Six things that affect your chance of a pay rise

- Published

How easy is it to get a pay rise?

You could try to wrangle more money out of your employer with hard work or canny negotiating tactics.

But in practice, other factors are likely to be more important. Some of these are in our control, but more often they come down to luck.

Being young (and born at the right time)

Pay tends to rise the fastest during your 20s. That is because you are likely to start off on a low salary and quickly gain skills and experience.

This rapid pace then slows during your 30s and 40s, with pay rising by 2% and 1% a year respectively. It then generally starts to fall as people move towards retirement.

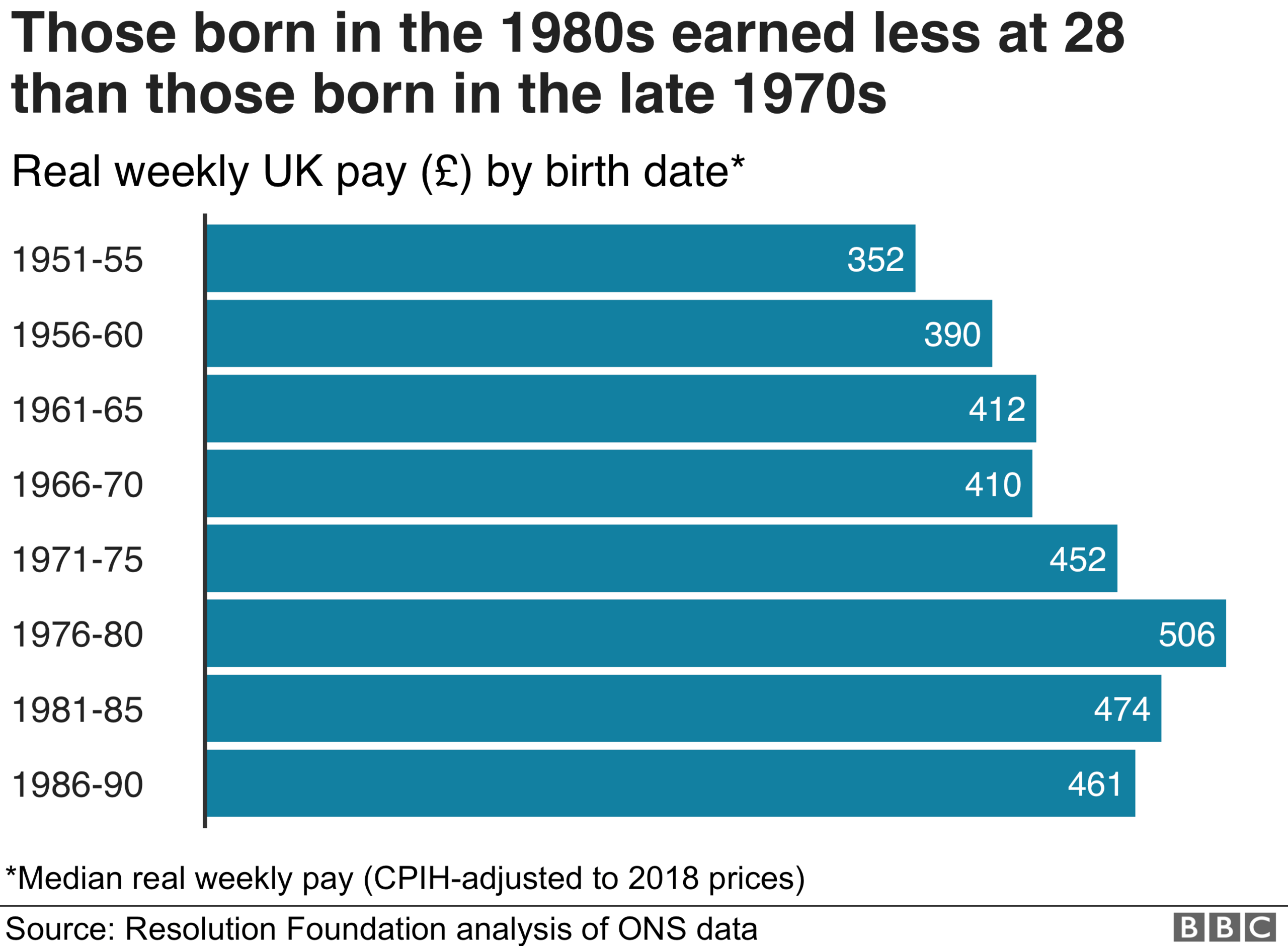

Until now, every generation has tended to earn more than the one before it. For example, those born in the early 1970s earned about 16% more at the age of 28 than those born in the late 1950s.

