Laura Ashley nears collapse as firms demand help

- Published

- comments

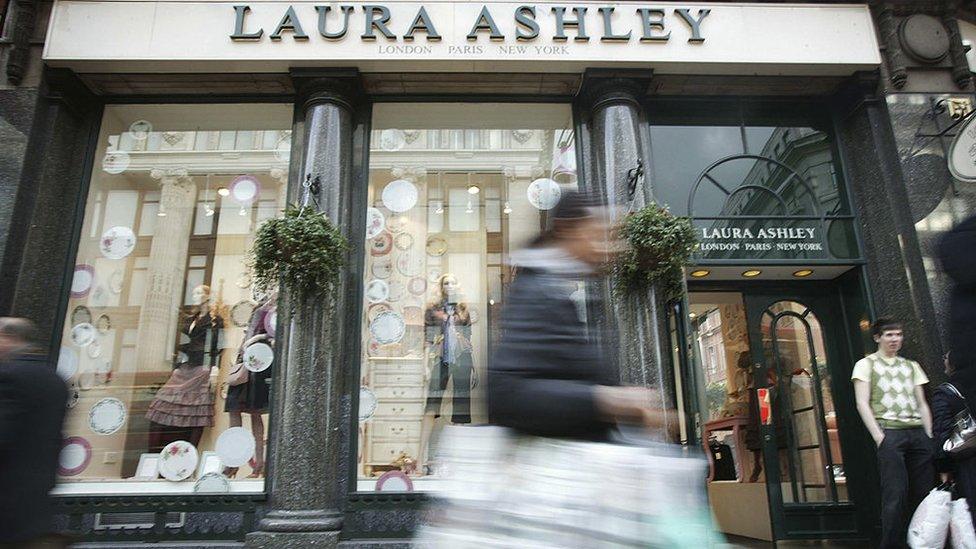

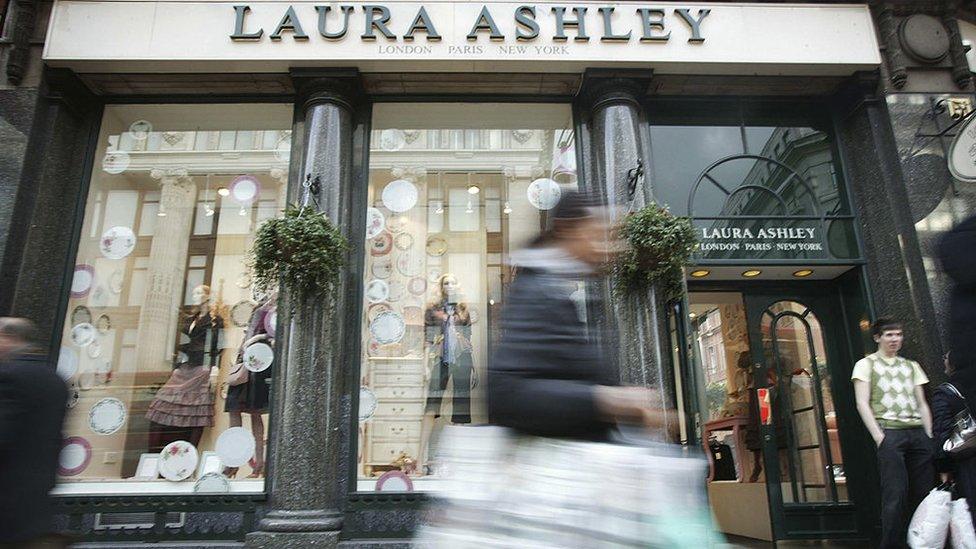

Fashion and furniture chain Laura Ashley has become the latest business casualty of the coronavirus pandemic.

Just two weeks after regional airline Flybe collapsed, the retailer has said it will have to call in administrators, putting 2,700 jobs at risk.

It is one of the many firms reeling from the impact of the coronavirus, with the government advising people to avoid unnecessary contact with others.

