Would you accept a loss to keep your money safe?

- Published

- comments

Some of the world's biggest investors are so worried about the future of the global economy that they have taken the extraordinary step of paying for governments to look after their cash.

They are nervous about a no-deal Brexit and the ongoing trade war between the US and China, as well as signs of a slump in demand in Germany, Europe's economic powerhouse.

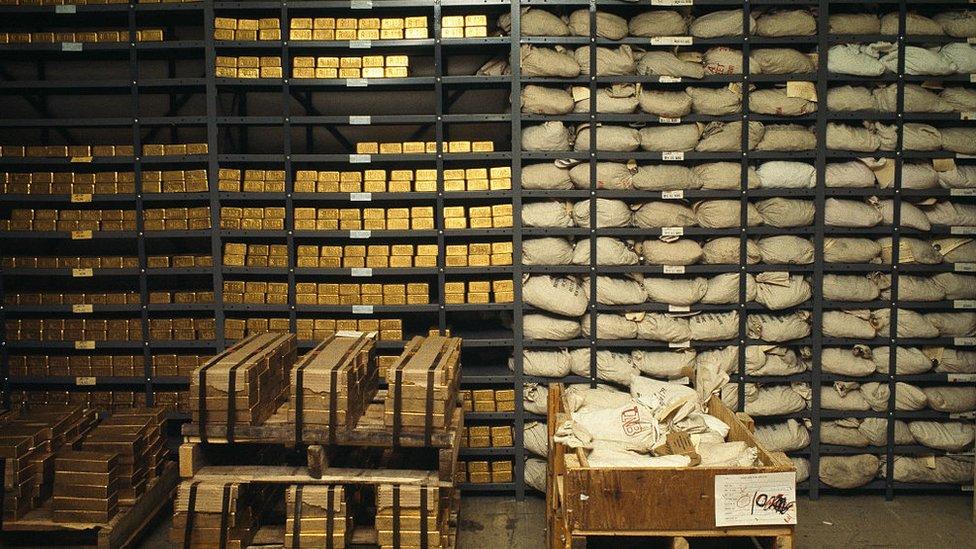

In times of crisis, investors usually flock to so-called safe-haven assets like gold, government bonds or good old fashioned cash.

But for big investors, like pension funds, cash isn't practical and gold is considered risky.

That has driven them toward government bonds and, unusually, investors are paying to hold them.

What are bonds?

In order to raise cash - to pay for everything from big infrastructure projects to covering the cost of their own debt - governments borrow money.

One of the ways they do that is to issue fixed-term bonds, under which companies and individuals lend a set amount of money to the government, which promises to pay interest every year until it returns the total amount borrowed on a pre-agreed date in the future.

Or, at least, that how it's supposed to work.

Countries that are considered to be good borrowers, like Germany, will pay less interest than risky debtors, like Argentina, which is considered more likely to renege on its IOU (I owe you).

Some big investors, such as pension funds, are limited to how much money they can put into riskier assets, which - twinned with a negative interest rate in Europe - has made bonds issued by the likes of Germany, France, Switzerland and Japan a very attractive purchase.

For example, the overwhelming demand has sent the interest paid on 10-year German bonds crashing to minus 0.65%, meaning investors will make a loss if they lend money to Berlin.

What does a negative bond yield mean?

In effect, investors are paying governments to borrow their money - and that does not bode well for those hoping for economic growth.

It means that people who make a living from predicting what economies will do in the future, are betting on interest rates remaining negative for at least ten years.

And, worse, the 0.14% yield on 30-year German bonds suggests that investors are expecting interest rates to stay in the red for the next three decades.

Tristan Hanson, who invests in bonds for M&G, says the current German bond price shows a "high degree of risk aversion" in Europe, where investors would rather accept a loss on holding their money than buy an apartment or invest it in stock markets.

"They are saying: 'I'd rather have a guaranteed small loss than risk a big loss in some other asset class'," Mr Hanson explained

Why not stick to cash?

For big institutional investors, cash is costly because they can't just put it under the mattress, according to Hargreaves Lansdown analyst, Laith Khalaf.

"I could build a massive secure basement and keep all my cash in that," he said.

"But actually that's quite expensive and if interest rates return to normal, I'm going to have an empty basement."

Big investors don't tend to keep their assets in a bank in case that bank fails, he added.

"If institutional investors are putting £30m in a bank, it means they have a lot of risk if that goes under," Mr Khalaf said.

Big investors also like to hedge liabilities by buying bonds, he said. A pension fund that knows its pensions in 20 years will cost a certain amount will buy bonds that it expects will let it meet those obligations.

He said the negative bond yields reflected broader economic woes.

Are investors panicking?

Will Hobbs from Barclays' investment arm believes investors' worries are overblown, saying the economy "doesn't look that bad".

He said the fortunes of the global economy were tied to the US, which "looks healthy".

"All economies are perfectly capable of starting a fight in an empty room.

"But the big recessions they tend to be driven by the US economy and what happens there," he said.

He said the negative bond yields had driven some investors to buy up gold, pushing prices to a six-year high.

But the investment boss warned people to be careful of buying the precious metal.

He said it's "very difficult to value", adding, "there's a huge amount of emotion invested in the price".

- Published14 August 2019

- Published15 August 2019

- Published8 August 2019

- Published5 August 2019

- Published19 August 2019