But for millennials, it is a different story.

Those born in the late 1980s earned less at 28 than the generation born 10 years earlier. That is because they started their careers in the middle of an unprecedented pay slump, following the 2008 recession.

However, there are ways to improve your pay growth. Going to university while young delays work, but often leads to faster pay growth for the rest of your 20s.

Graduates born in 1980 saw their average pay rise by 8% a year in real terms between the age of 22 and 30. That is compared with 6% per year for those whose highest qualification is A-levels, or 3% for those with an equivalent vocational qualification.

Changing jobs

Rather than negotiate a pay rise with your boss, you could try ditching your employer altogether.

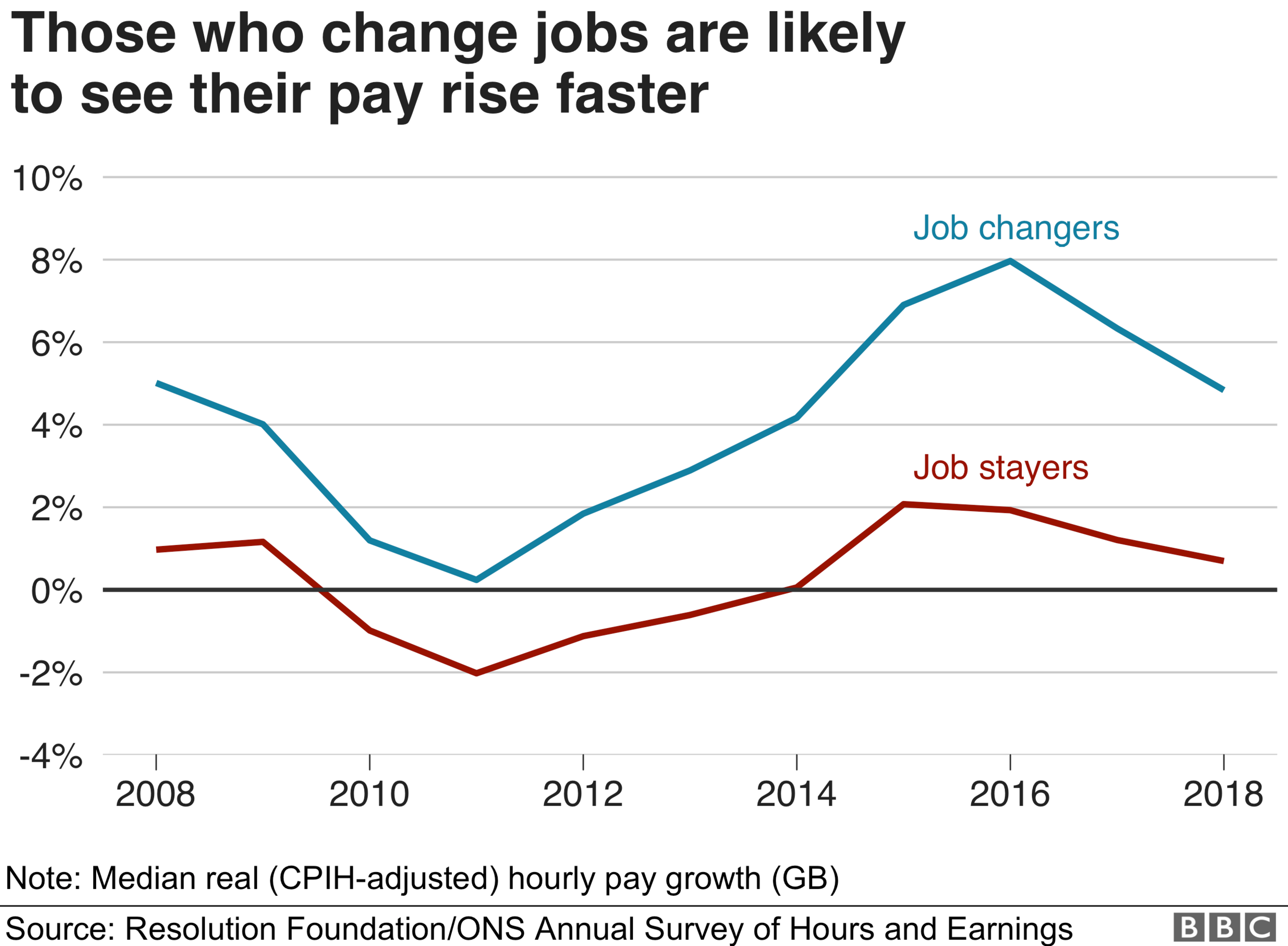

In 2018, workers who stuck with the same firm saw their average pay rise by 0.6% a year, after inflation.

But the typical pay rise in the year after changing employer was more than seven times higher, at 4.5%. A new job may make the most of the skills an employee has gained, while switching employer is often an opportunity to negotiate a pay rise.

Moving area and changing jobs

If you want a really big pay rise, you need to move house too.

In 2016, the typical pay rise associated with changing both jobs and region was 9%. People often move to cities such as London, Edinburgh or Manchester, where there is a wider pool of jobs to choose from, and often higher pay.

