Surge in part-time workers as job vacancies rise

- Published

- comments

The number of people in part-time work jumped in the three months to October, after falling sharply in the pandemic, official figures show.

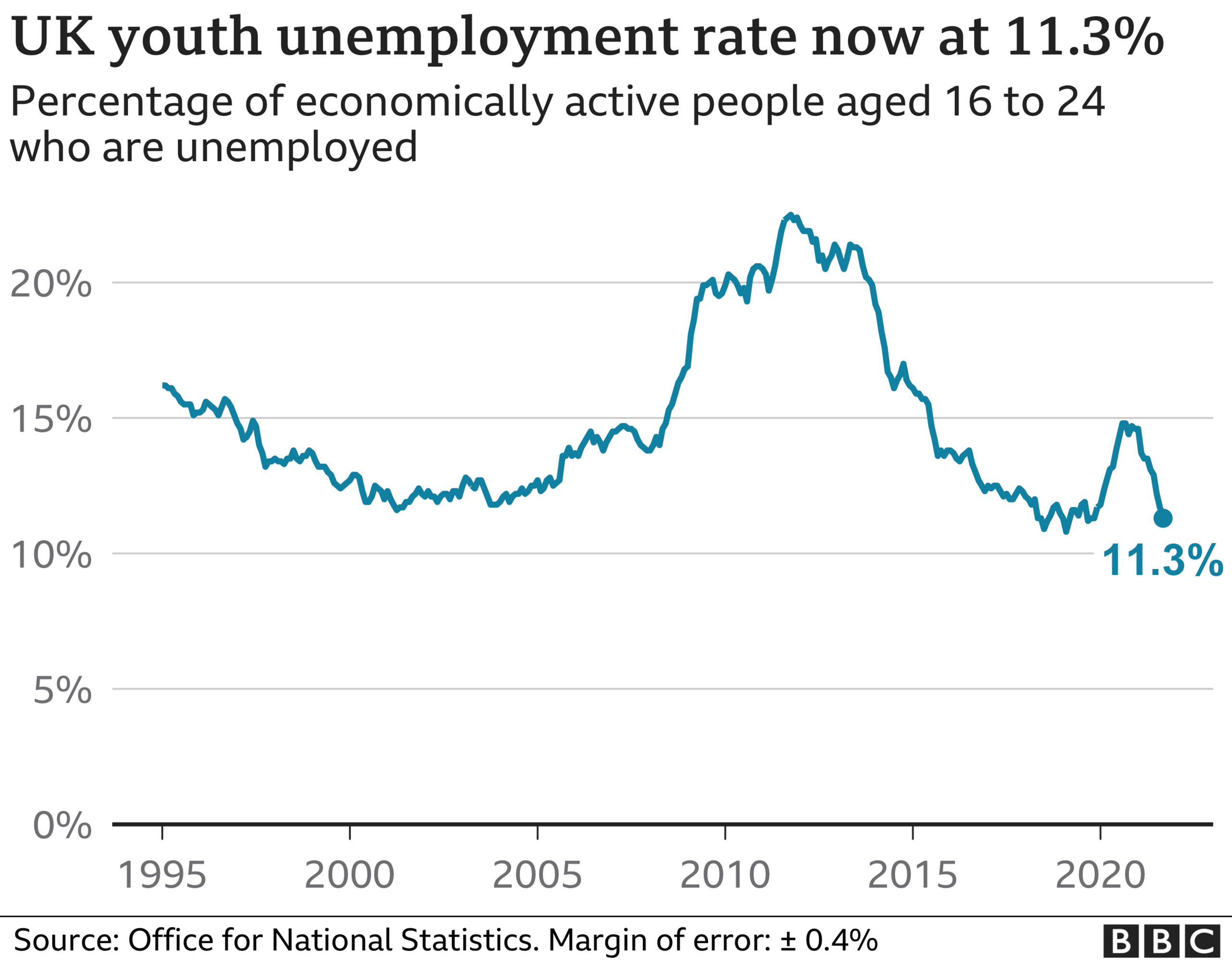

There was also a fall in unemployment among 16-24 year-olds, another group hit hard by the crisis.

