Loan shark fears as fewer investigations begin during Covid crisis

- Published

Fewer investigations into loan sharks have started during the coronavirus crisis despite violent threats against borrowers struggling to repay.

The pandemic has left people exposed to illegal money lending, but has also created practical difficulties for investigators.

Figures show falling numbers of new investigations compared with previous years in parts of the UK.

It comes as criminal lenders have been shaming non-payers on social media.

Covid effect

Each nation of the UK has specialist teams of investigators looking at illegal money lending.

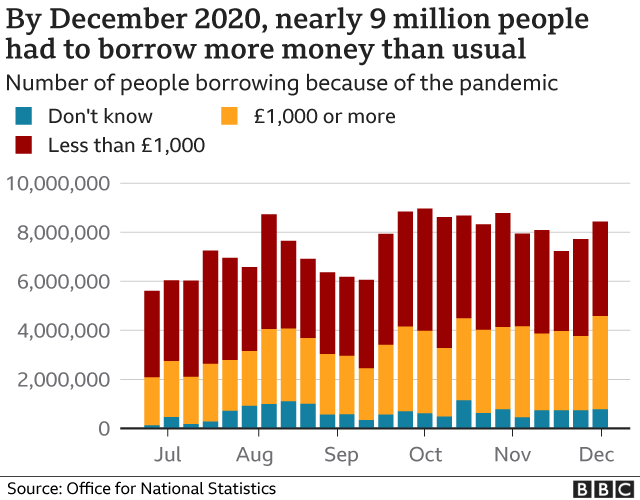

They have warned that the financial uncertainty for individuals during Covid, as well as less appetite among traditional providers such as banks to lend, have led to loans sharks attempting to fill the gaps.

Drops in income have led to some people missing repayments, and facing resulting threats of violence, intimidation, and sexual coercion.

A major report into the lending sector found that many loan sharks had moved online, using social media and online chatrooms to identify victims.

Investigators cannot always be so nimble, and coronavirus restrictions have caused practical issues such as difficulties in serving warrants.

As a result, the number of new investigations dropped during 2020 - with only 95 getting underway between April and November, according to figures released after Freedom of Information requests.

In England, in the seven months from April, 87 investigations were started, compared with 239 for the whole of the previous year, and 301 in the year before that.

In Scotland, trading standards said "due to Covid-19 restrictions, no investigations have commenced however there are some live enquiries still ongoing". There were two the previous year, and 10 the year before that.

In Northern Ireland, there were also no new inquiries, and there were 8 in Wales - both broadly in line with previous years, as Northern Ireland has not started any new investigations since 2015.

Jason Wassell, chief executive of the Consumer Credit Trade Association, which represents non-mainstream authorised lenders, said: "We know this been a difficult time to investigate and bring prosecutions but these figures are worrying.

"Loan sharks mustn't be allowed to get away with their illegal and dangerous activities, and investigators need our full support and sufficient funding to do their important work."

He said the authorities needed to "keep the pressure on".

'They threatened to beat me up in front of my children'

One victim borrowed about £450 and when she lost her job and found it hard to repay the money, she was threatened with violence.

"I didn't have enough, I couldn't eat properly, couldn't clothe my children properly," said the woman, who asked not to be identified.

"If I couldn't pay, they threatened to beat me up in front of my children.

"If the door knocked I'd be petrified, I constantly had my phone by my side and I'd lock the windows and doors. I had no confidence, I was so scared."

The recently-published Woolard Review for the City regulator, the Financial Conduct Authority, found that loan sharks were "innovating" by moving online.

It recommended that moves were made to remove these lenders from internet search results.

Tony Quigley, head of the England Illegal Money Lending Team, said that the criminals were shaming people for non-payment on social media, as well as coercing them into sexual acts in lieu of cash.

"With more of our lives moving online, the opportunities for loan sharks to exploit vulnerable people are increasing," he said.

"We know people contact the team when they have reached crisis point, but we would urge people to contact us sooner as we will support them and we can intervene to stop the loan shark."

Where to go for help

A spokeswoman for debt charity StepChange said: "The post-Covid landscape is, unfortunately, one that is ripe for exploitative and unscrupulous operators to take advantage of people in debt.

"But there are better ways of dealing with debt problems than resorting to illegal money lenders. Free, confidential advice from reputable organisations can help people avoid getting trapped in a spiral of ever more expensive borrowing."

StepChange has a guide to what to do if you owe money to a loan shark, external, and the Money and Pensions Service also has practical tips, external.

Anyone who believes they might be the victim of a loan shark can contact the Stop Loan Sharks 24-hour confidential helpline on 0300 555 2222, email reportaloanshark@stoploansharks.gov.uk or complete an online report form, external.

There is also free, safe and anonymous support via Stop Loan Sharks Live Chat, external 9am to 5pm, Monday to Friday.

Related topics

- Published25 August 2020

- Published24 February 2014

- Published21 January 2021