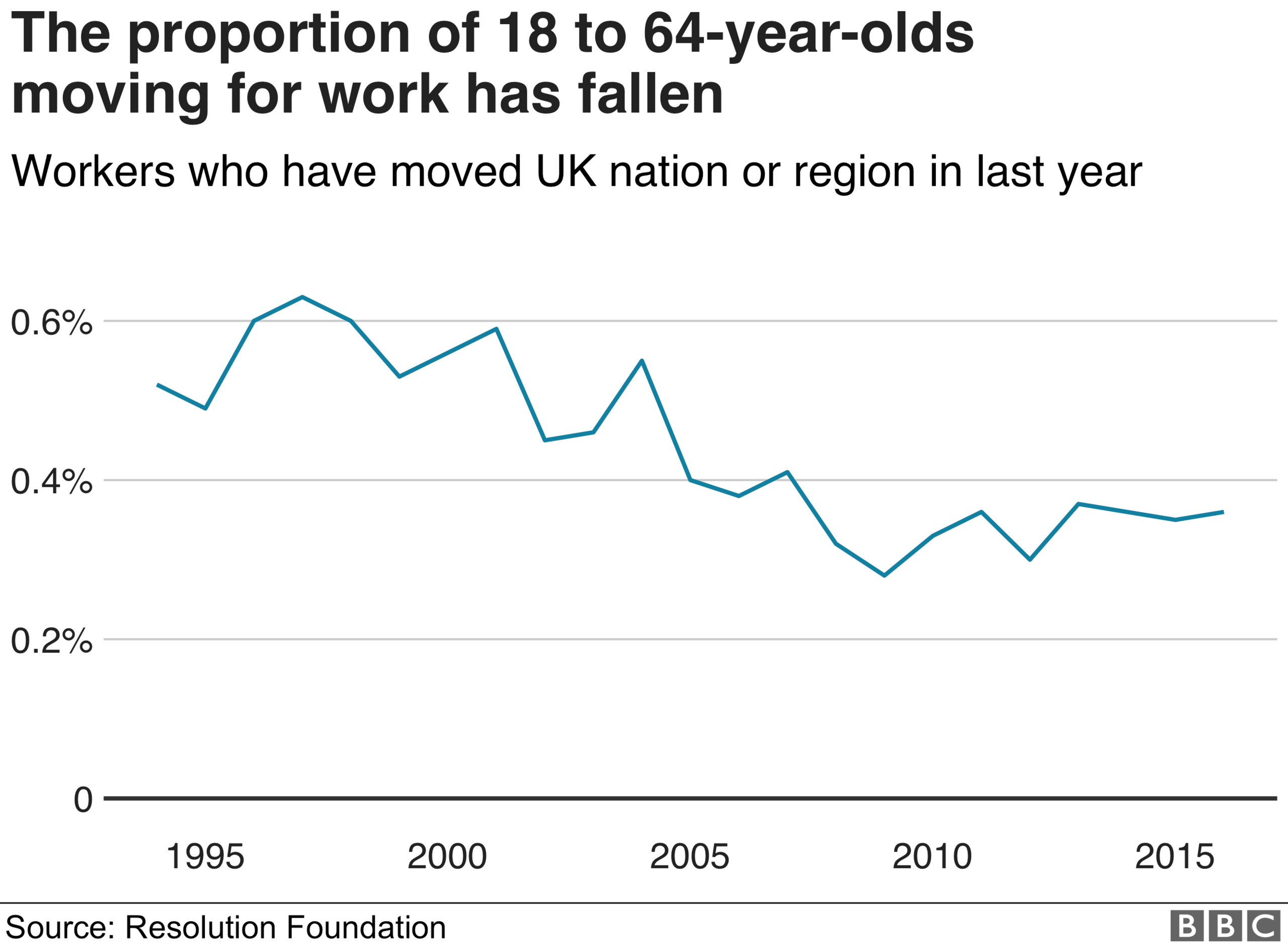

Despite this, young people in particular are moving jobs less frequently than they used to.

In part, this is because there are now fewer employment black spots across the UK and less of a need to up sticks to find work., external

Less positively, it is also because those bigger pay rises are now often swallowed up by higher housing costs.

For example, rents have grown by more than 90% in the highest-paying local authorities over the past 20 years,, external compared with 70% in the lowest paying.

Consequently, young private renters are two-thirds less likely to move home and job than they were in 1997.

