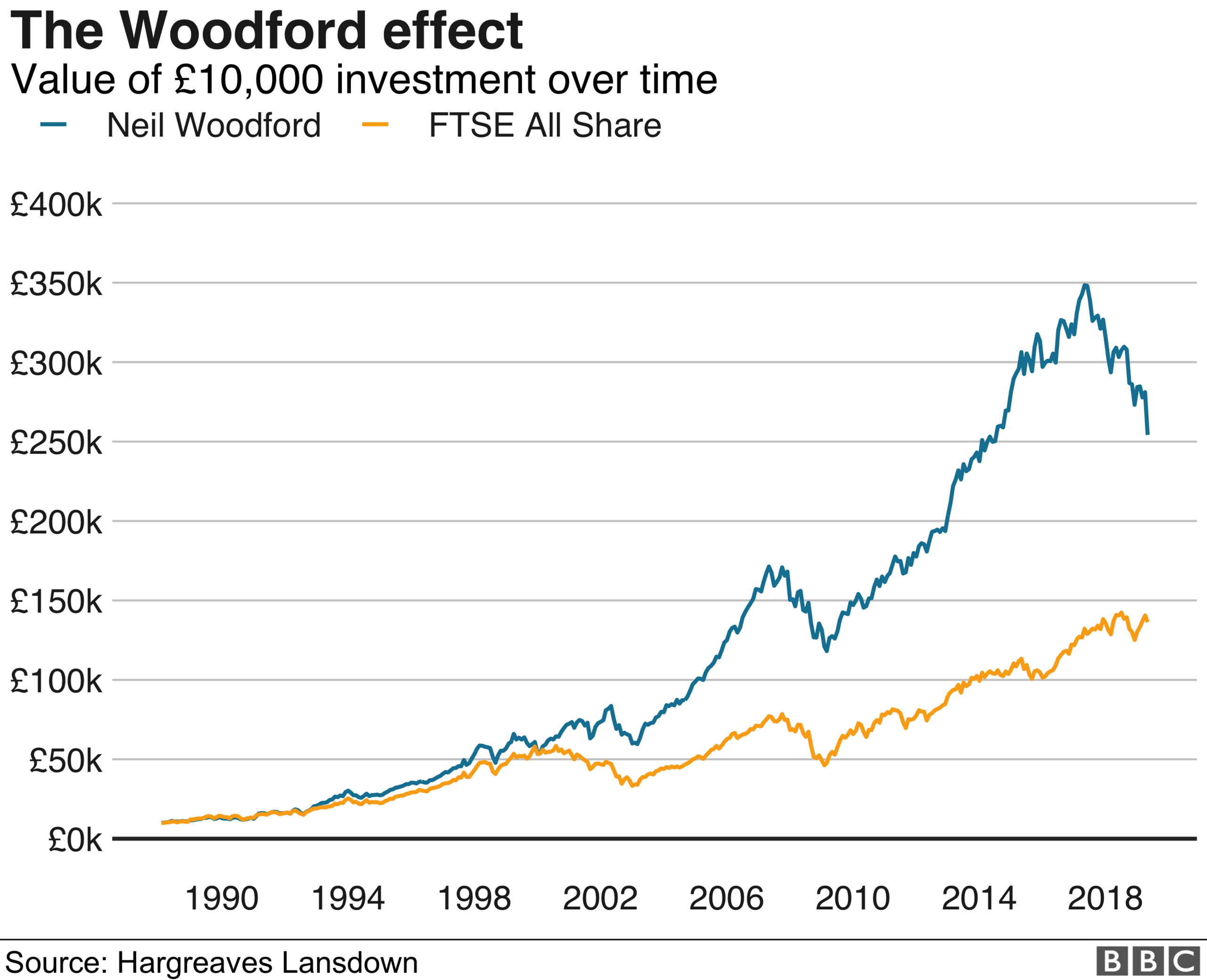

Neil Woodford is unconventional and has been successful for investors

Stockpicker Neil Woodford is unusual. Firstly, he is as close to a household name as is possible from the world of investing.

He is unusual among fund managers in shunning the City of London, having based his business in Oxford instead, and scrapping bonuses for staff.

His choice of investments is also unusual - sometimes choosing to put money into small businesses with shares not listed on a public stock exchange.

