#NoSpendJanuary: Can it really be done?

- Published

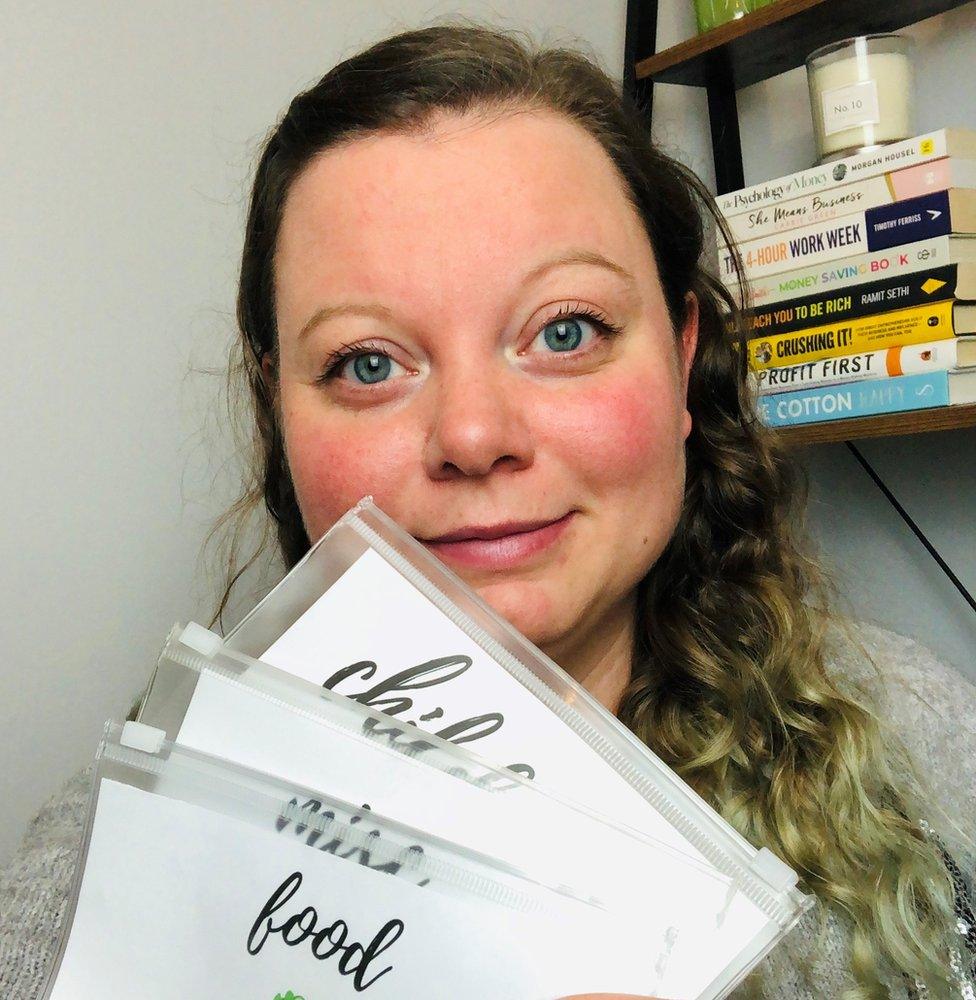

Nicola Richardson uses a cash envelope system to manage her money all year round

Nicola Richardson loves a frothy takeaway coffee on her way to work - but this month she will drive on by and keep the cash she would have spent in an envelope.

For the fifth year in a row she is taking part in No Spend January. Paying for even one caffeine fix is out of the question.

"I track no spend days - that's no eating out, no takeaways, no coffees, no alcohol, no paying for anything that isn't the bills and the food shop," says the 35-year-old teacher and mum-of-two.

Like Dry January - when people begin the year by quitting alcohol for a month - No Spend January involves abstinence after the festive season.

But instead of cutting back on booze, No Spend January involves cutting back on all non-essential spending. And for Nicola, all means all.

"Even the food shop I try and get as low as possible," she says. "Everyone has two or three meals they can make from Christmas leftovers - and there's food in the cupboards and freezer."