Being a man

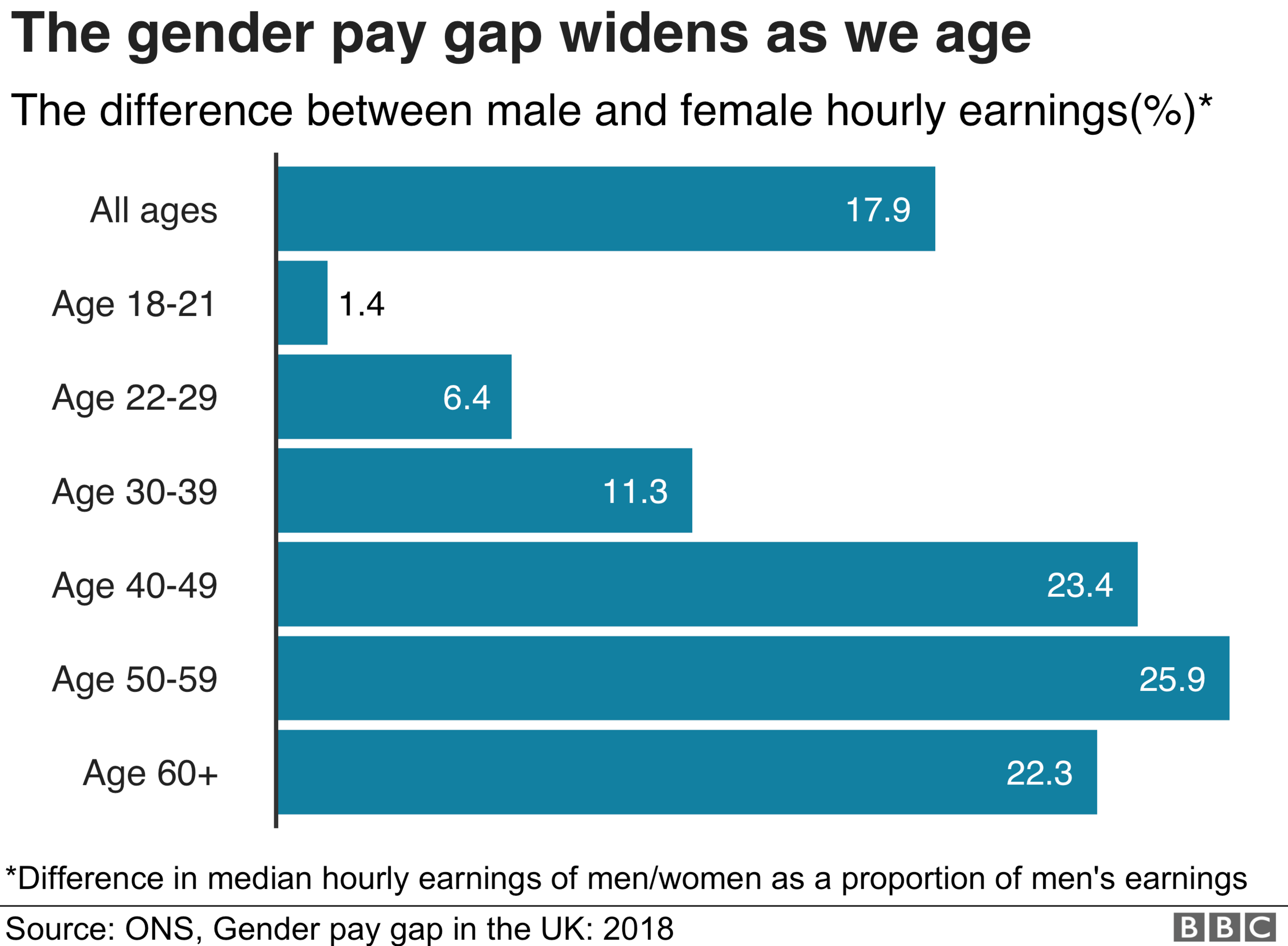

Almost 50 years on from the Equal Pay Act, significant progress has been made on closing the gender pay gap.

Nevertheless, on average, men are still paid 18% more per hour than women across full and part-time work combined.

The gap is smaller among younger workers, but grows to 11% by the time people hit their 30s. It continues to widen with age as the "motherhood penalty" kicks in.

One factor is that many mothers go part-time, which tends to pay less per hour than full-time work.

In 2018, more than half of working women with dependent children were part-time, compared with one in 10 men.

The gender pay gap grows to its widest when employees are in their 50s, when women are still far more likely to work part-time, but for other reasons.

A quarter of older female workers provide unpaid care - for example, to their parents or grandchildren - compared with an eighth of male workers.

