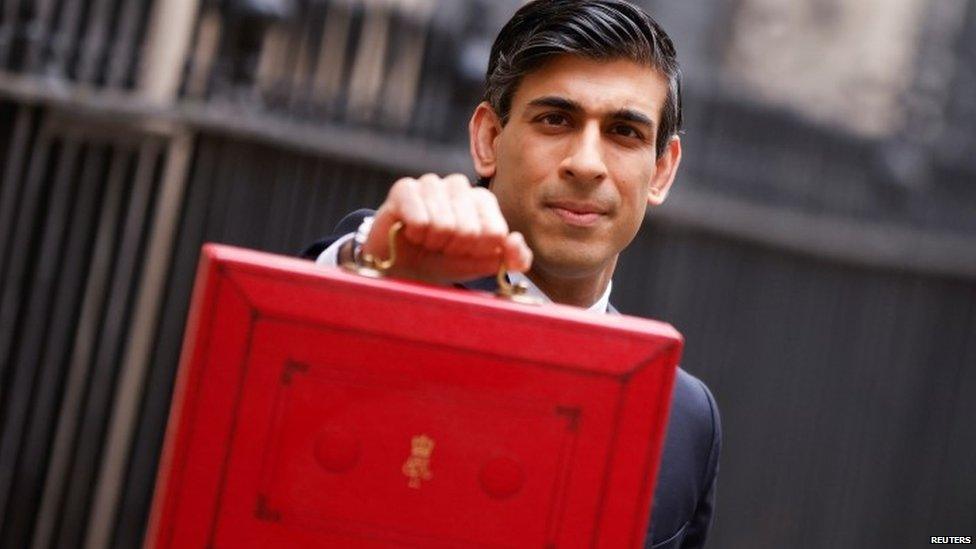

Budget 2021: Rishi Sunak lets the taxman take the strain

- Published

- comments

The money for this Government spending has to be found somewhere

Rishi Sunak might liken himself to a reluctant taxman, but his strategic decision has been to spend at the same time as keeping borrowing down, so taxation has taken the hit.

There are four big figures that tell the broad story here.

The really good news is that unemployment is now forecast to peak at 5.2%.

However, a significant spike in inflation to higher than 4%, set to last a year or so, partly reflects rising energy and fuel prices.

Meanwhile, taxation as a proportion of the economy at 36.2% is at its highest level since the 1950s Labour Atlee government.

And spending as a proportion of the economy, at nearly 42%, is at its highest sustained level since the 1970s.

All that leaves the British state under a Conservative government permanently bigger as a legacy of the pandemic.

But borrowing at the end of the new forecast is even lower than forecast before the pandemic.

And so the big story is that the corporation tax rises from the March Budget, required to shore up public finances after bad forecasts, have been kept as they were, even as those bad forecasts have been reversed.

There might have been some room to delay those tax rises or extend the corporation super deduction.

Top up

But that extra taxation has been kept to be deployed mainly in terms of extra spending.

That spending has been sprinkled towards some help with cost of living, and some surgery on the economy to improve skills and long term productivity.

Unprotected areas of the public finances forecast for a continuing squeeze have all been topped up. All will now enjoy rising spending.

Rishi Sunak has a better economic backdrop than he expected - but will keep business tax rises despite this

To be clear, the slowing in the rise in unemployment would have been scarcely believable 18 months ago and is the best measure of the pandemic economic rescue plan's success.

But before the Budget, I raised the question as to whether, after furlough, the public were becoming used to the idea that the government should solve problems such as rising living costs.

Despite the chancellor's protestations of his love for low, tax free-market conservatism, his actions show an attachment to higher tax and spending.

With new restraints on the ability to borrow, delivering on lowering this tax burden will require the economy to grow far more robustly than the disappointing rates forecast after 2023 of as low as 1.3%.

Small wonder that the chancellor was proclaiming a "new era of optimism" for the economy.

To deliver on his promises to reverse tax rises, that isn't just a hope, it's a necessity.

Related topics

- Published27 October 2021

- Published27 October 2021

- Published26 October 2021

- Published26 October 2021

- Published24 October 2021