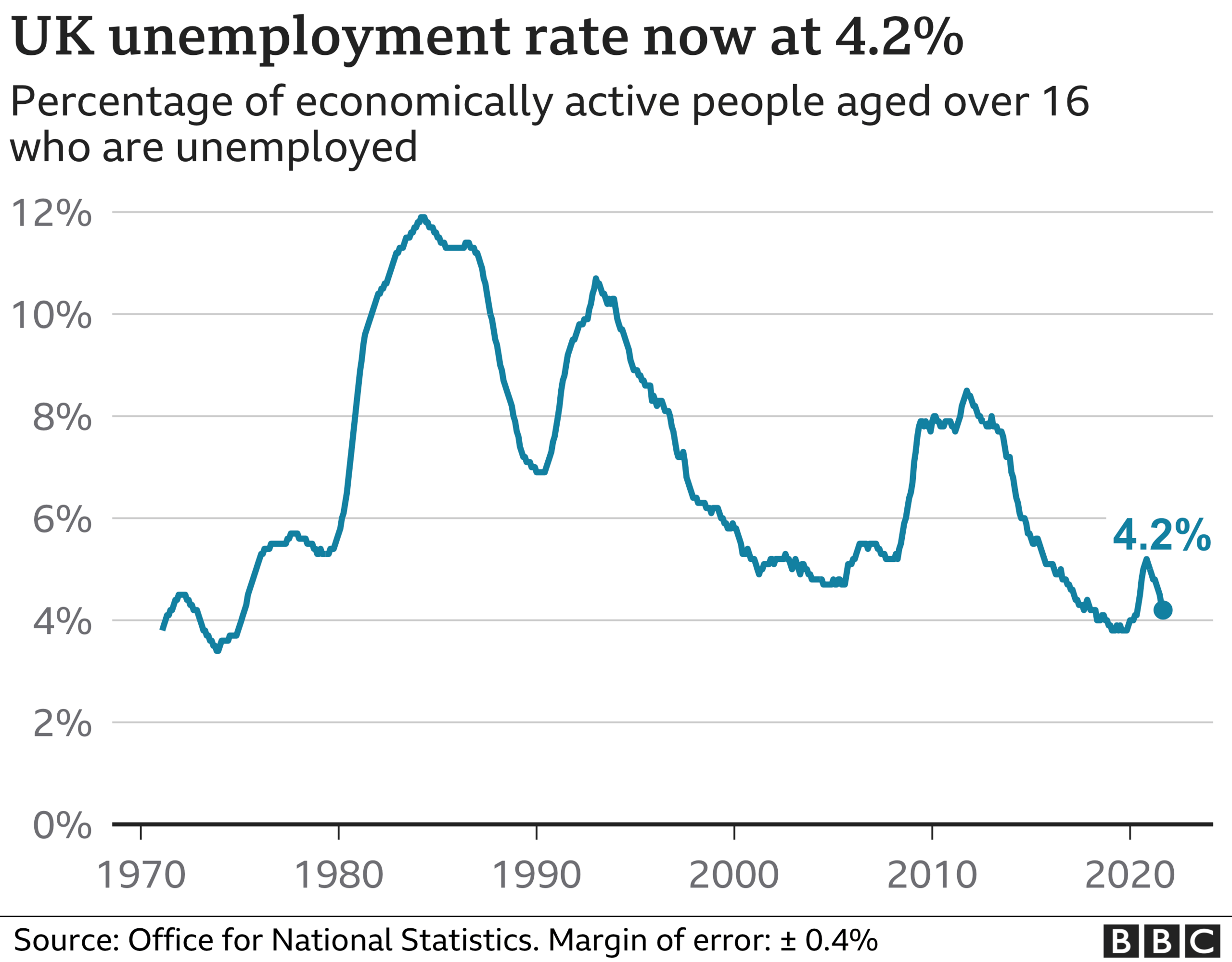

It comes unemployment continues to fall after a spike last year, with job vacancies now at a fresh record high.

But the figures predate the arrival of the Omicron variant which some fear may lead to restrictions in some sectors.

The overall unemployment rate fell to 4.2% between August and September, the Office for National Statistics (ONS) said, external.