Nicola, from Darlington in County Durham, says the challenge helps her finances recover from Christmas spending on her four and six-year-old boys, and from lots of family birthdays in December. (She will, however, spend on essentials for her sons.)

For Nicola - who runs a personal finance blog on YouTube called The Frugal Cottage - January cutbacks are part of a longer-term goal to retire at 50.

She and her husband Dave are part of the FIRE movement - which stands for Financial Independence, Retire Early. "No Spend January starts your year off in that mindset," she says.

With the money they save during January, they overpay the mortgage by £100 and put £700 into investments. And it doesn't stop in January. The couple uses a cash envelope system, external to set their spending limits all year round.

"I have five envelopes for variable expenses - food, petrol, children, eating out and miscellaneous which can be household stuff or things that come up," Nicola says.

"Each week I put an amount of cash in each envelope and that's what I spend. You can't go over that because there's nothing left."

She says the act of handing over physical money - rather than tapping on a card - makes their spending more real. "Although it doesn't feel that extreme to us, if you suggest it to people it can put them off," she says.

So back to No Spend January - what's the hardest part?

The people trying to retire as early as possible (from August 2020)

"We don't drink alcohol so that's not a big one for us," says Nicola. "And because the days are short and the weather is awful we don't mind staying at home.

"But I do really like a takeaway coffee and I can pass a drive-thru on the way to and from work, so that's probably the one I feel the most."

Yet even without her frothy caffeine fix, Nicola would still recommend the challenge.

"Everyone works hard for their money so this is a great exercise in making you aware of where it's going," she says.

"Even if you give it a go and you don't manage the whole month you won't have lost anything."

When Sam first started No Spend January she deleted shopping apps and unsubscribed from emails

Nicola is not alone in cutting back this month.

Every year, the hashtag No Spend January appears on Instagram and Twitter thousands of times as people share the ups and downs of the challenge - from eating leftovers and back-of-the-cupboard tins, to turning down nights out.

Some offer tips - using gift cards, store points, and free online offers are common - while others use the hashtag to lament the items they can't purchase ("Five things I've wanted to buy today..."). Some even post calendars, crossing off the days of their no-spend month., external

Samantha Grayer has been a No Spend January convert for four years - and her own personal version applies to fashion, beauty and lifestyle purchases.

"I apply it to anything I don't absolutely need like clothes, skincare and candles," says the 33-year-old fashion promotion lecturer at the University of Central Lancashire.

"I keep a list of anything I am tempted to purchase during January and then at the end of the month I review that list. More often than not the majority of the list I'm no longer interested in."

No Spend January fits into Sam's overall approach to sustainable shopping.

"I like to think about cost per wear when I buy things," she says. "I don't like to buy things for one occasion or season, it has to have a life beyond that.

"It has to be something I can dress up or down, layer and swap out with another piece so I can wear it out to dinner but also to work."

Sam says January is a great time to create new outfits from clothes she already has in the wardrobe

The start of the year is the perfect time to pause because it's when companies put pressure on us to continue our Christmas extravagance, she says.

"January emails are sale-led which are even more enticing and you can get caught up in the hype feeling like you're getting a bargain," she says.

"I enjoy consuming social media content but it can make you feel like you need to buy something and you could end up with trend-led purchases which don't actually fit into your wardrobe or lifestyle."

When Sam embarked on her first No Spend January she deleted her shopping apps and unsubscribed from marketing emails. Now she says a month break from shopping doesn't feel like a chore, because she enjoys sharing how she styles outfits from her existing wardrobe on Instagram, external.

"By the end of January I'm in the swing of it and I find I almost don't want to break it. I went to the end of March one year," she says.

"There's no point in doing it if you're going to lock yourself in the house and be sad and feel like you're missing out. But I think people might find it quite fun like I do."

So can No Spend January be done? Nicola says it can - and it's a valuable exercise for anyone wanting to take control of their finances.

For Sam it's a positive personal challenge: "If you set yourself achievable goals, it's possible for anyone to have a successful No Spend January."

Related topics

- Published3 November 2016