Its action comes as the chancellor prepares fresh support for companies.

Firms from many industries including airlines, retailers, restaurants, theatres and pubs have said the virus has pushed them to the brink, with several warning of imminent collapse without government help.

Chancellor Rishi Sunak has already announced a £12bn Budget package to help businesses deal with the crisis, including business rates relief for small firm and a new hardship fund.

But he said in his Budget speech he would "not hesitate to act" if more was needed, and he is expected to unveil new financial measures in the government's daily briefing on the outbreak on Tuesday afternoon.

'Footfall and turnover declining'

Carolyn Fairbairn, head of the CBI business lobby group, called for co-ordinated and fast action to support businesses. "We do not want to look back and say we acted too late," she said.

The bosses of sixty big High Street retailers including Top Shop owner Arcadia, Costa Coffee, JD Sports and Primark wrote to the government on Tuesday pushing for a suspension of business rates for large retailers.

"Turning specifically to the impact of the Coronavirus pandemic: there is no doubt that it is already being widely felt amongst the members of this group, with footfall and turnover declining by up to 50% in many towns and shopping centres," the chief executives said.

Earlier Robert Chote, head of the Office for Budget Responsibility, told MPs that Britain was facing something akin to a wartime situation for its public finances.

He added that now was not the time for the government to hold back on spending.

Sectors which have warned of problems include:

Nissan has suspended production at its Sunderland car plant.

The hospitality industry warned on Tuesday that new government restrictions around coronavirus could shut down firms.

Cafe chain Carluccio's said it could see closures "in days" due to the impact of the virus.

Airlines have had to cancel thousands of flights and ground planes and airports have warned they may have to close down operations.

The UK tourism industry is seeing a sharp drop in bookings amid travel restrictions across Europe and elsewhere.

Cinema chains Odeon, Cineworld and Picturehouse will temporarily close their doors until further notice.

Most sporting events have been suspended including Premier League football games, horse racing events, and the Six Nations rugby tournament.

Most businesses do not have insurance cover to compensate them for coronavirus losses, a trade body and other experts have said.

Small businesses, in particular, are unlikely to have such a policy.

The Federation of Small Businesses (FSB) chair Mike Cherry said: "Many will feel like they are being made to choose between their health and the very survival of their business. Nobody should have to make this choice."

He added that the prospect for small businesses over the coming weeks "is increasingly bleak".

However, some retailers are seeing a huge spike in demand, with Amazon workers abeing told to work overtime to tackle demand for goods.

EASY STEPS: How to keep safe

A SIMPLE GUIDE: What are the symptoms?

GETTING READY: What's the UK's plan and what could happen next?

TRAVEL PLANS: What are your rights?

IN-DEPTH: Coronavirus pandemic

Laura Ashley said the outbreak "has had an immediate and significant impact on trading". It had been in talks with its lenders about accessing more funds to continue trading.

But based on cashflow forecasts and continued virus uncertainty, it said it would not get that money in time.

The firm, which was also facing challenging High Street conditions, said: "The Covid-19 outbreak has had an immediate and significant impact on trading, and ongoing developments indicate that this will be a sustained national situation."

The outgoing head of the Office for Budget Responsibility, Robert Chote, has warned the Treasury Select Committee that some businesses will "inevitably" fail during the coronavirus outbreak.

Far from his usual approach of urging fiscal restraint, Chote says a temporary spike in borrowing would be sensible - saying it's better to spend a "little too much" than too little, adding: "When the fire is large enough, you just spray water" (and worry about the clean up after).

He highlighted that the government ran deficits of 20% of GDP for five years during the WW2 era (vs just under 2% of GDP last year), and said that was the right thing to do.

He also urged help for those working in the gig economy.

His words, coming hours before the chancellor is expected to outline more support, helped limit the fall in the FTSE 100 this morning.

- Published17 March 2020

- Published17 February 2020

- Published27 January 2020

- Published13 January 2020

- Published9 January 2020