Electric truck maker Rivian raises almost $12bn from share sale

- Published

Shares in electric vehicle firm Rivian are set to start trading in New York on Wednesday, after raising more than $11.9bn (£8.8bn) from investors.

That's as the shares were priced at $78 each, well above the company's target range.

That flotation ranks among the top 10 initial public offerings (IPOs) of all time in the US.

Yet Rivian only started delivering its first electric pick-up trucks to customers in September.

And the California-based start-up has made losses of over $2bn over the last two years.

But the van and truck maker has drawn significant investor interest, in part because it already has the backing of online giant Amazon.

And it is has beaten rivals include Ford and General Motors to a segment of the market - small trucks, pick-ups and SUVs - which is popular with American drivers.

The shares were priced at $78 each, external, which is above the target range of $72 to $74.

Rivian is already being compared to Elon Musk's Tesla, which transformed the market for electric cars.

Alongside the pick-up truck, Rivian is due to start rolling out its sports utility vehicle (SUV) in December and a delivery van in 2023.

"Rivian exists to create products and services that help our planet transition to carbon neutral energy and transportation," said RJ Scaringe the company's founder and chief executive in the firm's submission to the Securities and Exchange Commission (SEC) ahead of the share flotation.

"This is what inspired me to start Rivian, and it's what drives every decision we make as an organisation."

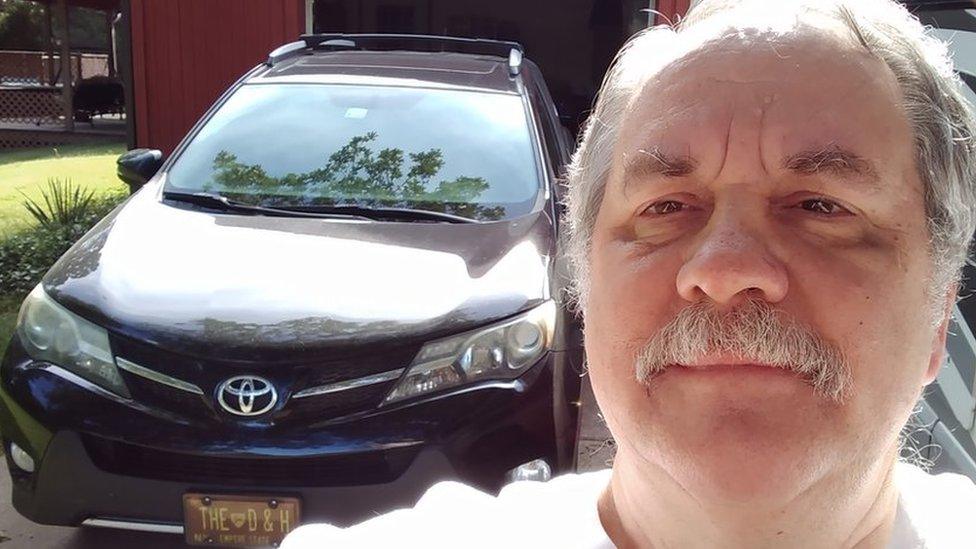

R.J. Scaringe has steered the company away from sports cars towards pick-ups and vans

The firm was founded in 2009 as Mainstream Motors, changing in 2011 to Rivian, a name derived from "Indian River".

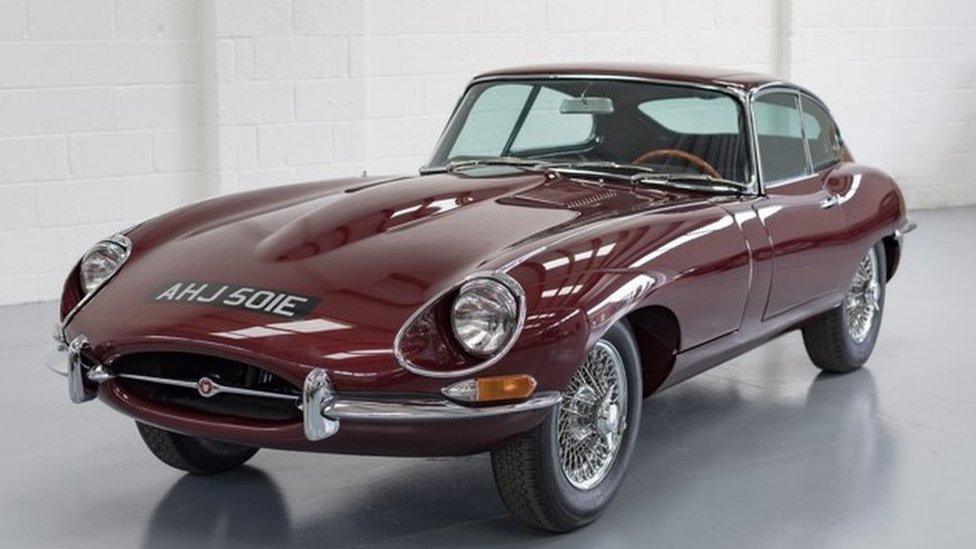

Originally Mr Scaringe pursued the idea of an electric sports car but later changed track to focus on trucks and vans.

Recently Rivian has invested heavily in production of the R1T which is designed as an aspirational, outdoor adventure style vehicle. It comes with the option of a three person tent roof attachment and a slide-out kitchen unit for cooking in the wild.

But crucial to investors' interest is the firm's relationship with Amazon, which not only owns 20% of Rivian, but has also said it will buy 100,000 electric delivery vans from the firm, once the firm starts to roll them out too.

Not so long ago, US investors didn't have that much time for electric vehicles. But things have changed - and how!

When Tesla went public in 2009, its shares were priced at $17 apiece, giving the company a total value of $1.5bn.

Today, the share price stands at well over $1,000, and the value of the company at more than $1tn.

That may explain at least some of the hype surrounding Rivian. EV businesses are simply hot property these days.

Factor in powerful backing from Ford and Amazon, pickup trucks that look all-American, even if they run on batteries, with commercial vehicles as well, and you can see why the IPO has gathered such momentum.

Rivian is not Tesla. Its products are very different, and deliberately so. But investors are clearly betting on the company one day becoming every bit as disruptive.

Ford has also invested in the firm, as well as working on its own electric trucks.

Karl Brauer at ISeeCars.com said there was a lot of excitement around the brand because of the backing it has already secured, and because it presents itself as a premium truck brand.

"It's not all about it being an electric vehicle. It's about it being an extremely effective truck that's powered by electricity," he said.

"I think people have a lot of anticipation, because they do feel like there's shades of Tesla here," he said.

However he said Rivian's fortunes could be undermined by an economic downturn reducing demand, or by mechanical or production difficulties.

There is already another cloud on Rivian's horizon. Its former vice president of sales and marketing, Laura Schwab is suing the company claiming she was was wrongfully dismissed after making a gender discrimination complaint about the "toxic bro" culture at the company.

She also says she warned the company its delivery targets were "not achievable".

You may also be interested in:

Who is Elon Musk? Meet the meme-loving magnate behind SpaceX and Tesla...published in 2021

- Published13 August 2021

- Published4 October 2021

- Published25 October 2021

- Published2 November 2021