Kier to cut 1,200 jobs as it seeks to cut costs

- Published

Troubled construction and services firm Kier has said it will cut 1,200 jobs as it seeks to make cost savings of £55m a year by 2021.

The cuts came as the firm's boss announced a plan to simplify Kier's business and reduce its debt.

The company will sell its homebuilding business, Kier Living, and will shut or sell other interests, including its recycling and rubbish processing units.

Kier will now focus on activities such as construction and road maintenance.

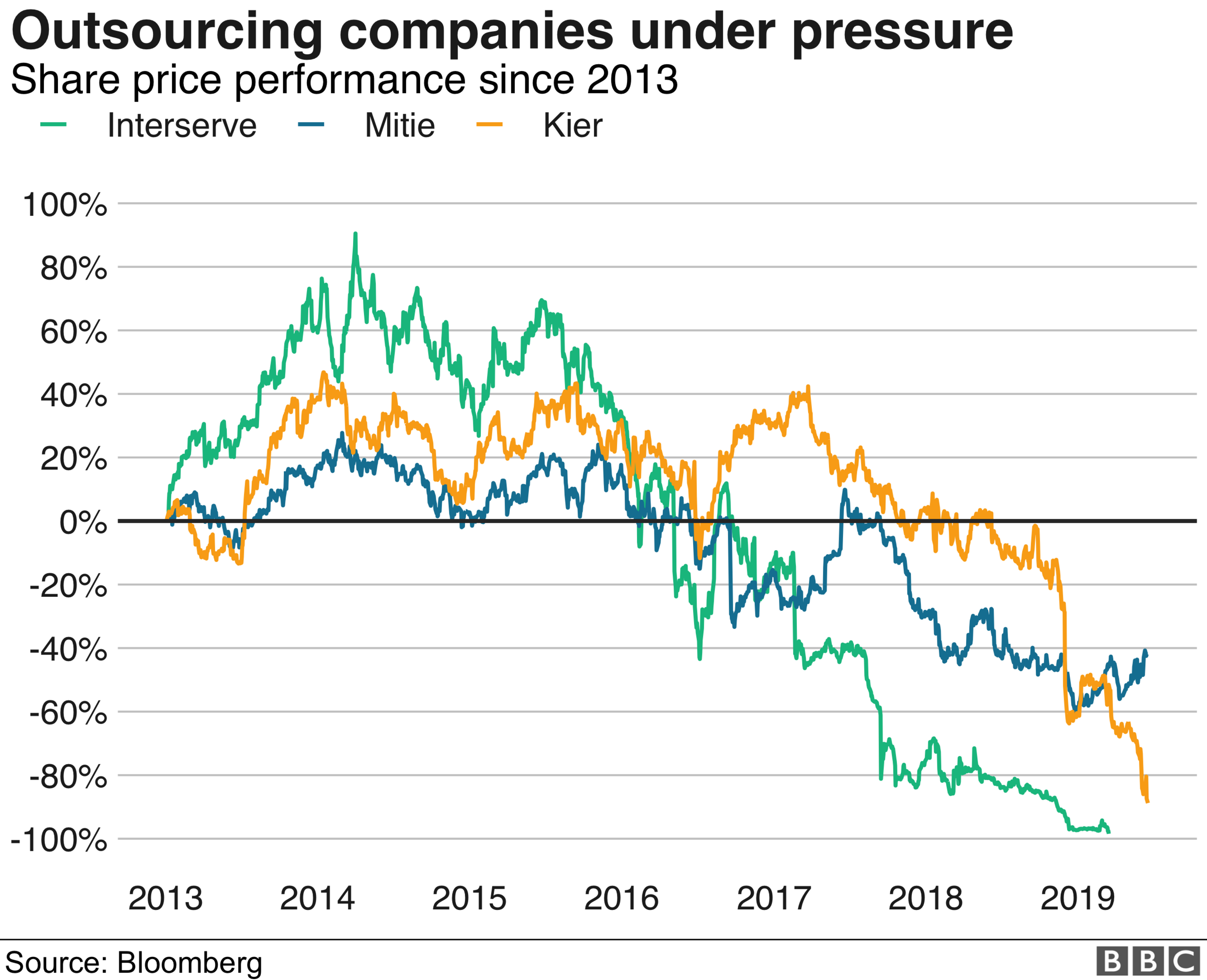

Shares in the company have fallen by more than 85% in the past year, and they fell a further 11% on Monday to about 116p.

"These actions are focused on resetting the operational structure of Kier, simplifying the portfolio, and emphasising cash generation in order to structurally reduce debt," said chief executive Andrew Davies, who took over the role in April this year.

"By making these changes, we will reinforce the foundations from which our core activities can flourish in the future, to the benefit of all of our stakeholders."

The company's woes are having ramifications beyond the construction world. The share price fall has affected its largest investor, Woodford Investment Management, which had to suspend its flagship fund after some of its investments lost value and investors withdrew their cash.

It has been a tough few years for outsourcing companies competing for government contracts.

Early last year Carillion, which cooked school meals and maintained prisons, collapsed into administration.

Many firms were found to be making low bids in order to gain contracts and booking revenues when the contracts were won, not when the money was actually paid.

This meant that when firms missed targets as part of these contracts, and were paid less as a consequence, the companies reported heavy losses.

Profit warning

Of the 1,200 jobs being lost at Kier, 650 of the posts are scheduled to be cut by the end of this month, while the remaining 550 jobs are expected to go next year.

The company added that several potential suitors had already expressed an interest in its Kier Living business.

Two weeks ago, shares in Kier tumbled more than 22% after the company issued a profit warning.

At the time it said underlying profit would be about £25m below previous expectations. It blamed higher costs and problems at units in its road, utilities and housing maintenance businesses.

- Published4 June 2019