Manufacturers urge bailout as sector suffers

- Published

- comments

The coronavirus crisis has left many manufacturers on the "cliff edge" and in need of government intervention, an industry body has warned,

The government should step in to support key sectors, in line with other countries, Make UK urged.

It said support should especially be targeted at the aerospace, carmaking and steel sectors.

Its plea came as new figures showed the sharp downturn in UK manufacturing continued last month.

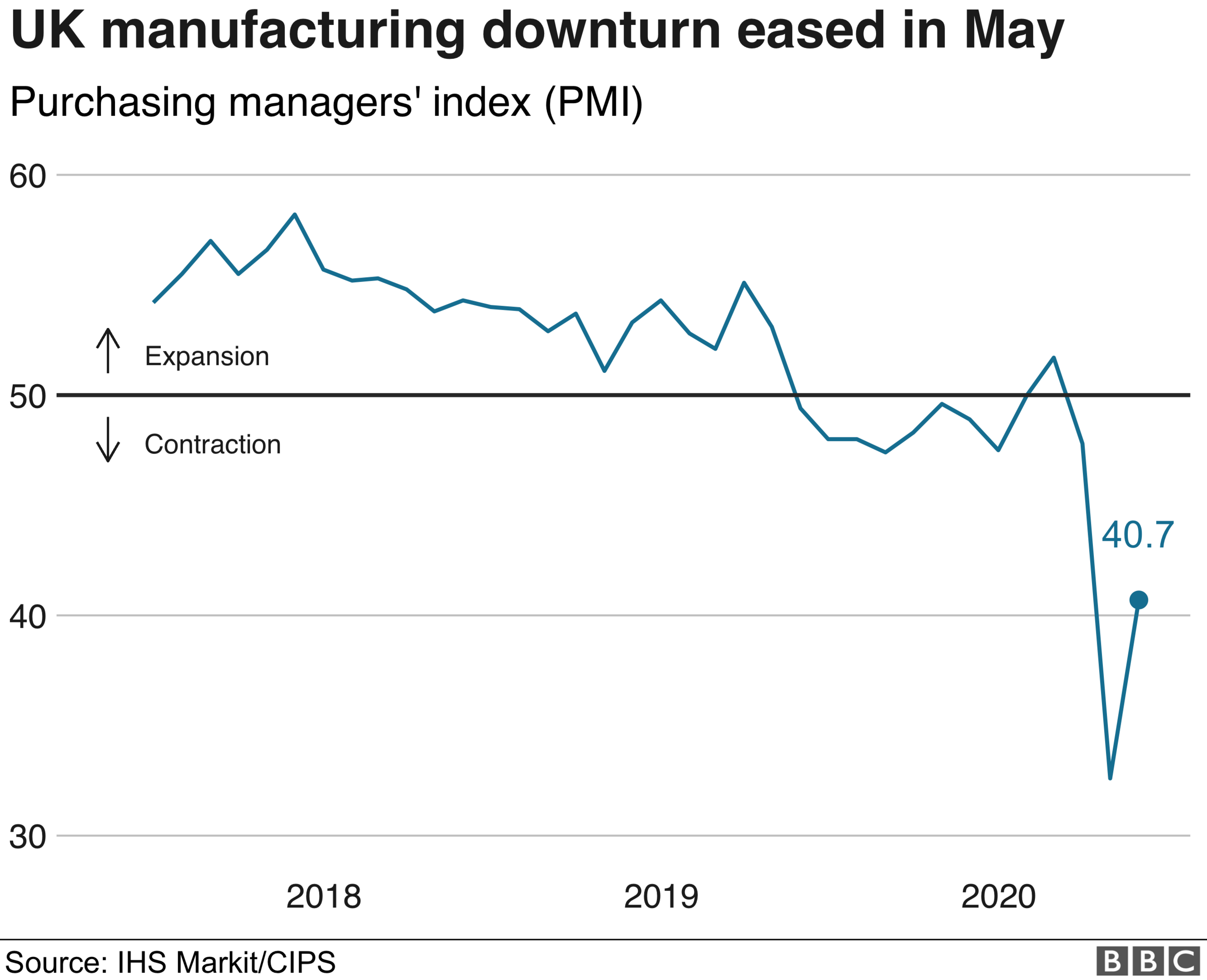

The closely watched IHS Markit/CIPS Purchasing Managers' Index (PMI) for the sector gave a reading of 40.7 for May.

It was up from April's record low of 32.6, suggesting the sector was not declining as quickly as before. Anything below 50 indicates contraction.

Rob Dobson, director at IHS Markit, said: "Those who typically see the glass half-empty will note that the UK manufacturing sector remained mired in its deepest downturn in recent memory.

"However, the glass-half-full perspective is one where the rate of contraction has eased considerably since April, meaning - absent a resurgence of infections - the worst of the production downturn may be behind us."

Uncharted territory

Make UK chief executive Stephen Phipson said: "We are now in such uncharted territory that what would until recently been thought of as unthinkable is now very much the reality.

"While the support schemes in operation are providing significant support to the economy, there are some sectors and companies who are fundamentally sound businesses and were trading positively before the pandemic.

"Instead, however, they have now been driven to the cliff edge by the nature of this crisis and may not survive without direct government intervention."

Mr Phipson said the firms in question were in "key strategic sectors for the UK internationally" and that the government should therefore "intervene directly to provide support and ensure their survival".

Make UK said its research showed that almost three-fifths of manufacturers believed it would take more than a year for trading conditions to return to normal.

RISK AT WORK: How exposed is your job?

EXERCISE: What are the guidelines on getting out?

THE R NUMBER: What it means and why it matters

LOOK-UP TOOL: How many cases in your area?

A SIMPLE GUIDE: What are the symptoms?

Commenting on the PMI figures, the EY Item Club said they lent support to the belief that UK economic activity could improve as lockdown restrictions are progressively eased over the coming weeks.

But it added: "Nevertheless, the UK seems on course for a record GDP contraction in the second quarter."

It said it expected the UK economy to shrink about 15% quarter-on-quarter in the April-to-June period.

"While the EY Item Club expects the economy to return to clear growth from the third quarter, we still see the economy contracting around 8% over 2020," it added.

"This assumes that there is a gradual further lifting of the lockdown over the coming weeks, following the latest moves that came into effect on 1 June."

- Published1 June 2020

- Published29 May 2020

- Published29 May 2020

- Published26 May 2020