Budget 2021: Millions will be worse off in 2022, says IFS

- Published

- comments

Millions of people are set to be worse off next year amid spiralling costs and tax rises, says an economic think tank.

The Institute for Fiscal Studies (IFS) said that inflation and higher taxes on incomes would negate small wage increases for middle earners.

Low-income households will also feel "real pain" as the cost of living is set to increase faster than benefit payments, it said.

The chancellor acknowledged in his Budget that families are under strain.

Paul Johnson, director of the IFS, said that "millions will be worse off in the short term" as a result of soaring costs.

On Wednesday, the independent Office for Budget Responsibility (OBR) warned that the cost of living could rise at its fastest rate for 30 years.

Its latest forecast predicted that inflation, which measures the change in the cost of living over time, is set to jump from 3.1% to an average of 4% in 2022.

The chancellor said it was because of increased demand for energy and supply chain issues as economies and factories recover from coronavirus curbs.

But the OBR pointed that supply constraints had been exacerbated by Brexit.

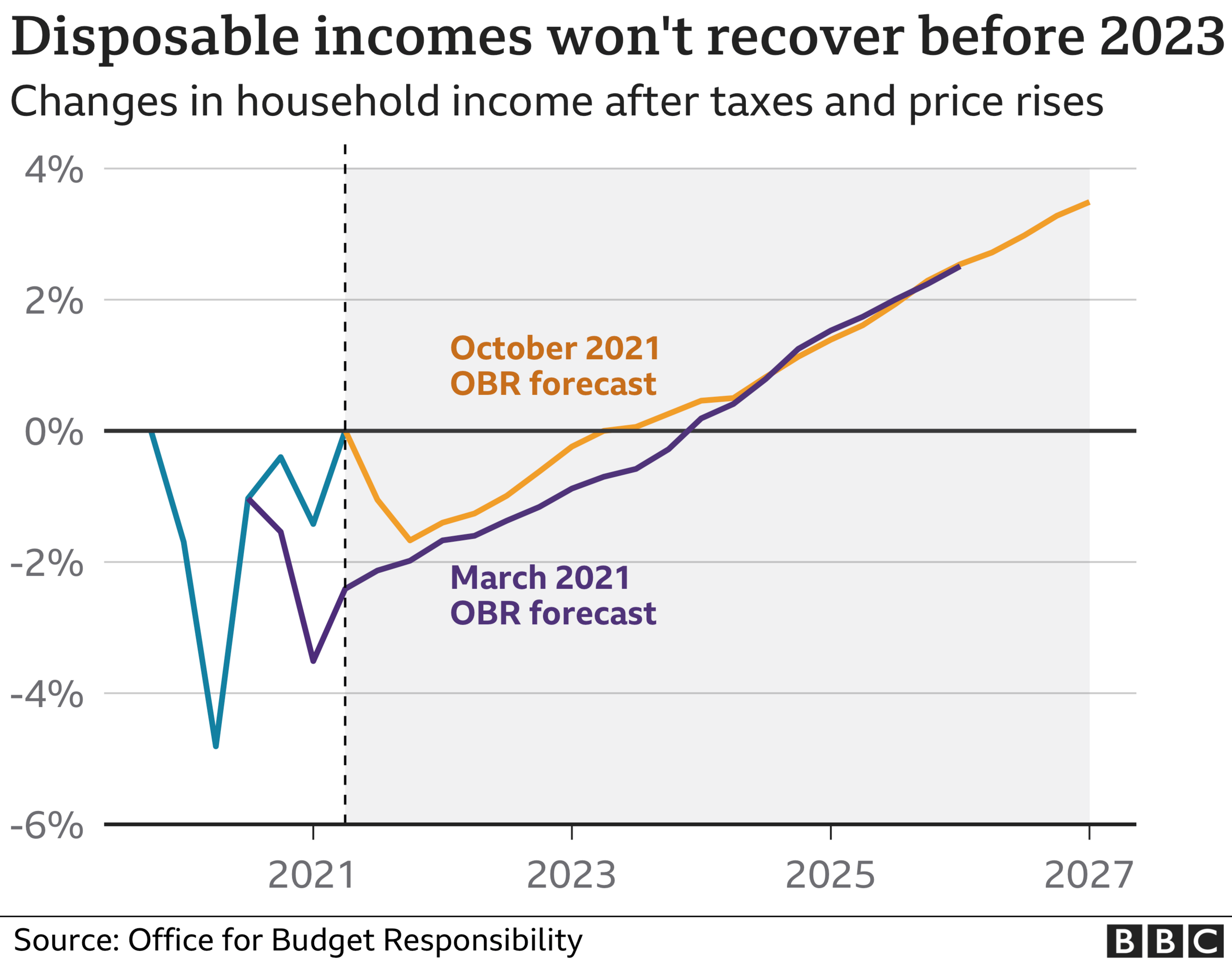

It added that once rising prices and rising taxes are taken into account, average household incomes are set to fall next year and won't recover before 2023.

In its analysis of Chancellor Rishi Sunak's second Budget of 2021, the IFS described the chancellor's delivery as "upbeat".

But Mr Johnson added: "Unfortunately for him, and for us, the outlook for living standards does not match this upbeat tone."

Over the next few years, increases to income tax and national insurance, paired with rising household bills, "will mean very slow growth in living standards", he said.

New IFS analysis suggests, external that over the next year, middle earners on about £25,000 will find their pre-tax pay just about outpaces price rises.

But once extra income taxes are due, their take-home pay will fall by about 1%, or £180 per year, after accounting for inflation.

That comes after an already tough decade for households, the IFS said. Had average earnings kept pace with trends seen before the financial crisis in 2008, they would have been 40% higher, its research found.

Mr Sunak defended his Budget, telling BBC Breakfast that it had "cut taxes for millions of the lowest-paid".

On Wednesday, the chancellor announced that the universal credit "taper" rate would be cut by 8% no later than 1 December, so that instead of losing 63p of benefit for every £1 earned above the work allowance, the amount will be reduced to 55p.

Rishi Sunak says universal credit is a "hidden tax on work" and the rate would fall by 1 December

The National Living Wage will also increase next year by 6.6%, to £9.50 an hour.

Mr Sunak added that it was his job to be concerned about inflation and his new fiscal rules were "how we build up resilience".

