Neil Woodford's flagship equity income fund to stay locked

- Published

Well-known stockpicker Neil Woodford's flagship fund will remain locked for investors, it has been confirmed.

The extension, announced as the initial 28-day suspension expired, external, means investors will have to wait at least another month to withdraw their money.

Investors in the Equity Income Fund have now not been able to access their money since 3 June.

Withdrawals were frozen after rising numbers of investors asked for their money back.

"It remains in the best interests of all investors in the fund to continue the suspension," Link, the regulated manager of the fund, said in a letter to investors posted on its website.

The next update on the fund will be before 29 July, the next formal deadline for a review.

Mr Woodford fuelled speculation that the fund could be locked for a long period, by reiterating that there is no "prescribed limit" to the suspension in a video statement to investors., external

"Of course, we understand that people want access to their money, they are very frustrated by not being able to deal in the fund. But we are using the time . . . to ensure we get the right outcomes for our investors," he added.

Ryan Hughes, head of active portfolios at investment platform AJ Bell said it was now "imperative" that Mr Woodford communicated clearly with investors on progress.

"While this is difficult given liquidity is a moving target, investors deserve to be kept fully informed as the portfolio is repositioned."

Mr Hughes said the fund's performance had continued to deteriorate since the suspension, dropping 4% compared to a 3% rise in the FTSE All Share over the same period.

Celebrated

Mr Woodford is one of the UK's biggest names in stockpicking - which is when a fund manager analyses the potential of different stocks to try to decide whether or not they will make a good investment.

He was widely celebrated for previous success, and backed until the suspension by huge investment supermarket Hargreaves Lansdown - but both now face questions over how business was conducted amid criticism from investors.

'We don't expect to see our money soon'

Investor Claire Jebson and her husband have some of their money locked up in the Woodford fund. It was supposed to be used to help pay for son Sam's university education which is due to start in September.

However, she does not expect her money to be unlocked for another six to 12 months - missing the planned start of his studies.

"We didn't know this block could happen - our mistake. It is good that we all are aware now, but sad that this had to happen for us to find out," she said, echoing the views of many investors.

"We do have a back-up plan and I am sure others are in a worse position."

Paul Madon, from Leicester, said he expected the value of the investment to drop sharply when the suspension is eventually lifted.

"I thought [the Woodford fund] would be boringly safe. It was not," the 67-year-old said.

"I will get out as soon as I can, and take the loss."

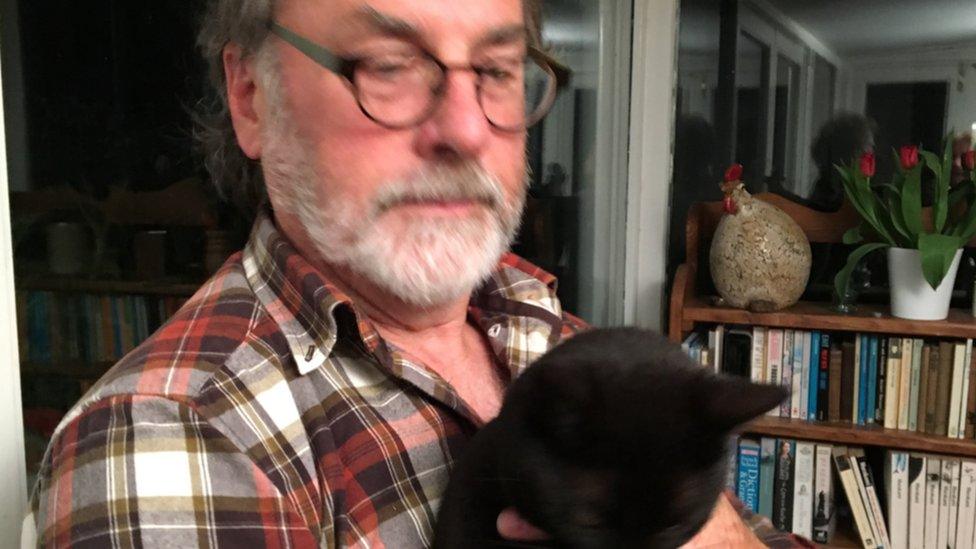

Stuart Evans based his investment on Hargreaves Lansdown recommendations

Stuart Evans, who is saving for his grandchildren and spoke of his frustration with Hargreaves Lansdown last month, also said he expected to take a "big hit" when the fund eventually reopens.

What happened to the Woodford fund?

When the fund launched five years ago, Mr Woodford's previous record meant thousands of investors trusted him with their money.

At its peak, the Woodford Equity Income Fund managed £10.2bn worth of assets, such as local authority pension funds.

In its first year, there were returns of 18% on investors' money, compared with an average rise of only 2% on the London Stock Exchange at the time.

However, far from uniquely, this was followed by struggles in the last couple of years.

Neil Woodford is under the regulator's microscope

As a result, the fund has brought very little return for investors who have been in it throughout. Figures from FE Analytics show the fund has made a total return of 0.36% since its launch.

It also meant that investors pulled out at an increasingly rapid rate. The fund now manages £3.7bn, according to the financial services and research firm Morningstar.

Owing to this "increased level of redemptions", Mr Woodford and his backers said investors would not be allowed to "redeem, purchase or transfer shares" in the fund. In effect, it was suspended while they reordered the fund.

There has been criticism that, in the meantime, Mr Woodford has continued to charge management fees to customers.

Nicky Morgan, who chairs the Treasury Committee of MPs, said fees should be halted while trading in the fund was suspended.

- Published6 June 2019

- Published11 June 2019

- Published4 June 2019

- Published4 June 2019