Unfortunately for investors who chose to trust him with their money, he has now taken the unusual step of suspending his flagship fund.

But the reason is far from unusual: when things started to go wrong, they wanted their money back.

What does Neil Woodford do?

A stockpicker - or fund manager - analyses the potential of different stocks to try to decide whether or not they will make a good investment.

Investors, ranging from big institutions such as pension funds to ordinary people with some money set aside, put money into his UK Equity Fund. That means your pension may be invested in it without you realising it.

The name of the fund is fairly clear. He invests in UK shares and pays an income to investors on a regular basis, which many put back into the fund. They could take their money out whenever they wanted.

Mr Woodford's "star" status was secured following 25 years of market-beating returns with Invesco Perpetual, partly when he saw through the dotcom boom.

But his performance since he went it alone five years ago has been dramatic. In its first year, there were returns of 18% on investors' money, compared with an average rise of only 2% on the London Stock Exchange at the time.

However, far from uniquely, this has been followed by struggles in the last couple of years.

As a result, the fund has brought very little return for investors who have been in it throughout. Figures from FE Analytics show the fund has made a total return of 0.36% since its launch.

That has been a shock to people such as private investor Peter Turlik, from London, who has £21,000 invested in the fund. He had a five-year plan, but it is not performing well.

"When you are aged 76, you don't want to lose £3,600, when you are not going to get it back. You don't have time like a 30-year-old," he says.

He is unhappy with investment platform Hargreaves Lansdown for promoting the fund.

"Trust and confidence begins to trouble you," he says.

What went wrong?

Investors had piled into the fund which, at its peak, had more than £10bn of people's money in it.

Some financial advisers had suggested it to their clients and Hargreaves Lansdown placed it in its Wealth 50 list of favourite funds.

"But its performance didn't live up to the hype and investors and commentators began to lose confidence," says Patrick Connolly, from financial advisers Chase de Vere.

Neil Woodford has an unusual style

He says that Mr Woodford's investing style is based on conviction. One of those convictions was a smooth outcome from Brexit, but politics has not played out that way so far.

The uncertainty over Brexit has hit UK shares and, in turn, the performance of the fund.

Some of the investments chosen by Mr Woodford have, so far, been unsuccessful. Provident Financial, for example, has had its difficulties, as have Kier and Purplebricks.

"The more the performance suffered, the more people wanted to get out," says Mr Connolly. The £10bn-plus fund now only holds £3.7bn of investors' money.

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

The exodus was a major problem, according to Ryan Hughes, of AJ Bell, as a considerable chunk of the investment was in illiquid holdings - investments that could not quickly be turned back into cash.

"Events such as this are rare, but it is a reminder to all of the risks that come with investing in illiquid assets while offering daily liquidity to investors. This never appears to be a problem when money is flooding in, but when sentiment turns, it can come back to bite investors badly, as has happened here," Mr Hughes says.

Now investors have been told they cannot redeem their investments, while the fund has been suspended for up to 28 days before another announcement must be made, or it starts trading again.

Their underlying investments remain, they will not lose it all, and many argue that pulling out will only crystallise any losses, rather than investing for the long term.

Mr Woodford's firm says the suspension will give it "time to reposition the element of the fund's portfolio invested in unquoted and less liquid stocks, into more liquid investments".

What lessons are there for investors?

This is a shock for many investors. A star of the sector is having what has been described as a "dark and terrible moment".

Some will point to this case as proof that paying charges to a "star" fund manager to try to beat the market is a waste of time and that, instead, people should invest in a passive tracker fund.

Warren Buffett, the world's richest investor, in a letter he wrote to his wife advising her how to invest after his death, suggested putting almost everything into "a very low-cost S&P 500 index fund".

Others, however, argue that active investment can be successful, but everyone needs to do their homework.

"Never learn how a fund manager invests after they have your money," says Mr Hughes.

Mr Connolly says it proves investors need to be "sceptical of the hype and to diversify their investments".

"Woodford was promoted as some kind of superstar and that is clearly not the case," he says.

That means not investing in one company or one type of investment, nor with one individual - however diversified their fund might be.

"It all goes back to the old adage of having your eggs in different baskets," he says.

- Published4 June 2019

- Published23 August 2016

- Published17 July 2017