Bank Governor Bailey 'angry' at criticism over regulatory role

- Published

The governor of the Bank of England has angrily rejected criticism that he was slow to make changes in his previous role overseeing City regulation.

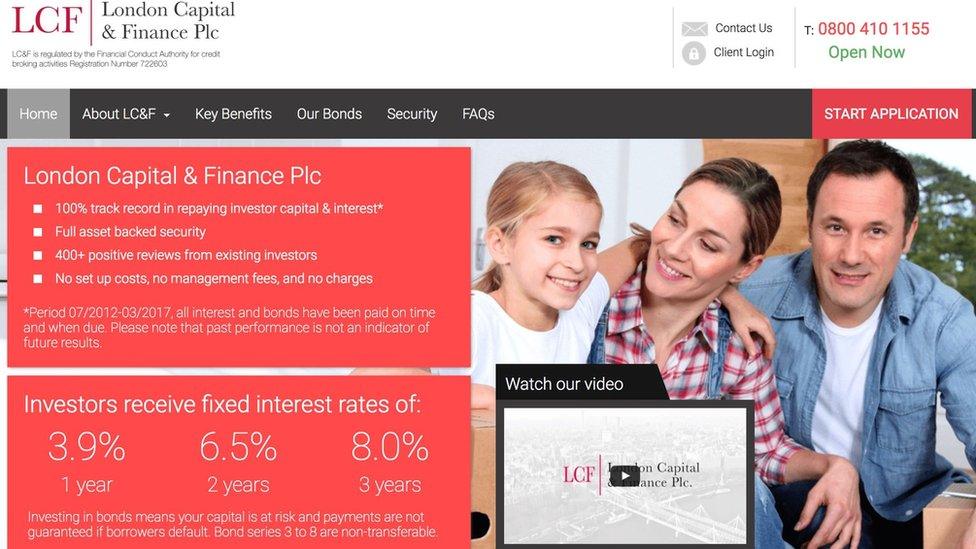

Andrew Bailey was head of the Financial Conduct Authority when a high-risk bond scheme collapsed two years ago.

Nearly 12,000 people invested £236m in London Capital & Finance before it went under.

A report last year said the regulator had failed to effectively supervise the firm.

The author of the report, former Court of Appeal judge Elizabeth Gloster, told Parliament last week that the slow pace of internal reforms at the FCA was not an excuse for what had happened to investors in LC&F.

Mr Bailey told a Parliamentary committee on Monday that he strongly disagreed with her view.

In particular he rejected a suggestion he had been among executives, asking not to be named in the report's conclusions, saying: "I am probably sounding quite angry now, and I am."

Mr Bailey said Lady Justice Gloster had described the regulator as a "broken machine".

"She sort of suggested to you that if only we had told the staff to pull their socks up, the problem would have gone away," Mr Bailey told the Treasury Committee.

"She even at one point in the report suggested that maybe it was a mistake to do the programmes of change, which I just fundamentally disagree with," he said.

He said that the regulator at the time had no way of collating concerns raised by investors from the 200,000 calls a year it receives from the public.

The Financial Services Compensation Scheme (FSCS) said last year that the majority of people who invested in LC&F would not be eligible for compensation.

Related topics

- Published9 January 2020

- Published17 December 2020