But Paul Johnson said that price rises meant that "real pain" would now be felt, as low-income households, which it describes as those working full-time and earning the National Living Wage, wait for their incomes to catch up.

"For some in work, that may never happen," he said.

High drama ahead?

After the political theatre of Budget Day, experts spend the following night and day backstage working out the impact on your household finances.

The answer to that question, as always, depends on your stage and circumstances in life.

If you are low-paid and in work, then the Budget had some comforting news for you - such as the minimum wage rises and universal credit changes - although that won't happen immediately.

In contrast, middle-earners and those out of work are facing a more worrying squeeze. Pensioners, concerned about hefty rises in bills to heat their homes, are feeling a bit forgotten.

For everyone, the next act is all about the cost of living. If prices rise at the top end of forecasts, then millions of people's financial situation could become quite a drama.

Setting out his Budget on Wednesday, Mr Sunak said it marked a "new age of optimism", announcing across-the-board spending increases for government departments.

But the fiscal event has also taken the UK's current tax burden to the highest level seen since the 1950s.

Mr Sunak described "corrective action" as necessary in order to pay back huge sums of money, borrowed during the pandemic to fund support programmes such as the furlough scheme.

But Mr Johnson told BBC Radio 4's Today programme: "What he's done is use the pandemic as cover for what I think was probably necessary - a big increase in NHS spending, being funded by this increase in National Insurance contributions, and undoing some of the very big cuts we've seen to the justice, further education and school system over the last decade."

He pointed to the fact that the OBR has also reduced its estimate of the long-term "scarring" effect of Covid-19 on the economy from 3% to 2%.

He suggested that the chancellor might hope to undo some tax rises in the future.

Mr Johnson also described the stagnation in living standards as "a very important political point" in a later interview with the BBC.

"If we're not getting better off over time, we're not going to feel so happy with the status quo," he said.

A spokesperson for the Treasury said that the government is "taking targeted action worth more than £4.2 billion a year to help families with the cost of living".

They described the decision to raise taxes as "difficult", but said that households would benefit from further investment in public services.

They said government decisions such as freezes to alcohol and fuel duty and the warm home discount "have been worth nearly £500 per year extra to households on average, and more than £1,000 for the poorest households".

- Published27 October 2021

- Published27 October 2021