More like this

Being at the bottom - or at the top

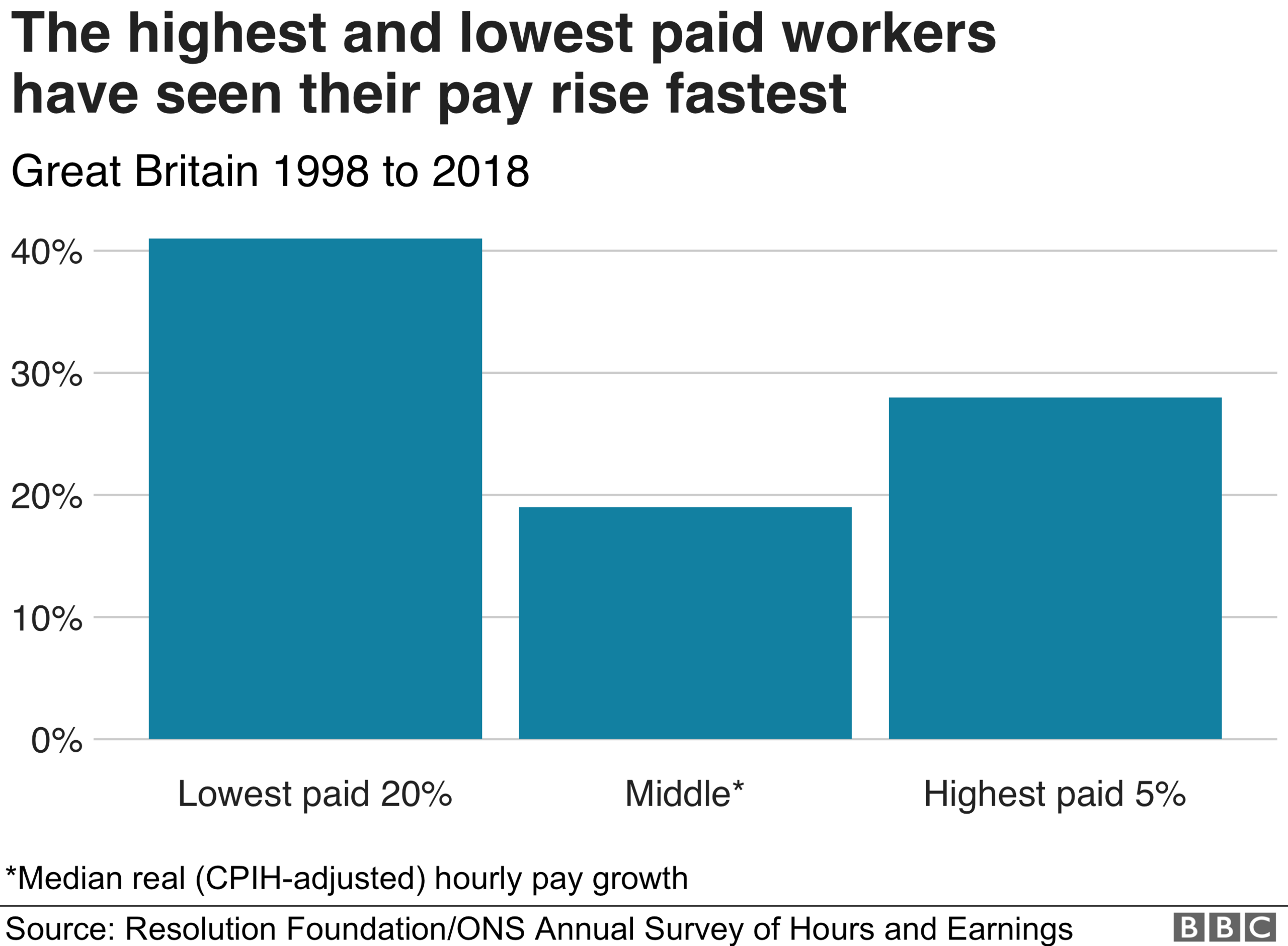

How fast your pay increases also depends on where you sit on Britain's pay scale - and those at the bottom have seen their pay rise by the most in recent years.

Over the past two decades, the lowest-paid fifth of workers have seen their real pay grow by 40% - twice as fast as middle earners.

That is mainly down to the introduction of the National Minimum Wage in 1999, which has steadily risen over time. It now stands at £8.21 for people aged 25 and over, making it one of the highest minimum wages in the world. This has in turn boosted wages for those in the pay band above them,, external the government claims.

But pay growth has not just been strong at the bottom. Those at the top have done well too. Average pay for the top 5% of earners grew about 50% faster than a middle-ranking worker over the last 20 years.

Being more productive - and hoping everyone else is

There are lots of reasons why our pay may grow, or shrink from year to year - from the decisions we take, to changes in government policy and how society values the work that we do.

But the long-term driver of what happens to our collective pay is how productive we are. The more we produce per hour, the more our employer can afford to pay us.

