US banks accused of failing the public during Covid

- Published

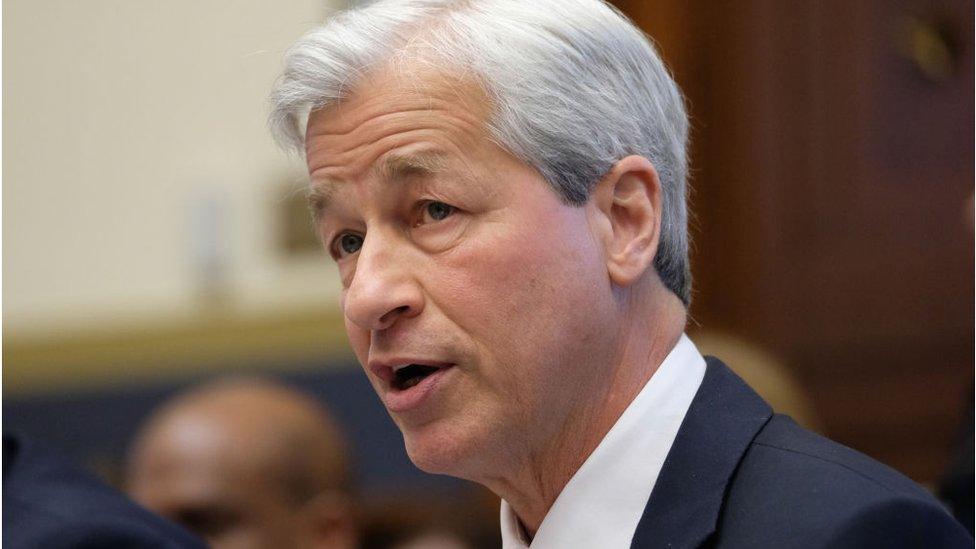

In a hostile exchange with JP Morgan boss Jamie Dimon, Senator Elizabeth Warren said the bank's claims to have supported people were "baloney"

Big US banks have been criticised for not doing enough to help ordinary people during the pandemic.

The bosses of JP Morgan, Bank of America, Citigroup, Wells Fargo and Goldman Sachs were grilled during an appearance before US lawmakers.

"Wall Street profits no matter what happens to workers, because those profits now come at the expense of workers," one senator said.

But the bank bosses pointed to relief given out during Covid.

In his opening remarks Democratic Senator Sherrod Brown, chair of the Senate Banking Committee, added that when employees get sick or lose their jobs, "they don't get a taxpayer bailout".

"And they all remember that Wall Street did," he said, referring to the 2008 financial crisis.

Sen. Brown also challenged chief executives over levels of pay: "Stock prices have soared, your own compensation is stratospheric, but workers are getting a smaller and smaller share of the wealth they create."

David Solomon, the boss of Goldman Sachs, said that it had given workers an additional 10 days of leave over the last year, as well as continuing to pay on-site staff such as cleaners or canteen workers even if they weren't working.

Jane Fraser, the chief executive of Citigroup and first female boss of a Wall Street bank, also pointed towards efforts to help small business owners.

She said the bank had issued $5bn (£3.5bn) in emergency Paycheck Protection Program (PPP) loans - with 80% going to firms with fewer than 10 employees.

Hostile exchange

Democratic Senator Elizabeth Warren also criticised the bankers for charging customers overdraft fees, even as regulators recommended that they should be waived.

In a hostile exchange with JP Morgan boss Jamie Dimon, she claimed the firm had collected about £1.5bn in overdraft fees in 2020 - more than any other bank at the hearing.

"You and your colleagues came in today to talk about how you stepped up to help your customers during the pandemic. It's a bunch of baloney," she said.

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

"This past year has shown that corporate profits are more important to your bank than offering just a little help to struggling families even when we're in the middle of a worldwide crisis," she added.

But Mr Dimon said he did not recognise those numbers and that the fees were cancelled for any customers who asked.

When each of the bosses were asked if they would refund the fees charged last year, they said no.

The executives also came in for criticism from Republicans at the hearing, wary of "woke-ism" and "left-wing attacks on capitalism".

Sen. Pat Toomey raised concerns over banks prioritising social causes, citing examples such as climate change, rather than clients' financial interests.

Each bank boss referred to efforts to reduce their carbon emissions, as well as their efforts to improve diversity in their organisations.

Related topics

- Published24 February 2021

- Published14 July 2020