THG shares climb as founder Matthew Moulding hints at going private

- Published

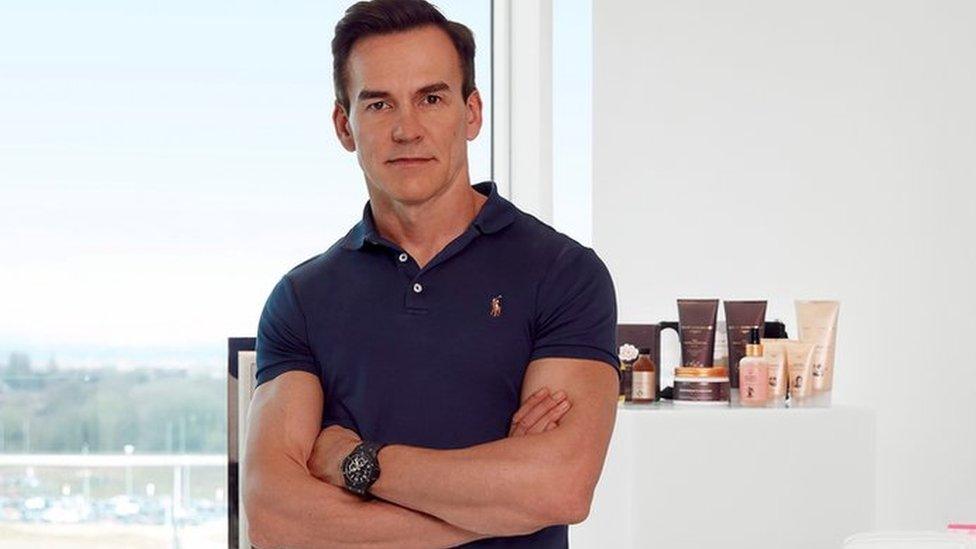

Matthew Moulding and his wife Jodie are worth £2.1bn according to the Sunday Times Rich List

The boss of health and beauty firm THG has hinted he may take the company private, a little over a year since it floated on the London Stock Exchange.

Matthew Moulding told men's magazine GQ , externalthat he regretted listing THG - which owns Lookfantastic - in the UK, where its shares have tumbled 70% this year.

The process "just sucked from start to finish" he said, adding that as a major shareholder he had "options" about its future.

THG's share price rose as much as 5%.

THG, formerly The Hut Group, floated on the stock market with a valuation of £5.4bn.

The company's shares peaked at nearly 800p in January this year, but they are now trading at 213p each.

Billions of pounds have been wiped off the company's value after a series of challenges over its structure, its corporate governance and a deal with Japanese investor Softbank to buy a stake in its technology business Ingenuity.

"I should have IPO'd in America. That's obvious. I didn't do it because I wanted to do everything in Britain," said Mr Moulding who, along with his wife Jodie, has a net worth of £2.1bn, according to the Sunday Times Rich List.

He said that at the moment he just tries to "get through the day".

"Jodie, my wife, has come in at four in the morning and she's seen me literally doing phone calls, starfish lying on the floor, just because it's a cold surface," he said.

In October, it was announced that Mr Moulding, THG's founder, chief executive and chairman, would relinquish his "golden share" in the company which had stopped it from being included in London's FTSE indexes and enabled him to block a takeover of the business.

The online beauty retailer and software firm, whose brands include Cult Beauty, make-up firm Illamasqua and supplements business Myprotein, also said it was seeking an independent chairman last month.

'Worst period ever'

Mr Moulding said that there were certain scenarios where the UK market "can work really well".

"But there aren't any examples, I don't believe, where an individual brings a big company to a public market and it can go well, certainly as you get to a certain scale anyway," he said.

The company has grown rapidly by snapping up skincare and lifestyle brands while also operating online platforms for other brands.

Mr Moulding described the stress he had experienced over the last year: "Genuinely I can say, from the moment I even announced on my Insta the IPO, from that day forward has been the worst period ever. Ever."

THG owns a number of online beauty retailers such as Lookfantastic and Cult Beauty

He said that as a "big shareholder" in the company, he would keep an "open mind" over its future, in an apparent hint he could take the firm private again.

When BBC News asked if THG could clarify Mr Moulding's remarks, it declined to comment.

For the moment, the executive's plan is just to "keep doing what I'm doing", he said, in the run-up to the key festive trading period.

In late October, THG announced that group revenues had increased by 38% to £507.8m in the three months to September on the same quarter last year.

It also raised revenue growth expectations for Ingenuity, a technology platform it hopes to license to other online retailers.

Mr Moulding said then: "We have delivered a strong trading performance in third quarter and enter our peak trading period with confidence."

- Published26 October 2021

- Published29 December 2020