"With still no sign of the end of the furlough scheme hitting the number of jobs, the total of employees on payroll continued to grow strongly in November," said head of economic statistics Darren Morgan.

"Separately, survey findings show much of the recent growth in employment has been among part-timers, who were particularly hard hit at the start of the pandemic."

What's happening with part-time and young workers?

As businesses struggled with successive lockdowns, the number of people working part-time fell sharply to 7.7 million in the March to May period this year.

However, as employers expanded again, this number has risen to 8.07 million in the three months to October, driving the latest quarterly increase in employment.

Younger, less experienced workers have also struggled to find work during the crisis.

But the ONS said the unemployment rate among 16-24 year-olds had now recovered to pre-pandemic levels at 11.3% - down from a high of 14.8% in the July to September period of last year.

What about job vacancies?

Job vacancies have continued to rise over the past six months as the economy reopens and employers race to hire staff.

Between September and November, they hit a fresh record of 1.22 million - some 434,500 higher than before the pandemic. However, the ONS said the rate of growth was slowing.

Rob Clarry, an economist at PwC UK, said there were "tentative signs" that demand for labour could be reaching its peak.

Has the end of furlough had an impact?

The end of the job support scheme in October has not led to a significant rise in unemployment, the ONS said, looking at the quarter as whole.

UK employers added 257,000 staff to their payrolls in November - taking the total number above pre-pandemic levels.

But on a monthly basis, there was a slight increase in the unemployment rate between October and November - from 4% to 4.3%.

And the ONS cautioned that some workers who have recently been made redundant may still be working out their notice.

Could Omicron make things worse?

Mr Clarry said it remained too early to judge the impact of Omicron on the labour market.

But he added: "We expect it to hit consumer demand for contact-intensive sectors, such as food and hospitality, over the near term. This could reduce demand for labour in these sectors over the coming months."

However, the chairman of Reed Employment, James Reed, said: "There's been plenty of talk from doomsayers that the Omicron variant will plunge us back into economic despair, but the outlook appears much more optimistic now compared with the first Covid wave we faced in March 2020.

"It's currently the best time in 50 years to look for a new job."

Commenting on the latest jobs figures, Chancellor Rishi Sunak said: "The jobs outlook remains strong thanks to our £400bn economic support package, Plan for Jobs and fantastic vaccine programme.

"To keep safeguarding our economic recovery and the lives and livelihoods of the British people, I am now calling on everyone to keep playing their part and get boosted now."

In broad terms the jobs numbers continued to reflect an encouraging recovery from the traumatic impact of the lockdowns, with payroll levels higher and redundancy levels lower than before the pandemic.

However, there was a modest impact from the end of the furlough scheme. On the monthly measure, unemployment in October, the first full month after the end of the Coronavirus Job Retention Scheme, was up to 4.3% from 4.0% the month before. That represents an increase of 77,500.

The full impact of the removal of furlough will take a few more months to filter into redundancy figures, given notice periods. The weekly measures suggest October's rise was the result of an initial spike in the first week of the month which settled down later.

Vacancies continue to set new records, but this is holding back the underlying economic recovery. There is a post-Brexit factor here, but also a number of older workers who have retired during the pandemic and a lack of students doing part-time work.

The impact of this ongoing jobs squeeze on annual wage settlements is the next unknown to watch for, after Omicron.

Could there be an increase in interest rates?

The latest jobs figures come in the week that the Bank of England's Monetary Policy Committee (MPC) decides on whether to raise its key interest rate from the current historic low of 0.1%.

It is under pressure to address fast-rising inflation, but wants to be sure that the expiry of the furlough scheme at the end of September did not cause a jump in unemployment before any decision to raise rates for the first time since the pandemic.

But the fast spread of Omicron has raised fears of a new economic slowdown and prompted investors to bet against a rate rise as soon as Thursday.

"The combination of a tight labour market and low unemployment evident in today's data could on their own be sufficient to merit a rate rise," said KPMG's UK chief economist Yael Selfin.

"Nonetheless, with the emergence of the Omicron variant over the recent weeks, we now expect the MPC to unanimously hold off raising rates until next year."

- Published10 December 2021

- Published16 November 2021