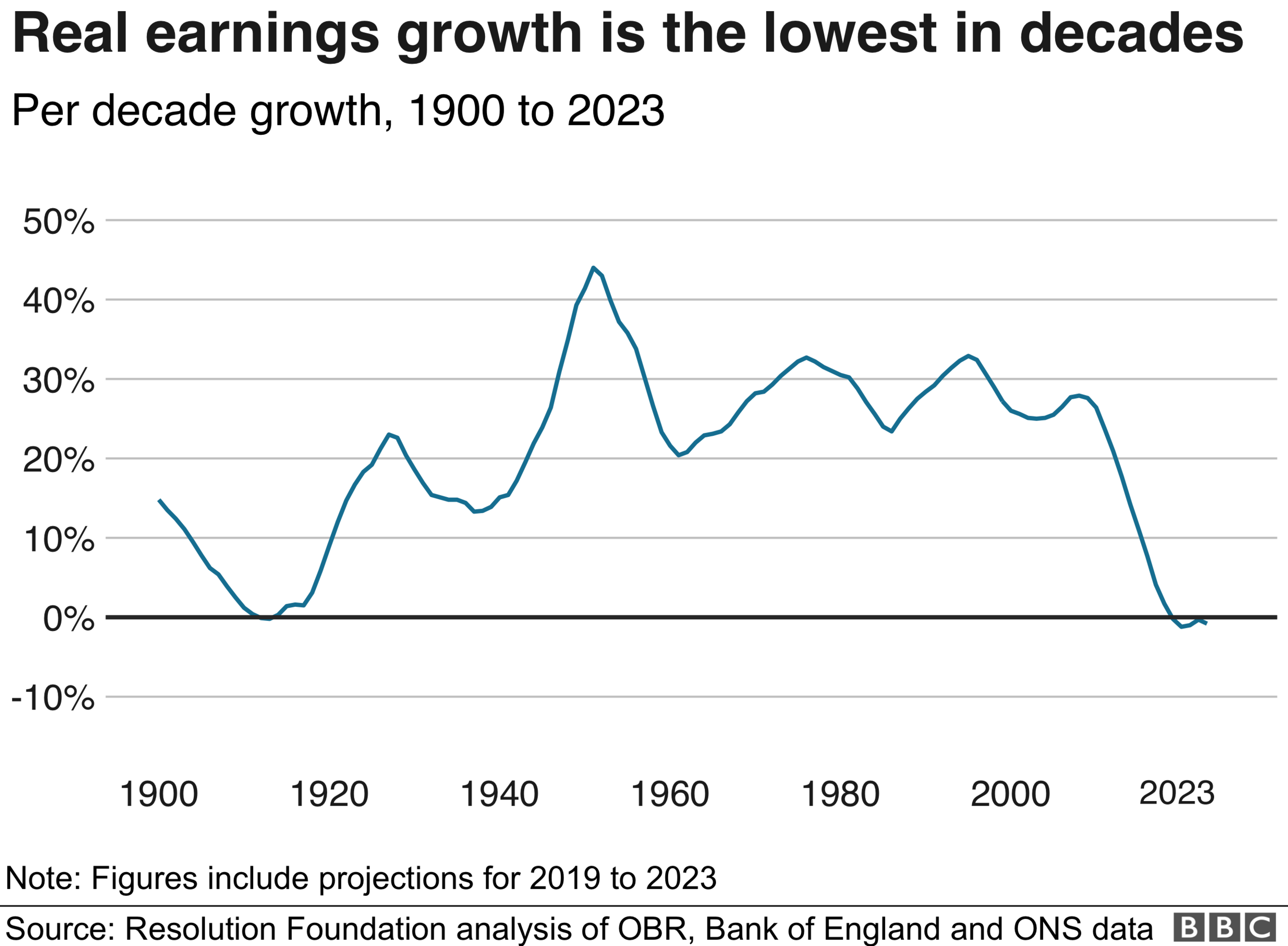

Britain's productivity was growing at about 2% a year pre-recession, but is effectively in the same place now that it was 10 years ago.

Boosting productivity, and consequently wages, is mainly in the hands of employers and the government, who can invest more in things like equipment, technology and training.

This is the key to making sure the next generation enjoys higher living standards than the current one.

About this piece

This analysis piece was commissioned by the BBC from an expert working for an outside organisation.

Nye Cominetti, external is an economic analyst at the Resolution Foundation, external, which describes itself as a think tank that works to improve the living standards of those on low to middle incomes.

You can follow him on Twitter here, external.

Edited by Eleanor Lawrie

- Published19 November 2019

- Published1 July 2019